6 Incredible Monthly Money Savings Challenges

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereThere are many money challenges out there, and I must admit that I genuinely enjoy adding some spark to my finances and some money challenges into the mix.

Finding the best 2023 monthly money challenges this year can be intimidating, especially if you are a beginner.

For ideas, you will be able to find many money challenges out there. Some are simple, and some are, well, challenging. Monthly money challenges will help you save money or make money.

This is what I love about money challenges. It's the fact that you can make it into whatever you want it to be as long as you reach your goals and get challenged in the process.

Many people oppose doing money challenges, but I believe that if you are looking for some thrill, then go for it! We did!

We have done a few, and I think my favorite was the 52-week saving challenge and how much I learned from it.

So what monthly money challenges should you look forward to this year? I found a few money challenges that will help you save money but will also help you reduce your debt; some might even help you make money!

Before you start, make sure you understand that having a budget and realistic goals in mind.

Below are five ways to save money effectively:

2023 Monthly Money Challenges to Try This Year

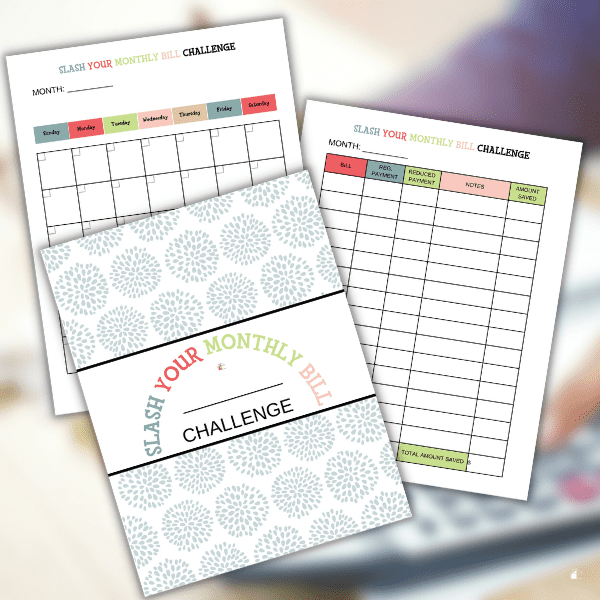

Slash Your Monthly Bill Challenge

To save money, take the Slash Your Monthly Bill challenge to help you bring your monthly bill payments down.

What I like about this challenge is that you will take the time to sit and review all your monthly bills and find ways to bring them down.

Even with your monthly bills, you can save money, believe it or not. In addition, you can control these monthly expenses because chances are you are overspending on them. For example, you might overspend cash on housing, food, utilities, and insurance.

The good news is that you can find plenty of ways to cut these costs. Of course, how much you save depends on how which cost-cutting ways you choose to make. But the truth is that you can save money with the Slash Your Monthly Bill challenge.

Here are some money-saving posts to help you slash your monthly bills!

- 5 Simple Ways To Save On Groceries

- How To Use Coupons Now: Why I Coupon This Way

- Learn To Coupon On A Low Income

Pay Extra Money Challenge

Taking the Pay Extra Money Challenge is an excellent way to get ahead in your finances.

This challenge concerns gathering all your bills and paying more than you would normally.

For example: take your credit card bills, and instead of paying the minimum, pay more!

What makes this challenging is that many of us don't have a budget and have difficulty paying more than the minimum monthly credit card payment.

The point is to find ways to get ahead and use a plan and a strategy to accomplish this challenge.

This is when taking more than one monthly money challenge will benefit! Here are some excellent resources to help you succeed at this pay extra money challenge.

Declutter and Sell Challenge

We need to take on this fun challenge at least once a year, the Declutter and Sell Challenge.

The Declutter and Sell challenge consists of you taking an entire month to declutter your home and sell your unwanted items for extra cash.

This is hard work but so rewarding. You get money for things you don't need anymore! Below are some resources to help you achieve success with this challenge.

- How To Eliminate Clutter From Your Home

- Why We Don't Don'toys For Our Children

- Yard Sale Mistakes To Avoid

Build Your Emergency Fund Challenge

Emergency funds are a must for everyone! But, sadly, not everyone saves money for a rainy day and spends it.

I was one of those people with no money set aside and depended on other things, like credit cards, to help me escape financial situations.

Things happen in life. This is nothing personal, nothing to do with luck or karma; that is just life.

For example, the stove will break down, the heater system will act up, and your car won't. These are examples of unexpected things that cost tons of money.

This is when having money saved away comes into place. For situations like these and more, having an emergency fund helps reduce stress and gives us peace of mind.

If you don't have any money saved toward your emergency fund, then the Build Your Emergency Fund challenge is for you!

The challenge for many of us is starting and maintaining an emergency fund. For this reason, I suggest this challenge because there will be one! Below are some resources to help you succeed in this challenge.

- Get Out Of Debt: Start An Emergency Fund

- Why Having An Emergency Fund Is Important

- How To Save Money When You Are Living Paycheck To Paycheck

Ways to Make Extra Money Challenge

If you need to make some extra cash fast, take on this Ways To Make Extra Money challenge and see how much extra cash you can make in a month.

I will tell you that this challenge might become your favorite once you learn how much money you can earn.

Seriously, who doesn't love money?

I do!

Sitting down and researching ways to find money is not hard. The internet is full of it, and I have some ideas for you.

I will tell you that this challenge is about making extra money, not spending money to make money.

Below are some ideas to make some extra cash:

Resources and ideas to make extra money post below:

- 5 Ways To Make Extra Money

- Earn Free Money

- 25 Ways To Save Money For Christmas

- Claim Your Unclaimed Money Now

Spending Freeze Challenge

This is a challenge that I love and sometimes dislike, but it works. Before you go on about not spending money when you need to spend money because you have bills to get, calm down!

A spending freeze challenge is about freezing spending money on things that are not needed.

You will have to pay your bills, but you will not spend money on things you usually spend on. Like coffee, going out to eat, and such.

Though it might sound simple, a spending freeze will get hard once you realize how much money you spend on things you think you need but can live without.

A spending freeze challenge takes planning and motivation, and you can find tons of support and information online.

Surviving a spending freeze might be tricky if you don't make an effort to it. I have done them and will share some tips to help you succeed in this challenge.

- Avoid shopping for fun.

- Do not go out shopping when you are hungry.

- Shop with a shopping list.

- Create a menu plan.

Monthly money challenges are fun and exciting and helpful for your finances. These monthly money challenges are ideas to help you take on the challenge.

Great TIps!!! I am going to start some of these challenges for the next few month.