Free FAFSA Application and Why You Need to Apply

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereToday we are going to talk about free FAFSA application and why you need to apply as soon as possible.

This is part of a sponsored collaboration with The College Board and DiMe Media. However, all opinions expressed are my own.

Maximizing your financial aid opportunities for college should be done as early as possible. The problem is that many find the Free Application for Federal Student Aid (FAFSA) application and its process a bit intimidating. Today we are going to talk about why you need to apply and the resources to help you get through it!

Free FAFSA Application and Why You Need to Apply

Let's begin with the basic question, shall we?

What is FAFSA?

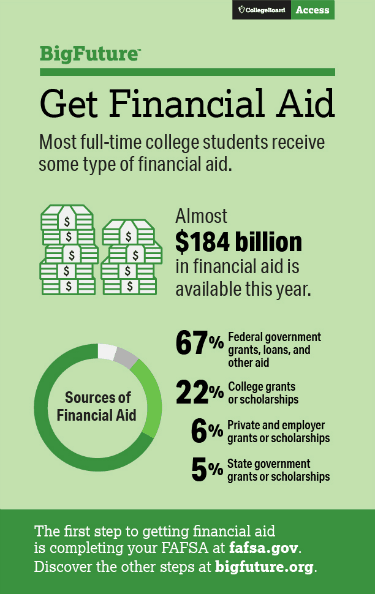

FAFSA defines which students qualify for most financial aid, including federal grants, work-study jobs, and student loans. Moreover, it determines the student’s eligibility for many private awards. There are many sources of financial aid:

- 67% Federal government grants, loans, and other aid

- 22% College grants/scholarships

- 6% private and employer grants/scholarships

- 5% state government grants/scholarships

The truth is that $184 billion in finances are available, and most full-time college students receive some type of financial aid in this country. The average financial aid award in 2014 was $14,210!

Related post:

- How to Maximize FAFSA Opportunities

- College Textbook Rentals

Why should you apply?

The problem is that many families don’t apply for fear of rejection, or not knowing the process, and the process begins with filling the Federal Student Aid (FAFSA) application found on fafsa.ed.gov. This form is available online, and you are encouraged to apply as soon as possible.

Creating an FSA ID

Before you apply, you will need to create an FSA ID and collect the documents needed to get started, you will create your ID here. The reason you need to create an FSA ID is that you are going to need a username and password to login to certain U.S. Department of Education websites. These websites include the Free Application for Federal Student Aid (FASFA) at Fafsa.gov

Look for scholarships

After you complete your ID and fill out the Free Application for Federal Student Aid (FAFSA), start looking for scholarships! To learn more about paying for college, including finding scholarships, visit BigFuture or download the CollegeGo app.

As a student, sites like BigFuture can help you with this process; BigFuture can:

- Search for colleges

- Compare colleges

- Find scholarships

- Help you to understand financial aid

- Navigate the college application process from start to finish

- Receive personalized deadline reminders

- Provide tips and guidance along the way

So what does the CollegeGo app do? The CollegeGo app will guide you through the essential steps in the college application with an interactive interface that uses:

- Games

- Video

- Search features

All this will give you the help you need to plan your college journey!

For Spanish speaking families, this process can be intimidating because the language alone can be a barrier, or it makes it hard to understand. The good news is that the College Board has also created Spanish language resources for parents and families to help your children plan for college.

Now that you have an understanding of this process, don’t wait; take advantage of it!

I have had to fill out the FAFSA about 6 times for my 2 daughters and I never felt it was complicated. It is pretty straightforward and easy to understand.

My daughter and I did our FAFSA application and I was shock how easy it was.