How To Save $10,000 In One Year

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereDo you have a goal to save $10,000 in one year? It’s possible with just the right combination of planning and dedication. Although it will require some hard work, saving such a large sum of money in such a short period can result in significant financial benefits when you reach your goals. Read on to discover key tips for budgeting, smart investments, and other strategies that could help you save 10k this year!

What can I do with 10K?

Once you’ve saved 10k, there are countless ways to put that money to use. An emergency fund is one of the best choices, as it will provide peace of mind and financial protection for you in case of an unexpected expense. If you have any debts or high-interest loans, you could use your 10k to pay these off and reduce the interest you have to pay.

You can also look into investing your 10k to create a passive income stream. Investing in stocks, bonds, and mutual funds can help you make more money over time, making saving even more down the line easier.

Finally, you can use 10k to achieve your other financial goals. If you’ve always wanted to buy a house, start a business, or travel the world, now may be the perfect time to make those dreams a reality.

Tips for Saving 10K in One Year

Saving 10k in one year is certainly a challenge, but it is definitely doable with the right strategies. Here are some tips to help you reach your goal:

1. Set a realistic budget: Determine what you need to save each month and ensure that your expenses don’t exceed your earnings. Tracking your spending and adjusting as needed can help ensure that you stay on track.

2. Automate your savings: Set up an automatic monthly transfer from your checking account to your savings. This will help make sure you don’t accidentally spend any of the money that is meant for saving.

3. Take advantage of tax breaks: Look into available deductions and credits to reduce your taxable income and free up some cash for savings.

4. Make smart investments: Investing in stocks, bonds, mutual funds, and other long-term strategies could help you make more money on the side and increase your savings even faster.

5. Live below your means: Avoid extravagant purchases and focus on living within your means so that you can put as much money as possible toward your 10k goal.

6. Prioritize saving over spending: Remember that reaching this goal is your top priority and make sure that any extra money goes straight into savings rather than towards impulse purchases.

7. Utilize apps and tools: There are plenty of budgeting apps, personal finance tools, and other programs that can help you keep track of your expenses and identify areas for improvement.

8. Get creative with ways to save: Look into side hustles or extra jobs that can help you make money on the side, giving you more money to contribute to your 10k goal.

Following these steps should help you get closer to achieving your 10k savings goal! With a little commitment and dedication, reaching your goals in as little as one year is possible. Good luck!

Is it good to save 10K in a year?

Saving 10K in a year is a great goal to have, as it can help you significantly improve your financial health and security. An emergency fund of 10K can give you peace of mind if something unexpected, like medical bills or job losses, comes up.

It will also provide a cushion and allow you to invest in different areas that can generate passive income. Saving money can also be an ideal way to prepare for large expenses in the future, such as retirement or a down payment on a house.

How do I budget to save 10K?

The first step to achieving your goal of saving 10K this year should be creating a budget. A budget will help you keep track of your income and expenses, so you can determine how much money is left to save.

Make sure to include all sources of income, including salary, investments, or any other earnings. Track your expenses, including rent/mortgage payments, utilities, groceries, entertainment, and other costs.

Once you have created a budget, keep in mind that if this is your first time creating a budget, you may need to make adjustments as you go. As your income or expenses change, review and update your budget accordingly.

After creating your budget, start making a plan or goal to save $10,000 a year. Break down the goal into manageable chunks and decide how much you want to save each month/week. Make sure to account for any unexpected costs, or if you find yourself falling short of your goal, adjust it accordingly.

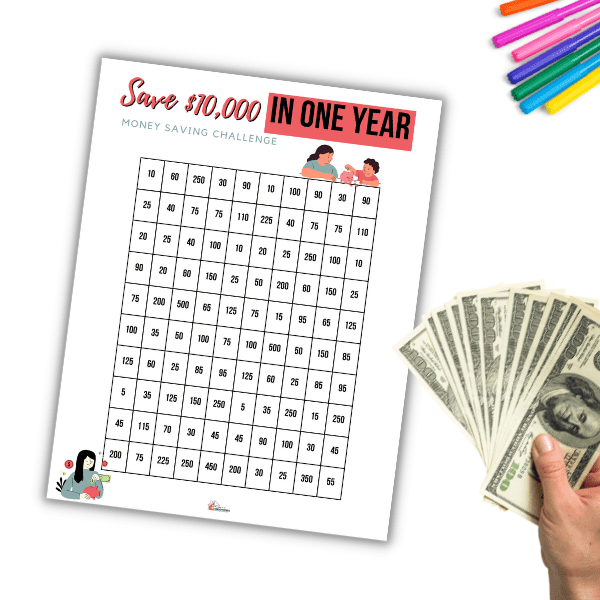

You can even try the 52 week money challenge to $10,000 and to help you start your journey!

How long does it take to save 10K in a year?

The time it takes to save 10K in a year will depend on your income, lifestyle, and budget. If you have a steady income and can save towards your goal consistently, it can take 12 months or less.

It may take longer to reach your goal if you have a lower income or more expenses. Don’t be discouraged if you don’t reach $10,000 in a year. Instead, focus on reaching smaller milestones and celebrating each victory!

What should I do with 10K for 1 year?

Once you’ve saved 10K, consider investing it in a high-yield savings account. This way, your money can continue to grow, and you can reach your larger financial goals faster.

You can also consider investing in stocks or other market vehicles to generate passive income or use your 10K to start a business. Another option is to use the money towards debt repayment or home improvements.

What is the smartest way to invest 10K?

The smartest way to invest 10K is to find an investment strategy that best fits your financial goals and risk tolerance. You can start by researching different investments, such as stocks and bonds. Consider investing in a low-cost index fund or ETF for long-term growth.

If you’re looking for higher returns, consider investing in real estate or peer-to-peer lending. Cryptocurrency investments can also be viable if you’re willing to take on more risk. Talk to a financial advisor or do your own research to determine which investment vehicle is right for you.

What do I do after I save 10K?

Once you have saved 10K, consider setting a new financial goal. You can use your savings as a stepping stone to reach larger goals like retirement savings or building wealth.

You can also use your 10K as an emergency fund in case of unexpected expenses. Consider setting aside a portion of your savings in a high-yield account to ensure your money earns interest.

Finally, you can use your saved money to give back. Consider supporting charities or causes that are important to you. This way, your money will go towards making a positive change in the world.

No matter what you decide, make sure you take steps toward financial security and stability. Saving 10K is a great accomplishment, and you should be proud of your hard work!

Free Save $10K In One Year Tracker

Are you looking for a free $10K savings tracker? Then you are in luck. Sign up to receive our emails and get the free pdf tracker in your inbox. Fill out the form below with your name and email.

5 Comments