$5 Savings Challenge (How to Save Big Saving $5)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereGetting started on saving money can begin with a $5 bill. Learn ways saving $5 can help you grow your savings. The $5 Saving Challenge is popular and fun to save money that doesn't require much effort.

There are many ways to do this five-dollar challenge, and one crucial factor is that you don't have to do any math, give up everything in life and live miserably to save money. All you have to do is save five dollars is not like saving a large amount of money.

What's the goal behind the $5 savings challenge?

The goal behind the $5 Savings Challenge is to create a simple, attainable way for people to begin saving money. The challenge encourages individuals to put aside $5 each week and increase the amount by $5 each week, which can add up to a substantial amount over a year. It offers an easy way to save money without making huge sacrifices. The challenge helps to create a habit of saving money and can be used to reach any financial goal, from emergency savings to buying a new car.

What is the $5 saving challenge?

The $5 challenge is a simple and achievable way to save money. It involves saving a set amount of money each week, beginning with $5 and increasing that amount by $5 every week. By following this strategy, participants can save up to $2,740 over the course of a year.

The challenge is gaining popularity on social media, as it is an easy way to save significant amounts of money over time. It can also be an effective way to prioritize savings, as the weekly amounts are small enough to be manageable for most budgets.

Love money-saving fun challenges? Check out, Tips to Successfully Complete The 52 Week Saving Challenge

Can you do this challenge without cash?

Yes, the $5 Savings Challenge can be used without using cash. Instead of relying on physical money, participants in the Challenge can use their debit or credit cards to deposit the designated amount into a savings account on a weekly basis. Additionally, those who prefer to scale down from $5 to $1 at the beginning of the month can use online banking or an app to transfer the specified amount into their savings account. This allows participants to save without ever having to use cash.

Here's an example:

Let's say you went to Walmart.com and ordered groceries; your total was $63.97. If your budget for that transaction was $75, you have left $11.03 after purchase. Therefore, you can transfer $10 (two $5 bills) into a savings account.

Another example is your rules on how you want to do this. For example, if you do a paycheck budget, calculate how much money you have left in each category at the end of the next budget and make a one-time transfer before your next budget cycle.

Love printables? Visit Cash Envelopes Template.

You can also do this monthly when you close out your budget. Another great way to transfer $5 is to head over to Starbucks or Target. Make it challenging!

Remember that this $5 saving challenge is customizable, and you are in charge here.

