Managing finances can be stressful and overwhelming for many people. However, using a budget binder effectively tackles the mess and stays on top of finances. In this blog post, you will learn what a budget binder is, its benefits, and how to use it to manage your money.

What is a budget binder and why do you need it?

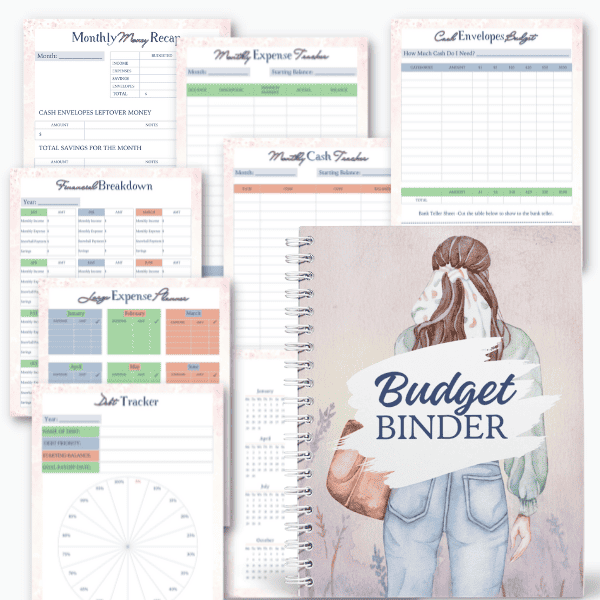

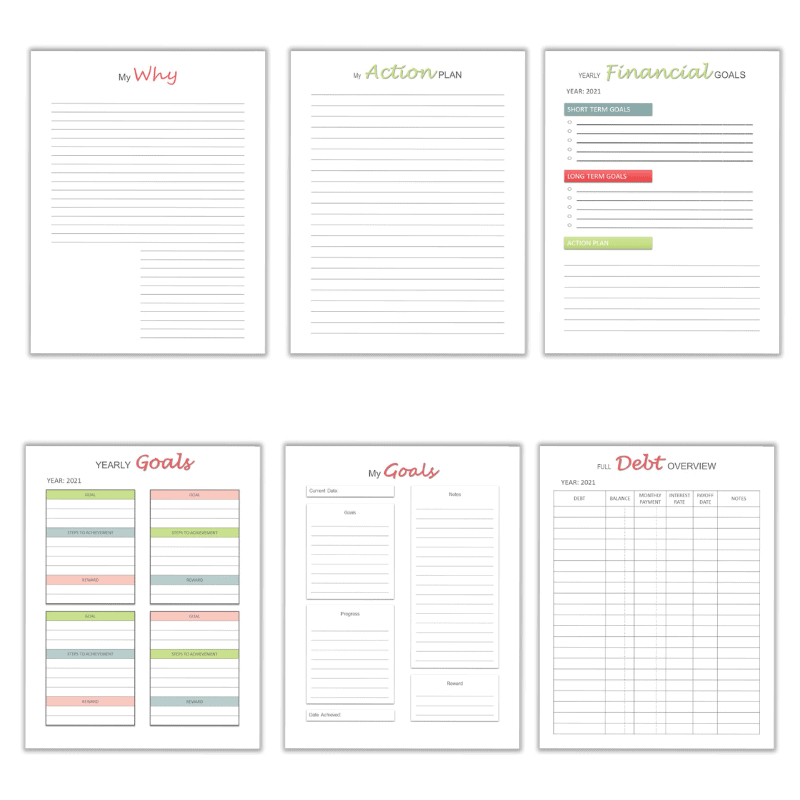

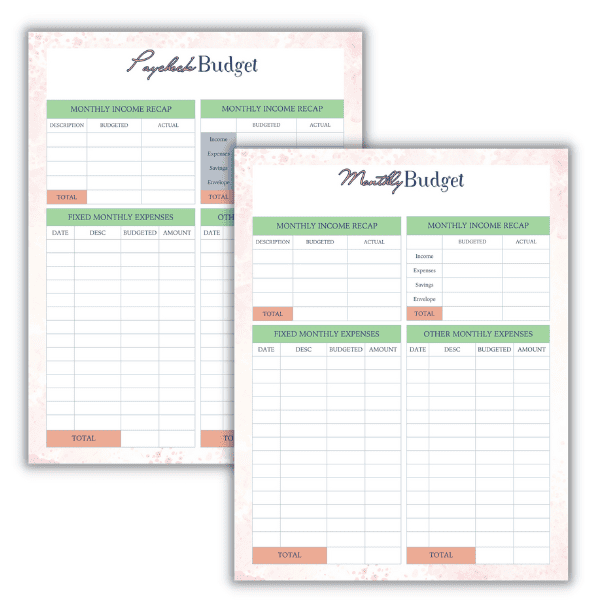

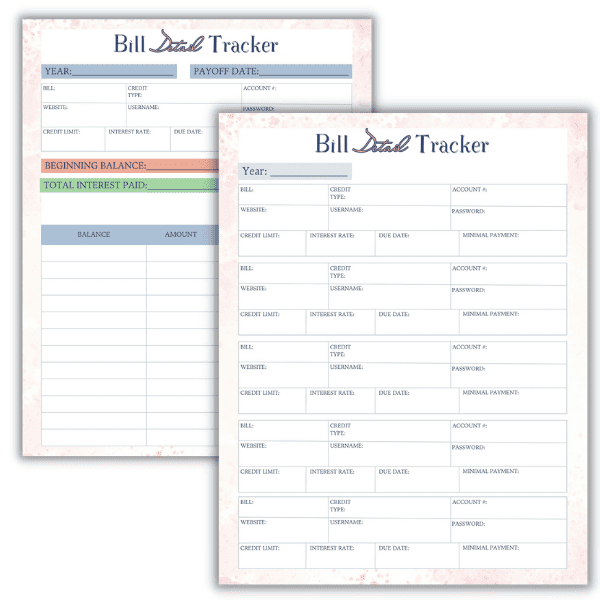

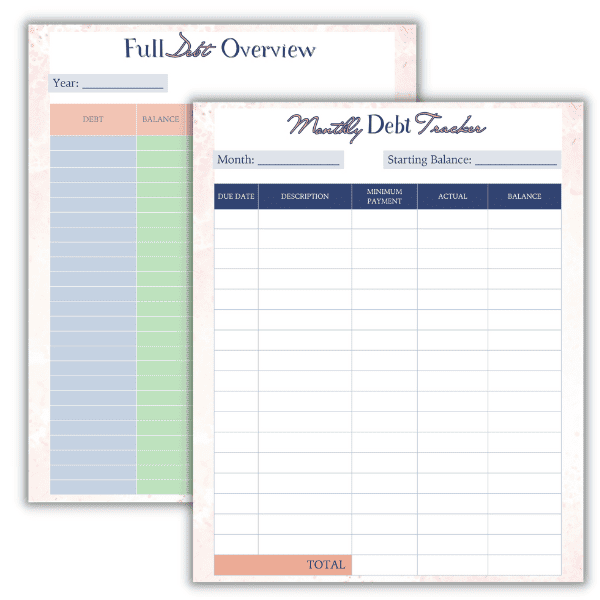

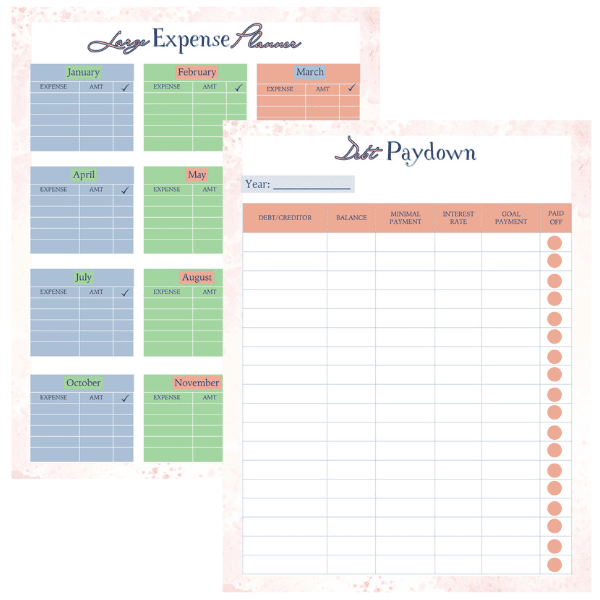

A budget binder is a notebook or folder that contains various pages to track your finances. You can purchase a ready-made budget binder or create one yourself by downloading templates for the different pages you need. The pages may include a monthly budget tracker, expense tracker, debt tracker, savings tracker, bill payment tracker, and financial goals.

Having a budget binder is essential for those who prefer the traditional pen and paper approach over financial apps and spreadsheets. It serves as a convenient tool to keep all financial information in one place, making it easy to access and track progress.

A budget binder is also a beneficial tool to achieve your financial goals. With all your financial information in one place, you can see where your money is going and make necessary adjustments to reach your financial dreams.

