How Can I Save Money Even If I’m Broke? (5 Smart Strategies)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereEven if you are broke, there are ways that you can save money. We will discuss five smart strategies you can use to help you save money even when you're on a tight budget. And you'll have some helpful tips and tricks to help make your finances a little more manageable.

So, without further ado, let's get started!

How To Save Money On A Budget

Start with a budget.

When it comes to saving money on a low income, a budget is your best friend. A budget is simply a plan for how you spend your monthly money. It can help you stay on track with your savings goals and make the most of every dollar you earn.

To create a budget, start by estimating how much money you will have coming in each month. This includes all of your sources of income, such as paychecks, government benefits, and pensions.

Next, estimate how much money you will need to cover your monthly expenses. This includes things like rent or mortgage payments, utilities, groceries, and transportation costs. If you have any debt payments, such as credit card bills or student loans, include those as well.

Once you have estimated your monthly expenses, subtract them from your monthly income. The difference is what you have left to save. Decide how much of that amount you want to put into a savings account each month, and then create a plan to make that happen. You may need to make some adjustments to your budget to ensure that you can save as much money as possible.

If you find that you are not able to cover all of your expenses with your monthly income, there are a few things you can do:

- Look for ways to reduce your expenses. There may be areas where you can cut back on spending without making too many sacrifices.

- See if there are any government benefits or tax credits available to help reduce the cost of living expenses.

- Look for part-time work or freelance opportunities that can bring in extra income each month.

- Talk to creditors about setting up a payment plan that fits within your budget.

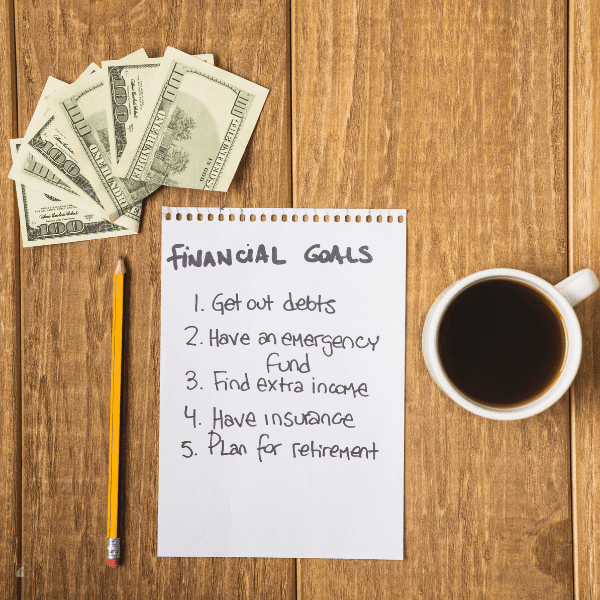

Create financial goals.

When you’re working on a budget, it’s important to set some financial goals as well. This will help you stay motivated and focused as you work to get your finances in order. But when you’re living on a low income, it can be tricky to create realistic goals that will actually help you save money.

Here are a few tips for setting financial goals on a tight budget:

- Make sure your goals are specific. Don’t just say, “I want to save more money.” Figure out how much you want to save each month and what you need to do to make that happen.

- Be realistic about what you can achieve. If your goal is to save $200 per month, but you only have $50 left at the end of each month, then you need to adjust your goal until it’s more achievable.

- Make a plan of action. Once you know your goal, figure out what steps you need to take to achieve it. If you want to save $200 per month, you might need to cut back on your spending or find ways to make extra money.

- Put your plan into action! Once you have a plan, it’s time to start taking steps to reach your goal. Make sure to track your progress so you can see how far you’ve come and stay motivated along the way.

Saving money on a low income can be difficult, but it’s not impossible. By setting specific financial goals and creating a plan of action, you can work towards improving your financial situation one step at a time.

Related posts:

- 6 Things You Are Not Doing That Are Costing You Money

- What to Save For This Year (8 Top Money Categories You Must Save For Today)

- 5 Things To Avoid During A Recession

Use any extra money toward your savings.

Making extra money on a low income can be difficult, but there are ways to do it. One way is to use any extra cash you have after you create a budget and set financial goals. This extra cash can be put toward growing your savings.

One way to grow your savings is to put your extra cash into a high-yield savings account. This will help you to make the most of your money. You can also look for other ways to grow your savings, such as investing or taking advantage of compound interest.

If you are looking for ways to make extra money, there are a number of things you can do. You can start by looking for ways to cut back on your expenses. There are many ways to do this; some may be easier than others. You can also look for ways to make more money, such as by taking on extra work or finding side hustles.

Making extra money on a low income can be difficult, but it is possible if you are creative and willing to make some sacrifices. By using any extra cash you have after creating a budget and setting financial goals, you can grow your savings and improve your financial situation.

Stay motivated!

When it comes to saving money on a low income, motivation is key. If you're not motivated to save, you're likely to find reasons to spend your money rather than put it away for the future. So, why is motivation so important?

There are several reasons why staying motivated is essential when saving money. First, if you're not motivated, you'll find it difficult to stick to your budget or financial goals.

Second, without motivation, you may not have the energy or willpower to make small sacrifices now in order to save larger sums of money down the road.

Finally, staying motivated can help you stay positive and hopeful during difficult times – both financially and emotionally.

How can you stay motivated when saving money?

There are many ways, but some of the most effective techniques include setting goals, focusing on positive outcomes, breaking your goal down into smaller steps, plotting your progress, and rewarding yourself for meeting milestones along the way.

For example, if your goal is to save $1,000 over the next six months, break that goal down into smaller steps. Decide how much you want to save each week or month, and create a plan of action that will help you reach your goal.

Then, track your progress and celebrate each milestone along the way. And finally, reward yourself with something special when you reach your final goal. This could be anything from a new outfit to a weekend getaway – whatever helps keep you motivated and inspired.

Staying motivated is essential when saving money on a low income. By setting goals, focusing on positive outcomes, breaking your goal down into smaller steps, plotting your progress, and rewarding yourself for meeting milestones along the way, you can make saving money easier – and more enjoyable!

Don't give up!

When it comes to saving money on a low income, it is important not to give up. Things might not work out the first or second time, but they will. You must find the budget and a system that works for you and your finances.

Creating a budget can be challenging when your income is low. You might have to change your financial goals, and finding extra cash might be difficult. But don't give up—you can do it!

One way to make saving money easier is to find a system that fits your lifestyle. Maybe you can put aside a small amount of money each week or save up for specific purchases. Whatever you do, make sure it's something you can stick to.

It's also important to stay motivated. Saving money can be tough, especially when your income is low. But if you keep reminding yourself of why you're doing it, you'll be more likely to succeed.

Saving money on a low income isn't easy, but it's definitely possible. Just don't give up!

Getting started with your first budget is hard! I had to make some adjustments to my categories the first few months until I got the hang of budgeting and my spending habits. I still sometimes got over on some areas though.

I think the biggest mistake I make is not to evaluate the budget all the time. I draw up the budget and then get so disappointed when we don’t stick to it to the last cent that I just give up. Great reminder that it is a constant process.