8 Tips On How To Not Spend Money This Month

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereThis month I am not going to spend money. Repeat after me. This month I will not spend money on things we don't need!

Yes, I am dead serious and to be clear, I am talking about wasting money on things that are not important. I challenge you to take a look at your spending habits and make this month a no spending month.

Can you go an entire month without spending any money on things you don’t need?

Believe it or not, this is not as easy as many people think.

But let's be honest here for a minute, to not spend money is very challenging to many. If that were the case, yours truly here would not be writing about this financial issue.

We spend and overspend money on just about anything.

People overbuy! We overbuy food, clothes, and other items and the sad part is that we really don’t need to.

The good news is that if you overspend and are looking for ways to not spend money, we got some tips for you.

You are not alone! I overspend! Guilty!

I make no secret that I am an emotional spender, this was my downfall years ago, but I do take a not spend money challenge very seriously.

And thanks to these tips I can keep track of my spending because these eight tips have worked for me over and over again.

So, are you ready to not spend money and get your finances on track this month?

Good because I'm ready too!

You can find many tips on how to not spend money when you search online. Some suggestions are greats, others too extreme for me. The key is to find the one tip or ideas that work for you and your family.

For example: Not spending money on toilet paper. A great way not to spend money I'm sure, but this doesn’t work for me. However, cutting coupons and using money-making apps to save money works better for me.

Apps such as:

- Ibotta

- SavingStar

- Fetch Rewards (use code DK24W to earn 2,000 points)

- Shopkick

Do you get the idea?

I also know that many people also ask this question:

How to not spend money on food

The truth is that the steps below work for all types of spending including groceries. One thing to help you stop all kinds of spending this month is to focus on weekly goals.

Take your monthly goal and break them down into weeks. Why weeks? You see, when you break your goals and focus on reducing your spending weekly it will help you stay focus.

I also do weekly goals because that way I don’t get bored and it is more challenging for me, and I can hold myself accountable for not getting it done!

Each week I do these 8 tips to help me cut my overspending and help me to stop spending money on things I don't need.

8 Best Tips to Not Spend Money

Write it down!

Each week or each day, depending on how you see fit your personality, write down your goals.

I do weekly goals and this helps me set the pace for the rest of the week. I like to write my goals on Sundays, but you pick the best day that works for you!

Having a great notebook or planner is a great idea because you will have a central location to keep track of your goals and other personal notes to keep you focus and on track.

Check out these posts:

- 20 Sneaky Ways to Save Money Today!

- 6 Everyday Money Wasting Habits You Need To Stop Today

- 6 Things You Are Not Doing That Are Costing You Money

Weekly budget

The best way to not spend money this month is by breaking your budget into a weekly budget.

I will do my budget by week instead of a monthly budget. This will give me a more detail look at my spending.

If the weekly amount is $175 for groceries (this is an example), then I should be able to account for all that money that week.

Creating a weekly budget will make things more realistic and achievable than if you use a monthly budget, at least for me.

Now, if you feel more comfortable using a monthly budget then that is OK. The point of doing this is to make sure you keep control of your money and not spend money on things you don't need.

Cash only

Using a cash system simply works and it had helped us to save money and to limit our spending. The reason I do this is that I know personally that when I use cash I tend to save more.

All the loose change goes into our pickle jar and knowing that I only have that set amount of money to spend keeps me on track.

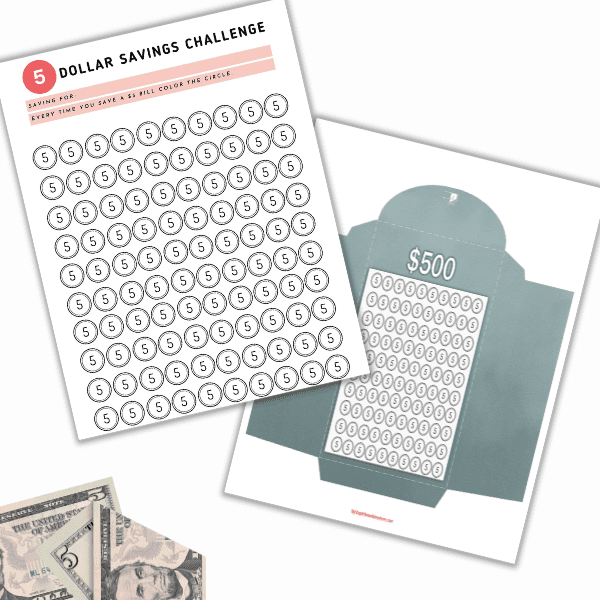

If you don't know how the cash envelope system works, then I suggest you use this method to reduce your spending and to help you control your money.