Benefits of using a budget binder

There are numerous benefits of using a budget binder. Here are some of the benefits:

- Keep everything organized: All your financial information is in one place, making it easy to access and view.

- Remember why you're doing this: Having all your financial goals and expenses in one place can motivate you to stay on track.

- Keep sight of the big picture: Your budget binder offers a bird's eye view of your finances, allowing you to make informed decisions for your financial future.

- Keep your budget easily accessible: Having a physical copy of your budget makes it easier to review and update regularly.

- Keep tabs on all your savings goals: Tracking your savings separately helps you see how close you are to achieving your goals.

- Stay on top of debt: Your debt tracker helps you stay current with payments and take steps to pay it off faster.

- See where your money is really going: Your expense tracker helps you identify where you're overspending and make necessary adjustments to stay within your budget.

- Don't miss a deadline: Your bill payment tracker helps you stay on track with deadlines and avoid unnecessary late fees.

A budget binder is a helpful tool to keep track of finances, achieve financial goals, and reduce stress. Whether you purchase a ready-made one or create it yourself, having all your financial information in one place will make managing your money much easier.

Setting Up Your Budget Binder

Once you have decided to create a budget binder, the next step is to set it up. The following are some guidelines on how to set up your budget binder.

Choosing the right binder

The first step in setting up your budget binder is to choose the right binder. A three-ring binder is ideal for this purpose. It is durable, easy to use, and allows you to add or remove pages as needed. Choose a binder with a sturdy cover and a size that fits your needs.

Essential supplies you need

The materials needed to set up your budget binder are straightforward. You will need a three-ring binder, dividers, and some colorful pens or markers. The dividers are to separate each section of your budget binder, and the pens/markers are to color-code or make it easier to distinguish between sections of your binder. You might also want to have some white-out on hand in case you make any mistakes.

Creating sections in your budget binder

The next step is to create sections in your budget binder. There is no specific section that everyone should add to their budget binder. However, here are some suggestions:

- Monthly budget tracker: The front section of your budget binder can be for your monthly budgets. You can have one for each month of the year.

- Expense tracker: This section allows you to track your expenses. You can create a table and record your expenses for the month, including rent, utilities, food, entertainment, etc.

- Debt tracker: This section allows you to track your debt, including student loans, credit cards, car loans, or any other debt you might have. You can also use this section to track your progress in paying off your debt.

- Savings tracker: This section allows you to track your savings, including emergency funds, vacation funds, retirement savings, and any other savings goals you might have.

- Bill payment tracker: This section allows you to track your bills and when they are due. You can create a table and record the due dates, amounts due, and when you paid them.

- Financial goals: This section allows you to set your financial goals and track your progress in achieving them.

Setting up a budget binder is an effective way to manage your finances. By choosing the right binder and essential supplies and creating sections in your binder, you can easily track your monthly budgets, expenses, and bills, set financial goals, and stay on top of your finances. With a budget binder, you can reduce stress and stay on track with your finances.

Tracking Your Income

One of the most important aspects of creating a budget binder is tracking your income. This section will cover how to create a monthly budget, calculate your income, and set financial goals.

Creating a monthly budget

In order to effectively track your income, it's important to create a monthly budget. This will help you understand exactly how much money you have coming in and going out each month. To create your monthly budget, start by listing your monthly income and then your monthly expenses.

How to calculate your income

Calculating your income is an essential step in creating a budget. Start by including all sources of income, such as your salary, tips, or any side hustles you may have. Don't forget to include your spouse or partner's income if you have a joint budget. Once you have listed all sources of income, subtract your taxes, social security, and any other deductions to get your net income.

Setting financial goals

Now that you have a clear understanding of your monthly income and expenses, it's time to set financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound. For example, you might set goals to pay off debt, save for a down payment on a house, or build an emergency fund. Use your budget binder to track your progress towards these goals and adjust your budget accordingly.

By tracking your income, creating a monthly budget, and setting financial goals, you can take control of your finances and work towards your financial dreams. Use your budget binder to stay organized and motivated. Don't forget to review your budget regularly and make adjustments as needed. With time and commitment, you can achieve financial success.

Recording Your Expenses

Different types of expenses to track:

To effectively track your expenses, it’s important to categorize them. Common categories include housing expenses (like rent or mortgage payments), transportation expenses (like gas or public transit costs), food expenses (like groceries or dining out), personal care expenses (like haircuts or gym memberships), and entertainment expenses (like movies or concerts).

