Free Cash Envelope Template

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereMany people struggle to stick to a budget. It's too easy to overspend when you see something that you think you need to buy.

Thanks to debit cards, spending more than you had intended is much easier. That's why many financial experts recommend the cash envelope system.

This old-school method helps ensure you don't spend more than you are meant to. So let's take a closer look at what it is and how it can help.

What Is the Cash Envelope System?

The cash envelope system is a budgeting method that requires you to put money into an envelope for a variable expense.

For example, groceries are a variable expense. Therefore, each pay period, you will put the amount you have allotted to groceries into an envelope.

The idea is that you spend only what's in the envelope. So, for example, when you go shopping, you'll leave your debit card at home and only have the money in the envelope.

Other variable expenses include gas, household supplies, entertainment, clothing, and personal care. Again, you'll want to have a different envelope for each expense.

How Does It Help You Stay on Budget?

The cash envelope helps you stay on budget by forcing you to be more conscious of your spending.

When you know that you only have a certain amount of cash to spend, you'll be careful what goes in your cart.

You'll also be less likely to grab things you don't need just because they are on sale.

If you're the type that justifies spending more because something is a stock-up price, you'll be forced to rework what you're buying to make it work with your budget.

What Should You Do with Leftover Money?

People often ask what you should do with the money you have left over. It's always a good idea to roll that money into the next pay period. We all have months when we'll need to spend more than usual.

For example, when the holidays roll around, you'll more than likely spend more money on groceries.

Rolling the money to the next pay period helps ensure that you have more money for those extras.

The cash envelope system is a great way to ensure you stick to your budget. Give it a try and see how it works for you.

You'll be surprised at how much less money you spend. Best of all, you'll also find that you have fewer impulse buys and work even harder to stay within your budget by couponing or looking for other ways to save money.

How we use our cash envelopes

We used the cash methods at the beginning of our financial journey. Then, after a few years, we stop.

In late 2018, we decided to change our financial game, including using cash envelopes.

Now we are not fans of cash envelopes. We are not. We have made this clear in posts, but guess what?

Cash envelopes work. They help us save money and stay focused.

We don't enjoy using cash envelopes because it is not convenient. So instead, we swipe our cards and spend more money. It's a fact.

Using cash helps us save money, and because this is a primary focus, we decided to go back to using cash envelopes and growing our savings.

In January, we saved $541 thanks to using cash!

This year I encouraged my readers and subscribers to challenge themselves if they are not using cash envelopes and start immediately.

To make this fun, I created different money envelopes and Valentine's Day envelopes to use this month.

If you doubt the cash method, stop! Cash works, and you can make this work for you and your family.

Do you pay your bills all in cash?

The real world is not about paying for everything in cash. I pay my bills online and have categories that we use cash only.

What are the categories of cash envelopes?

- Housing

- Groceries

- Transportation

- Clothing

- Pets

- Kids & School

Of course, these are just samples of the cash envelope categories you can have, and as I always say, these should be categories that reflect you and your budget.

For February, we decided to take on a new challenge, and this time we are doing the Cash Envelope Challenge.

For February, we are using more cash envelopes and sticking to them. This is important because, to be honest, we enjoyed our No Spending Month in January and used cash for many things.

That's why we saved a lot of money. Of course, we hope to save even more this month, but we shall see.

To help you understand more about categories, continue reading because I will show you more details below.

When you create a budget, you create categories such as:

- Food

- Household

- Utilities

- Car service

- Mortgage

- Healthcare

- Etc.

The good thing about the cash envelope system is that you don't have to make categories for EVERY category on your budget.

You make envelopes for categories that you can control or that are problematic.

For example:

You don't make an envelope for your mortgage because you already know how much your mortgage is each month. It's even automated; each month, the mortgage company withdraws it from your account.

Your cash envelope categories should be the ones that affect your finances. The ones that you typically overspend your money on.