Using the cash method

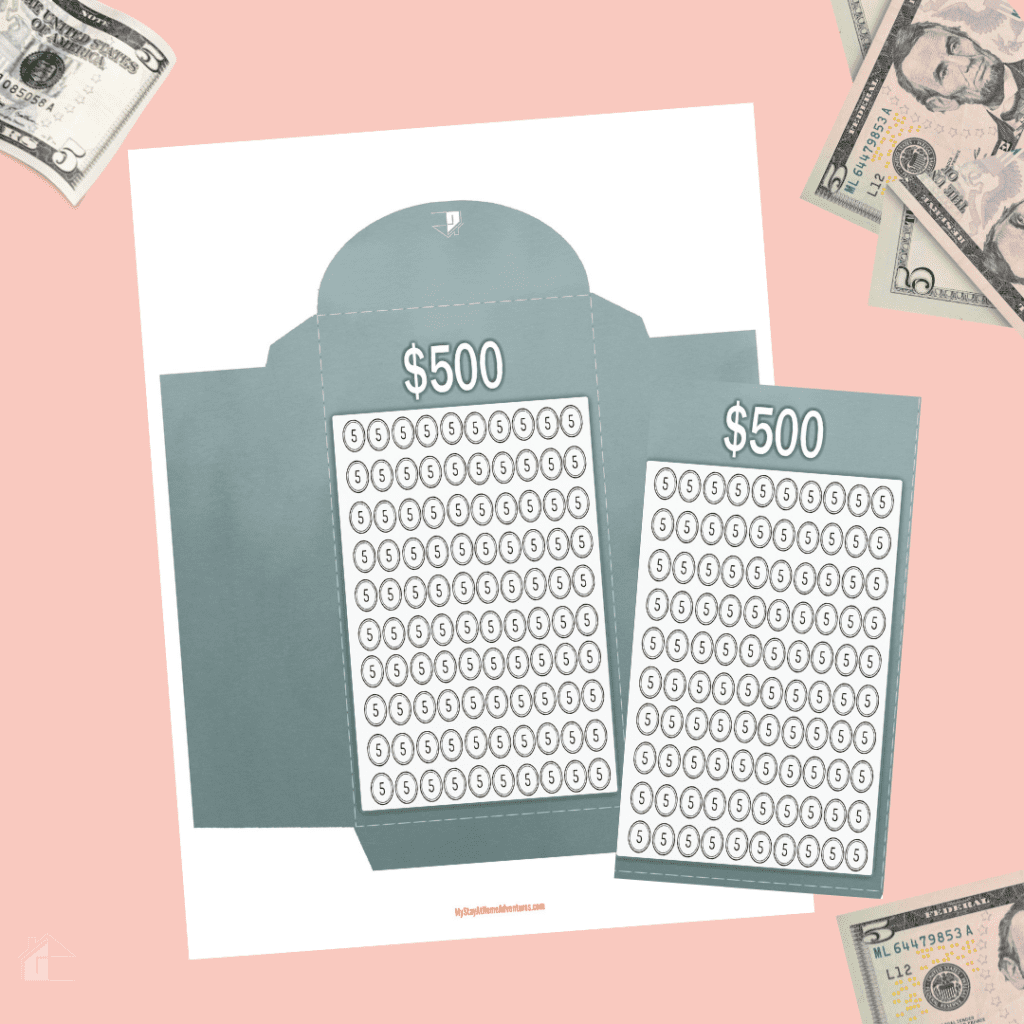

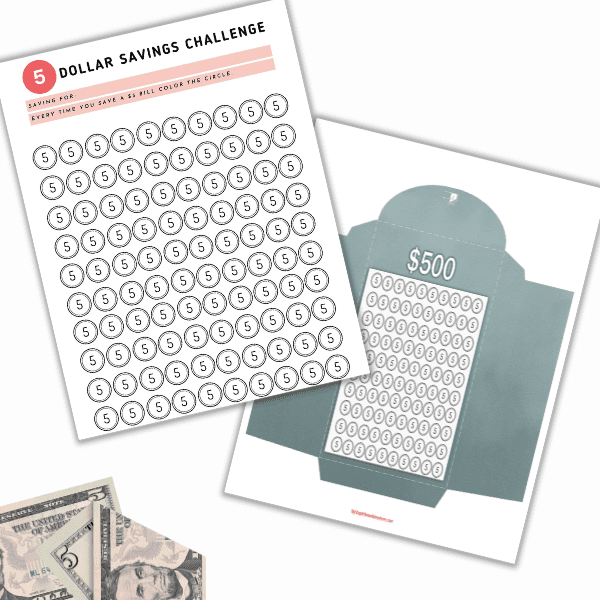

If you save $5 bills every time you use cash and get one, you can save it in a cash envelope, jar, or any safe location where you store your cash.

How do I start a $5 saving challenge?

Starting a $5 saving challenge is easy and can be done in a few simple steps. First, deposit $5 into a savings account for week 1. Then, for each additional week, increase the amount saved by $5 until reaching the desired savings goal.

Alternatively, you can set aside the $5 bills you receive as a change and save them instead of spending them. The 52 Week $5 Challenge provides an attainable goal of saving $5 and increasing it by $5 weekly. This challenge is an easy way to save thousands without requiring much effort or thought.

The key idea here is to make a spending goal, save the $5 bill and make it a habit.

Making saving a $5 bill a habit is where the challenge comes in. It's essential to be consistent with your $5 savings goal so you can see results at the end of the year.

If you find that $5 is too easy or hard for you, feel free to adjust it.