It's not my favorite method because I don't like carrying cash with being at all, but the honest truth is that this system works when it comes to tracking your spending and saving money.

Shop with a shopping list

If you don't shop with a shopping list, then you are a genius and I want to know how you can remember everything and stick to a budget without one.

OK, maybe you have a great memory, but the truth is that not everyone is as disciplined and have a great memory as you.

Having a shopping list always helps me out and keeps me on track of what I need to purchase.

My problem is that when I go shopping I tend to forget the list. I finally got this app for my mobile phone that is helping me in this department.

If you are like me a thing to do is to take a photo of your shopping list just in case you forget it.

Create a menu plan

I’m a big fan of menu planning. I love creating them and using them. If you don't have a menu plan you are missing out on how much time and money you can save by creating a menu plan for the week.

Below are two important reasons why I love creating and using a menu plan:

Convenience:

Creating a meal plan will reduce the amount you spent going to the grocery store to look for what you need. You have all the ingredients available for your meals. This will avoid stress and the “what’s for dinner” from the rest of the family.

Less waste:

When you plan what your family is going to eat for the week, you will plan meals that you know everyone will enjoy. This avoids having food wasted because you didn’t overbuy products you didn’t need. You avoided creating meals that were not popular with your family.

A menu plan will give you an idea of what ingredients you are going to need and when you partner this with what you have in your pantry and your store ads you can increase your savings.

To not spend money, simply stick to meals with ingredients you already have or items that are on sale. Also, stick to meals that are simple to make to avoid overspending on ingredients you don't have at home.

Analyze my bad habits

I think I know what went wrong during the month of May; no planning. I budgeted the same I budget for the previous month and didn’t take to account birthdays, Mother’s Day, and graduation parties.

I have to analyze my budgeting skills and look at my calendar. I also need to stop being hard on myself, we are not perfect.

Read more money-saving articles:

Taking the time to look at your budget is important and obviously, during that month in May, I didn't. I just simply took a few minutes and didn't think of anything.

I was rushing and I wanted to be done with budgeting. To avoid this, always take your time and look at your calendar then create your budget.

Avoid shopping for fun

I will go shopping when I need to go shopping. Shopping just because I’m bored or need to get out of the house is no excuse for spending money.

If I have no reason to go to the store, then I will not. To not be tempted get unsubscribe from deal sites and favorite stores to reduce the urge to shop.

Will not go to the store hungry

Believe it or not, this seems to be one of my downfalls. I tend to go around the time when I am craving lunch. You know what happens when you are hungry and you are shopping; you overspend.

Look not spending money is not as simple when we are so programmed to spend it.

However, knowing this and doing these steps will help you to limit your overspending once a week at a time.

I was skeptical at first about a not spending week or even a month, but it worked and one week can turn into two weeks and so on.

When you start implementing these tips, you will see your saving grow and that my friend is such a great feeling.

We do the change jar thing, too! And coupon of course. 🙂 We are guilty of shopping hungry on occasion, though. Never good for the pocketbook!

I made sure I stuffed my face (not good for my diet) before I headed to Aldi LOL Thanks you!!

This post could have not crossed my path at a better time! I NEED to stick to that shopping list and stop food shopping when hungry! You’re so right, and I think you’ve covered all the great tips… I recently started shopping fruits and vegetables at my local farmers market and it’s saving me good money. Plus, the farmers market doesn’t have much of an assortment of dry goods (and all those BOGO offers) that a normal supermarket has so, I’m saving there too. Thanks for such a great post!