Top categories people overspend:

- Food

- Restaurant

- Clothing

- Travel

- Entertainment

- Personal care

I recommend you stick to 5 or 6 envelopes. (We will cover more later.)

Related posts:

Why do people fail at using this system?

Many people struggle to use the cash envelope system for budgeting successfully. This is often due to the lack of consistency required; if users do not dedicate themselves to faithfully adhering to cash-only purchases, it becomes challenging to stay organized and adequately allocate funds.

Additionally, cash can easily be spent impulsively, which is not ideal for budgeting purposes and will only lead to failure when attempting this system.

Without proper planning and dedication, cash envelopes are not the most effective way of tracking expenses, which is why many people struggle with this financial tool.

When I hear people telling me that they tried the cash system, it didn't work, yet they are still struggling financially, I tell them this: It's not the cash envelope method that failed; it's you.

People fail to use this method because:

They went with a negative attitude.

Not having a positive attitude and outlook when using the cash envelope system is another reason many struggles with it. In addition, it can be challenging to stay organized and keep track of expenses without being passionate about budgeting.

Additionally, if one does not have an optimistic mindset when attempting to use the cash envelope system, they are likely to become frustrated and give up quickly.

A positive attitude and mindset are essential to successfully utilizing the cash envelope system and achieving financial success.

The cash envelope system isn’t sexy, and it does take effort. Are you going to let that stand in the way of your financial freedom?

They weren't committed.

Not having a solid commitment and dedication when using the cash envelope system is another reason many struggles with it. Without being committed to budgeting, it can be challenging to stay on track; if one does not have the willpower to stick to their allocated funds, then this system may prove ineffective.

Sticking to a cash-only budgeting system requires discipline and dedication, so without these qualities, it cannot be easy to stay on track with the cash envelope system.

They lacked organization.

The organization is also key to successfully using the cash envelope system. It cannot be easy to stay on budget without an organized plan for allocating funds and tracking expenses.

Additionally, if one does not have an organized system for tracking and monitoring spending, one may find the cash envelope system ineffective. Therefore, being well-organized is essential when attempting to use this financial tool and achieve success with budgeting.

The truth is that you can make this method as convenient for you as you can. When we first started, we made tons of mistakes, heck we couldn't figure out budgeting at all, but we didn't give up.

Giving up was not an option, and we weren't quitters.

Our problem was that we made this system too complicated and created a budget system that was someone else's.

Make the cash system work for YOU, not others.

Commit.

What do I do with the leftover cash from our cash envelopes?

What should you do with your leftover money? This is a good question, and below I will show many options on what to do with your leftover cash.

With your leftover money from your cash envelopes, you can do this:

- Pay debt

- Rollover to the next month

- Save it

When is this the best idea?

If you are focusing on paying down or eliminating your debt, use the money left over to pay off your debt.

How to decide which debt to pay down? (highest interest or lowest balance)

I'm going to say that when it comes to paying down your debt, you need to do what works for you and your family.

Many say to pay off the smaller debt, the high interest first, or the higher debt.

My opinion is that you should do what works for you and you feel good about it. Pay the debt that gives you the most anxiety!

I eliminated my consumer debt first before my auto loan because the consumer debt gave me more anxiety than the car loan.

Getting rid of the debt that gave me anxiety was essential to me.

Rollover

When is this the best option?

Beginners often ask what they should do with the money they have left over.

It's always a good idea to roll that money into the next pay period. We all have months when we'll need to spend more than usual.

For example, when the holidays roll around, you'll more than likely spend more money on groceries.

Rolling the money to the next pay period helps ensure that you have more money for those extras.

How to allocate the next month's envelopes

How you allocate the cash is by simply keeping the cash in the same category. For example, if you have $50 left on your grocery envelope, add that amount to the next payday.

Example:

Budgeted amount – $300

Leftover amount – $50

Total Envelope amount – $350

Save

Best places to save (cash, savings account, investment?)