What can I do if I don't have $5?

If someone does not have $5 to participate in the $5 saving challenge, there are still plenty of other options. They can start with small amounts of money and gradually increase the amount they save as their income increases. They can also look for other ways to save money, such as cutting back on unnecessary expenses or using coupons.

Below are some examples of ways to get $5:

- $2.50 from loose coins in your wallet or $3 if you don't have $0.50

- Use cashback from rebate ads and credit cards such as:

- Ibotta

- Fetch Rewards

- Swagbucks

- Capital One Cashback – Use credit card cashback/

- Save the change until you reach $5, and then transfer it or save it

This $5 challenge is not meant to be hard, but it's just another way to save money, and that $5 will add up by next month!

What can you save with $5 a day for a year?

With just $5 a day, you can save up to $1,825 annually. Investing that amount in an account with a 10% annual return could net you around $30,000 in 10 years and $330,000 in 30 years. Additionally, if you saved $5 a day for six months, you would have $900. The 52 Week $5 Challenge helps you start saving money by giving you an attainable goal of saving $5 and then increasing each week's savings amount by $5. By the end of the year, you could have saved up to $1,825.

What are the pros and cons:

The $5 Savings Challenge is a great way to save money without too much effort. The challenge encourages people to use cash for purchases, and studies show that people who use cash generally spend less.

The challenge also allows for a gradual increase in savings, starting with small amounts and increasing over time. Additionally, it is easy to catch up on the challenge even if someone starts later in the year. All these factors make this challenge a great way to save money and improve financial management.

One of the cons of the $5 savings challenge is that it may be difficult to accrue $5 if you don’t spend much cash. Additionally, some people may not be comfortable having that much cash around the house or prefer to use debit and credit cards.

Furthermore, staying motivated in a savings challenge where the reward is incremental can be difficult, especially if the challenge is spread out over a long period of time. Finally, the challenge might not suit everyone's budget, as $5 can be too much for some people.

What can I do with the saved money?

With the money saved from the $5 savings challenge, you can do so much! You can use it to plan a vacation, pay off a credit card bill, build up your emergency fund, or save up for any other financial goal. It’s an attainable goal that can help you start saving money on the right foot.

With the money saved from this challenge, you can:

- pay debt

- save for an emergency fund

- save for vacation

- invested (I use Acorn Investing)

- save for your sinking fund

Plus, it’s a fun and easy way to keep track of your progress and watch your savings grow each week. So why not give it a try? With just a few small steps, you could be on your way to achieving your financial goals.