I forget to budget for birthdays or holidays for the month. Like for Father’s Day this month. Ugh…

This is our first month trying the whole cash envelope system. I went to the bank to withdraw the money and we divided it. We are hoping having cash will stop us from spending as much. I avoid Target like the plague until I get my spending habits under better control. I’m such a sucker for that place! haha

Thanks for sharing tips!

Thanks for the tips! Going to the grocery store hungry is a big mistake for me too!

♥Heather

http://golddippedchaos.com

My cousin once told me to move any money I have left at the end of the month to my savings account whether it is $5 or $200. It has served me well to start each month from a zero base.

I now get into a contest with myself during the last week of the month to see how many purchases can be moved to the beginning of the next month. This includes shopping from my pantry so I don’t go to the grocery store, stretching my gas mileage to get to the first of the month without buying gasoline, etc. The money that remains in my checking account from not making purchases then gets moved to my savings account. Works for me.

I get paid twice a month so my budget is bi-weekly. Each payday is assigned certain bills depending on the bill due date. I took a calendar and used last years bills to see when insurances are due, adding in birth dates and holidays, etc. My budget is for a whole year and I add in the bills that come due every three months, six months, or yearly to the month they come due. This way I can look at each month and know what to expect. No surprises.

One more thing, I was in a class where the lesson material was about bill paying. The teacher pointed out how important it was to pay rent, utilities, food, etc., first. I was amazed at how many in the class then said with straight faces something like, “But then I won’t have any money for fun.”

Shopping with a list is crucial for me. If I ever go in without a list I am guaranteed to forget something and have to go back and also buy things we don’t need. If I have a list I can stay focused, make a beeline to what I need and get out fast! Great list! Sharing!

I’m there with you. I because I know myself I need to keep myself on track. I even go to the store sometimes with a list and cash only. Thank you so much for commenting Anne. Have a great week!

I hope you have a great week as well!

I loved your idea to do a weekly budget along with the monthly one. I feel like that would motivate me a little more plus help me be self aware. I’ve also used cash to pay for things such as groceries and it helped me so much to see where every penny was going! Thanks for the tips.

One of the things I’ve really challenged myself with lately is to make all of our meals at home. Being a busy work-at-home mom, I find myself scrambling to make dinner at the end of a busy day and it’s so much easier to just buy something that is ready-made. But eating out costs a lot more money and you buy extras that you wouldn’t normally buy or eat (e.g. appetizer, sodas, etc.). Since I work from home, though, I do have the luxury of prepping a meal when I take a lunch break. So I challenged myself to stop the eating out cycle, plan ahead and make dinner more. The first week was really hard, but now I feel like my first thought at the end of the day is “what can I make,” versus “where can we go?” The food I cook might not taste as good as it does at a restaurant, but it costs less…and I can always learn to cook better. I’ll add that to my list next. 🙂

I think it biggest thing is to plan ahead in general. I try to limit my trips to the store for groceries, every other week. I also include toiletries and baby items in those trips. So, along with meal planning for my husband and myself, I also plan out our son’s baby food meals and take an inventory on his diaper, etc. Another quick skim over our shampoo and similar items and then I’m off to the store! Planning out all of this stuff in advance saves me from an impulse trip, and impulse buying!

I say start small! This is my first week ever trying a ‘no spend week’ and my goal this week is to not go out for lunch or dinner. Seems easy but I’m always running out of the office for lunch or picking up dinner on the way home. I did a little meal prep and went grocery shopping Sunday. I also looked through my fridge & cabinets to see what left overs we could eat through before they go bad. So far so good-but it’s only Wednesday! lol

YAY!! You can do this! Let me know how your week went.

This is really helpful. I am starting to save my money now. This would really help me.

Yep, cash only is my single-most greatest mantra in the saving world. When I deal with hard cash and shell out few hundreds for a top, for instance, it pains me because that’s my hard-earned money right there. I have realised that I spend a lot less when I deal with cash.

Great list and definitely key points to help you save. I love Amazon Prime. It helps me so much when the week is busy and I need to find certain things for school.

“This month I will not spend money on things we don’t need!” – I am going to write that on my bathroom mirror! My husband and I have an ambitious plan to pay off all of our debt (including our two mortgages) in the next 4 years, so we can use ALL the advice. We already meal plan and do weekly budgeting, but I love the idea of setting weekly goals.