- You can use the leftover cash and add it to your savings account. We recommend creating a savings account that is not easily accessible to you. We use CapitalOne 360 and Digit because money is not easily accessible.

- Loose change can be added to a jar and cashed later. We have a summer jar, which we use for our summer outings and pool days.

- You can put that cash into an investment.

- You can also save cash in your home. As inflation affects our finances, we decided to increase the cash we save. We use this money as miscellaneous and to keep up with cost increases.

Saving goal

I recommend you save money as well as pay debt. You can do both, and there is no wrong way regarding your finances.

Many believe one way of doing personal finances works for everyone, which is far from the truth.

Again, your personal finance is your own and should reflect you and no one else.

Do what works for you when it comes to saving money.

Can you pay a debt, roll over cash, and save simultaneously?

Depending on your financial goal, you can do all three. We tend to save and roll over the money for the kids and school category all year round.

My boys are special needs children and go to summer school. During the summer, I might not spend a lot, so that category grows when back-to-school time helps me pay for supplies for them because I have rolled over what has been left over.

For Christmas categories, we save it and deposit the money into our Christmas account when the holiday is near. Our goal is to have our goal money saved by Black Friday.

Finding a System That Works For You

When it comes to budgeting and finances is called personal for a reason, it should reflect you and your family.

I explained how the cash envelope system works. First, you create a budget, make categories, get the blank envelopes to write the types, stuff the envelopes, and use them until the next budget or payday.

The leftover cash can be used for debt, savings, or rollover. But I wanted to talk to you about different ways to fill your envelopes.

I mentioned earlier that the good idea is to fill your envelopes with money every week or when you get paid.

Let's be honest for a minute; if you are living paycheck to paycheck, it won't be easy to stuff your envelopes one time at the beginning of the month.

If you are starting the cash envelope system, then break your monthly budget into weeks. Then, either fill your envelopes one time a week or biweekly.

You can also budget your paycheck, which means you will create a budget for each paycheck you receive and, on that day, head to the bank and fill your cash envelopes.

Cash Envelopes – Once a Month

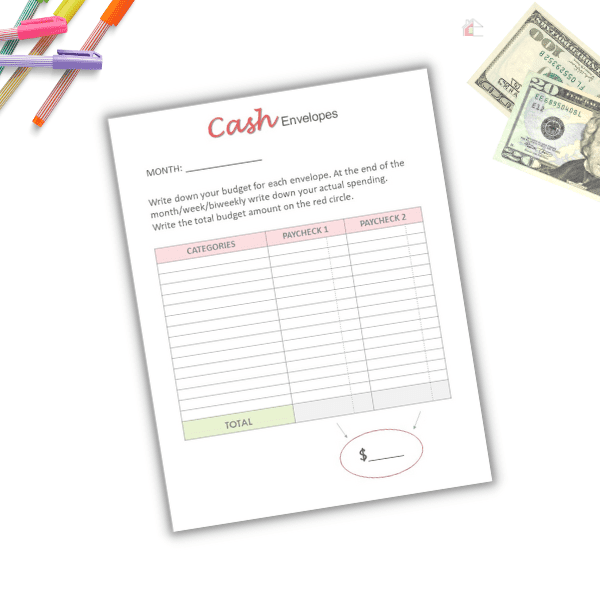

I'm going to show different ways to stuff your cash envelopes using a Cash Envelope Sheet (Monthly)

First, you are going to write the month where it says month.

Then you will write down the categories you have created for the month.

This is just an example:

- Household

- Groceries

- Transportation

- Clothing

- Pets

- Kids & School

Next, on the column that says Budget write down the budgeted number for the month.

Write it down if you budgeted $700 for groceries and $ 25 for pets.

On the total row, write down the total for the budgeted amount.

In the Actual column, you will write the amount you spent at the end of the month.

In the circle, you write down the total amount of cash you need for the month, which this the total amount budgeted.

If you have the fund to stuff your envelope with the monthly budgeted amount, use the How Much Cash Do I Need sheet or any blank sheet and head over to the bank to get your cash.