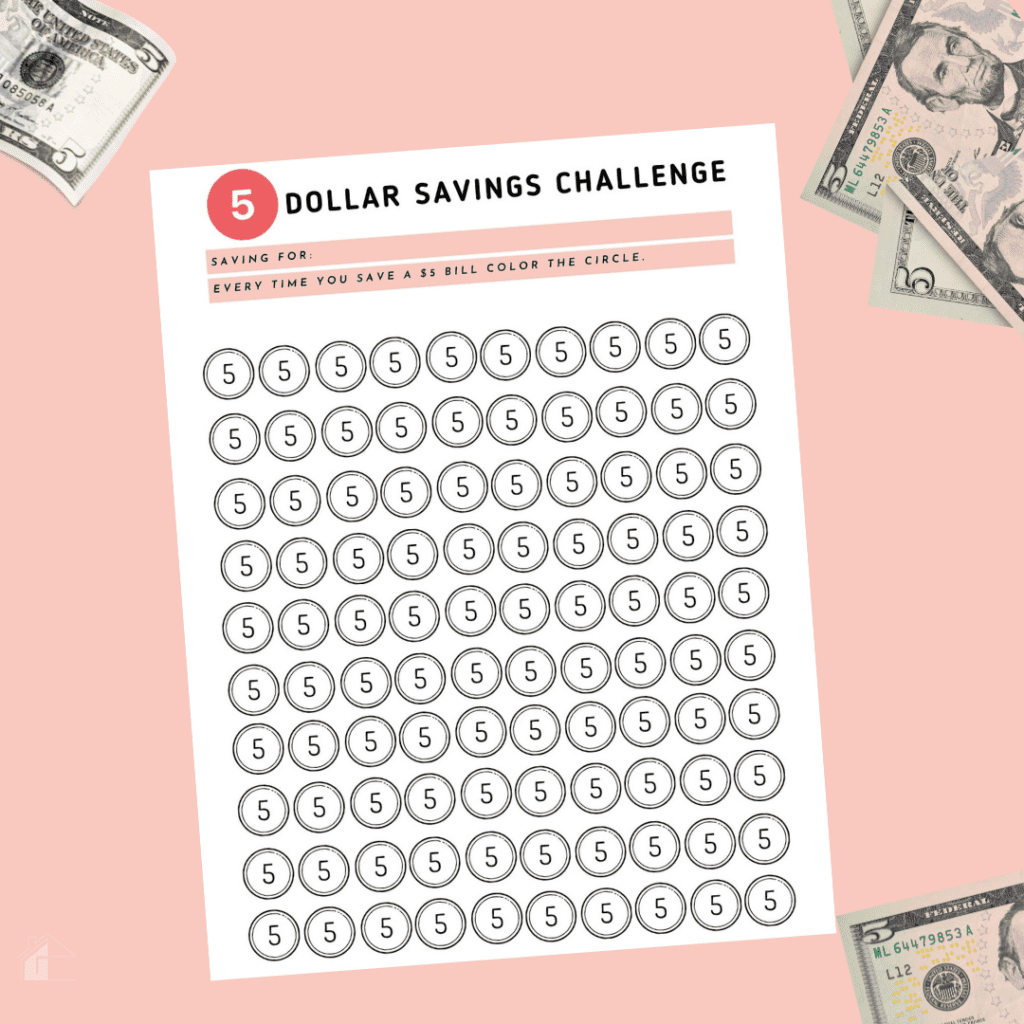

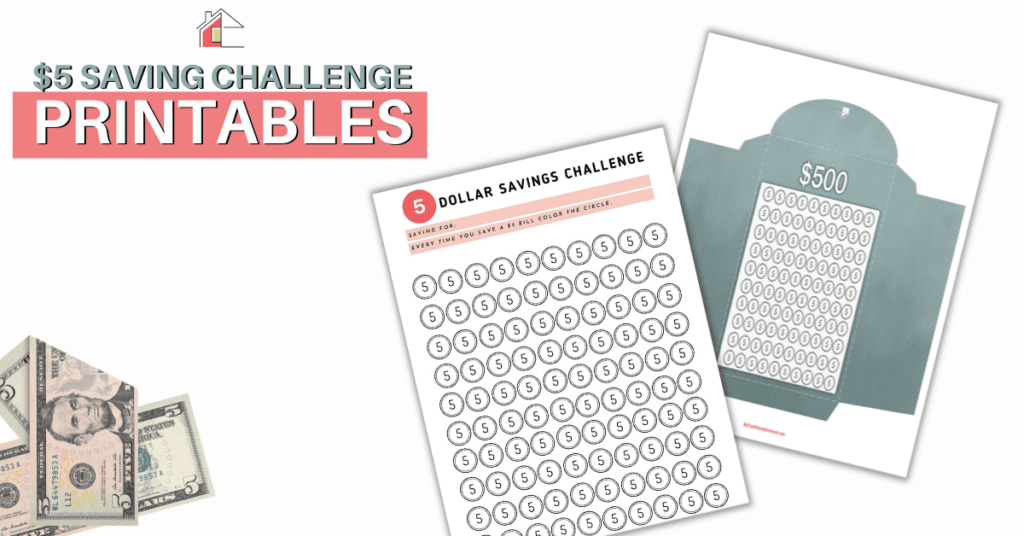

$5 Saving Challenge Printables

Ready to start saving? Get the printables at no cost when you subscribe to my weekly newsletter and other freebies!