How to track your expenses:

There are multiple ways to track your expenses, but the most important thing is to find a system that works for you. As mentioned in the previous section, one method is to record each expense in a notebook or ledger. Another option is to use a budgeting app or spreadsheet, many of which allow you to categorize your expenses and automatically tally the totals for you.

Tips for reducing unnecessary expenses:

Once you’ve been tracking your expenses for a while, you might start to notice patterns and areas where you could cut back. A few tips for reducing unnecessary expenses include:

- Eating out less and cooking more meals at home

- Shopping for groceries with a list and sticking to it

- Canceling subscriptions or memberships you don’t use

- Using coupons or shopping at thrift stores for clothing and other purchases

- Finding low-cost or free entertainment options, like visiting a park or checking out books from the library

By tracking and reducing your expenses, you can make sure you’re living within your means and saving money for your financial goals. Remember to keep your budget binder up to date and adjust your spending habits as needed. With discipline and consistency, you can make progress towards a brighter financial future.

Savings are a critical component of achieving financial security and stability. Whether it’s building an emergency fund or saving for a down payment on a house, having money set aside can provide a sense of peace and security.

The importance of saving

Saving money allows for financial flexibility and freedom. Unexpected expenses like car repairs or medical bills can easily derail a budget without savings to cover them. Also, having savings means not having to rely on credit cards or loans to cover unexpected expenses, which can lead to growing debt and financial stress.

Creating a savings plan

To start saving, it’s important to set clear savings goals and create a plan to achieve them. This can be done by using a budget binder to prioritize saving as a monthly expense. A savings plan should include setting a specific goal, determining a time frame, and calculating how much money needs to be saved each month to reach that goal.

For example, if the goal is to save $5,000 for a down payment on a house in two years, the savings plan might involve saving $208 per month. This requires discipline and a willingness to adjust spending habits. However, having a clear target and a plan to achieve it can make it easier to stay motivated and committed to the goal.

Monitoring your savings progress

To ensure savings goals are being met, it’s important to track progress regularly. This can be done by using a savings tracker in a budget binder, an app that monitors savings progress, or a spreadsheet. Also, revisiting the savings plan periodically can help to identify areas where adjustments may need to be made.

In some cases, it may be useful to automate savings contributions from paychecks or other income sources. This can help ensure consistent progress is being made towards savings goals without having to constantly think about it.

By prioritizing savings and regularly tracking progress, it’s possible to achieve financial security and stability. A budget binder can be an effective tool for creating a savings plan, tracking progress, and making adjustments as needed. With discipline and consistency, anyone can build a savings habit and work towards a brighter financial future.

Debt Management

Debt can be a major source of stress and financial burden for many individuals and families. However, with proper management techniques, it is possible to tackle debt and work towards becoming debt-free.

Identifying and prioritizing your debts

The first step in effective debt management is to identify and prioritize all outstanding debts. This can be done by creating a debt inventory list that includes the name of the creditor, the balance owed, the interest rate, and the monthly payment. Once all debts have been identified, they can be prioritized based on the interest rate, the size of the balance, or other factors that may be important to the individual.

Creating a debt repayment plan

After prioritizing debts, the next step is to create a repayment plan that outlines how much to pay towards each debt and when. A budget binder can be a useful tool for creating a debt repayment plan and tracking progress towards debt-free living. The repayment plan should also include a realistic timeline for paying off all debts based on the amount of money that can be put towards debt repayment each month.

Strategies for paying off debts

There are several strategies for paying off debts that can help to accelerate progress and minimize interest charges. One popular strategy is the debt snowball method, which involves paying off debts starting with the smallest balance first and then working upwards. This can help to build momentum and provide a sense of accomplishment. Another strategy is the debt avalanche method, which involves paying off debts starting with the one with the highest interest rate and then working downwards. This can help to minimize overall interest charges.

Other strategies for paying off debts include debt consolidation, balance transfers, and negotiating with creditors for reduced interest rates or payment plans. It’s important to explore all options and choose the strategies that work best for individual circumstances.

Effective debt management is an important step toward achieving financial stability and freedom. By identifying and prioritizing debts, creating a debt repayment plan, and utilizing effective debt payoff strategies, it’s possible to become debt-free and work towards a brighter financial future. A budget binder can be a valuable tool for managing debts and staying on track toward debt elimination goals.

Debt management is a crucial step towards achieving financial stability. Once a well-defined debt management plan is in place, it's important to stay organized and keep track of all bills to avoid getting deeper into debt. This is where a budget binder can be extremely useful.

