How Do You Stay Frugal During Inflation (7 Tips From A Frugal Mama)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereAs prices continue to rise, it can be tough to stick to a budget. But with a few simple tips, you can keep your spending under control and make the most of your money. Here are seven helpful suggestions for staying frugal during inflation. Read on to learn more.

How can you save money when inflation is high?

It's a predicament many Americans find themselves in as the cost of living steadily rises. But there are ways to fight back against inflation and keep your spending in check. Here are seven tips to stay frugal during inflation:

1. Keep an emergency fund. During periods of high inflation, it's essential to have a savings cushion to fall back on if your income doesn't keep up with rising prices.

2. Review your budget regularly. Take a close look at your spending habits and make adjustments to ensure you're not overspending.

3. Invest in quality items. When inflation is high, it's essential to be mindful of what you're spending your money on. Invest in quality items that will last instead of buying cheap, disposable products.

4. Clip coupons and shop around. Comparison shopping can save you a lot of money when prices are high. If you are shopping online, use tools such as Capital One Shopping, and you can learn more about it here.

Coupons are always a great way to save money, and you use digital, or if you prefer paper.

5. Avoid debt. Taking on too much debt can be a significant burden during high inflation. Try to live within your means and avoid borrowing money whenever possible.

6. Consider alternative transportation. With gas prices on the rise, it may be time to consider alternative transportation methods, such as carpooling or public transit. Want to avoid wasting gas shopping? Consider free shipping or delivery. Please take advantage of free shipping. Walmart has free shipping available to their plus members.

7. Stay flexible. Be willing to adapt your spending habits as inflationary pressures change. By following these tips, you can keep your finances in check and avoid overspending during periods of high inflation.

Where should I keep my money during inflation?

Keeping your money in the right places is crucial when inflation is high. So here are seven tips to help you stay frugal during this time:

- Keep your money in cash: When prices are constantly rising, it is important to have cash on hand to purchase items when they are at their lowest price. Having physical money will also make it easier to barter with others.

- Invest in gold and silver: Gold and silver are two commodities that tend to hold their value even during times of inflation. If you invest in precious metals, you can ensure that your money is safe from the effects of inflation. In the future, if you decide to liquidate your investment, you have the option to sell it online through The Alloy Market, providing you with a seamless and convenient selling experience.

- Buy stocks: Investing in stocks is another way to protect your money from inflation. While the stock market can be volatile, over the long term, it has outperformed inflation.

- Save in a high-interest savings account: A high-interest savings account is good if you are looking for a place to store your money safely. These accounts typically offer interest rates higher than the inflation rate, meaning your money will grow over time.

- Invest in real estate: Real estate, like stocks, tends to appreciate over time. This makes it a good investment during periods of inflation. You can also use real estate to hedge against inflation by renting out your property.

- Pay off your debt: One of the best things you can do during inflation is pay off your debt. This will reduce the amount of interest you have to pay, freeing up more money to save or invest.

- Cut back on your spending: One of the best ways to stay frugal during inflation is to cut back on your spending. By living a simple lifestyle, you can save more money and protect yourself from the effects of inflation.

You might like these frugal living posts:

How can you stay frugal during inflation?

There are several ways to stay frugal during inflation. Investing in quality items instead of cheap, disposable products is one way.

Another way is to compare prices when shopping and take advantage of coupons and discounts.

Additionally, it is essential to avoid debt and live within your means. Finally, you can reduce your spending and live a simpler lifestyle. Following these tips, you can stay frugal during inflation and protect your finances.

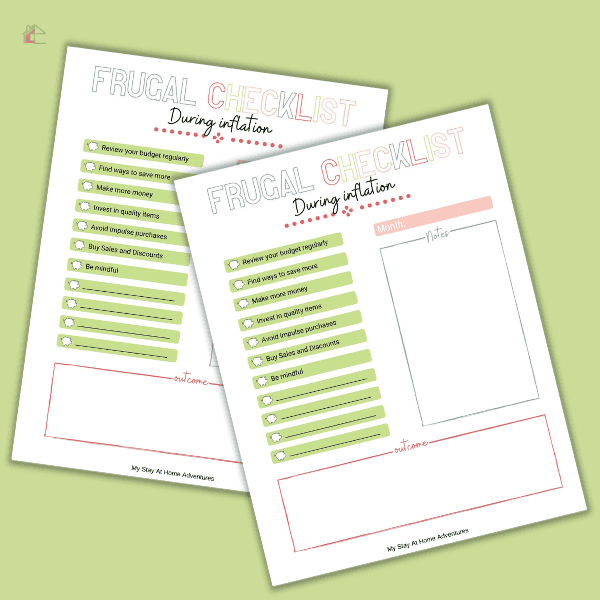

Other ways are to:

- Find ways to save more: Look for ways to save money on groceries and other necessary purchases.

- Make more money: Try to find ways to earn additional income.

- Invest in quality items: Save money by investing in quality items that will last longer.

- Avoid impulse purchases: Avoid impulse purchases and stick to your budget.

- Buy Sales and Discounts: Look for sales and discounts when making purchases.

- Be mindful: Be mindful of your spending and focus on your financial goals.

Following these tips can help keep your costs down during inflation and save money in the long run.

By following these tips, you can save yourself a lot of money during inflationary periods. Do your research, know where to keep your money and what investments are best during these times, and be mindful of your spending. If you can do all of this, you'll be in good shape to weather any financial storms that come your way.