Then grab your envelopes and fill them with the cash for the entire month.

Remember that once the money is gone, it is gone! You can't refill your cash envelopes until the next budget, so please be careful.

If monthly cash-filled is not your thing, I'll show you how to fill your envelopes in another way that will help you keep the amount of cash low and more manageable.

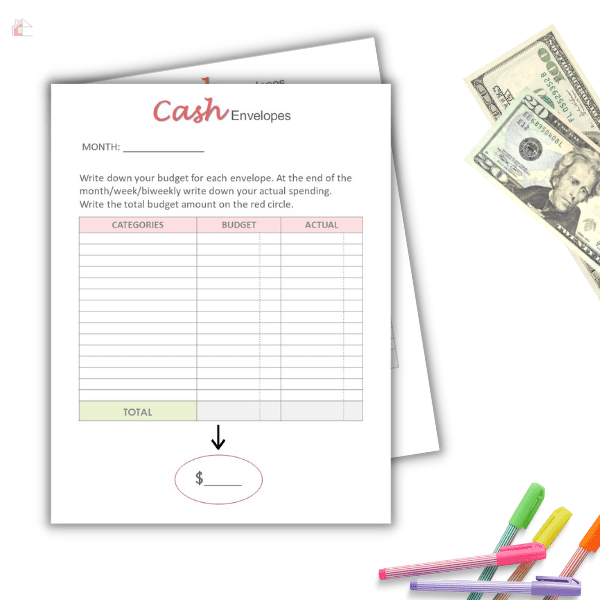

If you want to fill your envelopes every two weeks, then all you need to do is break it down into two weeks.

The example sheet is one we use in our binder, and we break it down into paychecks since we get paid every two weeks.

We love this system because we don't have to deal with so much cash, and it is easy to see and manage our budget progress.

Even if you use this method to fill your cash envelopes, I recommend you use the Cash Envelopes Monthly Sheet I showed you previously or the system shown.

You need to budget your categories for the month and then break them down.

This will make the system easy because you will see the process work.

Now with the biweekly sheet AFTER your monthly budget, you will see how your month looks.

First, you are going to write down your categories under the category. This is just an example:

- Household

- Groceries

- Transportation

- Clothing

- Pets

- Kids & School

Next, you will look at your bills and your budgeted cash category. You know how your accounts work and how much you need to pay each paycheck, right?

Let's go over this example. Let's say we budgeted $600 for groceries and, looking at my bills and first paycheck. I can pull $300 until the next payday for my cash envelope.

You plan to pull your last $300 on the second paycheck.

On the sheet, you will write down the amount you will fill the envelope, which is $300 under paycheck 1 and $300 under paycheck 2.

Now household, you have budgeted $75, and you will be OK pulling $25 in the first paycheck because, on your second paycheck, you will purchase a lot more. So then you write $25 under paycheck 1 and $50 under paycheck 2.

You will go and do this for all your categories. Write down how much you will pull for each paycheck and add the total.

When you add the total for Paycheck 1 and paycheck 2, it should equal the budgeted amount on your first page.

You don't have to split your categories in half. We don't fill our Christmas envelope until the second paycheck because on our first one. We spend more on groceries and our kids and school events.

Where to get a horizontal cash envelope template

We believe that using cash will help you get your finances under control.

The cash envelope system will help you to:

- Save money

- Eliminate debt

- Control your finances

- Change your life

Because we believe it can help you, you can download our horizontal cash envelope template for free when you subscribe to our newsletter.

But before you go, you will learn how to print, fold, and use this envelope template.

Are you ready?

Let's begin!

Free Cash Envelope Templates

Below is a photo of how to fold the free envelope template you will receive when you sign up for our newsletter.

Below is the tools I use:

If you are interested in using budget binder printables, click the link here.

If you are interested in learning how to use an excellent budgeting system and get these cash envelopes, then fill out the form below.

16 Comments