Bill Tracker

Benefits of tracking your bills

Tracking bills can be an important aspect of financial management. It helps individuals to keep track of when bills are due, avoid late payments and late fees, and maintain financial stability. A bill tracker can help keep an individual's finances in order and avoid any last-minute surprises.

Creating a bill tracker

A bill tracker can be created easily by using the templates available in the budget binder. The tracker should include the date when the bill is due, the amount, and the creditor's name. It's important to update the tracker frequently to ensure that all bills are accounted for. If possible, bills can be paid automatically to avoid the hassle of manual payments each month.

Tips for staying on top of bills

To stay on top of bills, it's important to create reminders on a phone or computer, use automatic payments, and keep up with all changes in billing or payment dates. Also, it's essential to always check bills to ensure there are no errors or extra charges. Further, it's good practice to try to keep bills within a comfortable budget to avoid any financial strain.

Effective debt management should be followed by organized bill tracking. A budget binder can be especially helpful in keeping track of all bills and avoiding payment delays or missed deadlines. By following a comprehensive and proactive approach towards managing debts, individuals can eliminate their debt and work towards achieving their financial goals.

Bills and Due Dates

Organizing bills and due dates

Keeping track of bills and due dates can be overwhelming at times, especially if you have bills due on different days of the month. However, it is important to stay on top of your bills to avoid late fees and other financial setbacks. The key to staying organized with your bills and due dates is to create a system that works for you. Here are some tips for organizing your bills and due dates:

- Gather all of your monthly bills and make a list of each bill and when it is due. This will give you an overview of your monthly expenses and due dates.

- Use a budget binder or a spreadsheet to keep track of your bills and due dates. A budget binder allows you to keep all of your bills and other financial documents in one place, while a spreadsheet allows you to easily track when each bill is due.

- Make sure to review your bills and due dates regularly. This will help you avoid any surprises or late fees.

Creating a bill payment schedule

Once you have organized your bills and due dates, it is time to create a bill payment schedule. A bill payment schedule will help you stay on track with your bills and avoid late fees. Here are some steps for creating a bill payment schedule:

- Determine how much money you need to pay your bills each month. This will help you create a budget and ensure that you have enough money to cover all of your bills.

- Decide when you will pay each bill. You can either pay your bills as they come in or schedule specific days each month to pay your bills.

- Set reminders for when your bills are due. This can be done through a calendar, an app, or even a sticky note on your fridge.

- Consider setting up automatic bill payments. This can help ensure that you never miss a bill payment.

By creating a bill payment schedule, you can take control of your finances and avoid any late fees or other financial setbacks. With a little organization and planning, you can stay on top of your bills and achieve financial success.

Meal Planning and Grocery Shopping

When it comes to managing finances, one of the most significant areas people overspend on is groceries. Not to mention, groceries are a necessity and can't be completely avoided. Hence, it's important to learn how to stick to a grocery budget and buy food that meets your nutritional needs. Here are some tips to help you plan and stick to your grocery budget while also minimizing food waste.

Planning meals and creating a grocery list

One of the most effective ways to save money on groceries is by planning your meals in advance and creating a grocery list. Here's how you can start:

- Look at your calendar for the week: Before planning your meals, it's essential to take a look at your schedule for the week. See if you have any social events or busy days where you won't have time to cook elaborate meals.

- Plan your meals for the week: Based on your schedule, plan your meals for breakfast, lunch, and dinner. Make sure to pick recipes that use the same ingredients to avoid waste and save money.

- Create a grocery list: Once you have your meals planned, it's time to create a grocery list. Include all the ingredients you need for each recipe.

- Stick to the list: When you are at the supermarket, try your best to stick to the grocery list. Avoid other items that aren't on your list, as those items can add up and cause you to overspend.

Sticking to your budget while grocery shopping

After you have planned your meals and created a grocery list, it's time to head to the store. But before you do, here are some helpful tips to help you stick to your budget:

- Set a budget: Before heading to the store, decide how much you want to spend on groceries for the week. Stick to that budget and avoid overspending.

- Look for deals and coupons: Check out the sales and deals of the week to save extra money. Also, you can always look for coupons online or in-store to lower your expenses.

- Avoid pre-packaged meals: Pre-packaged meals and snacks are often more expensive than if you were to make them yourself. Opt for fresh produce and ingredients to save money.

- Buy in bulk: When possible, buy items in bulk, especially non-perishables like beans, rice, and oats. Not only is it more cost-effective, but it also reduces your trips to the store, saving time and effort.

- Keep track of your spending: Always keep track of your spending while shopping. Keep a calculator handy, or use a budgeting app to monitor your expenses and make sure you don't exceed your budget.

Grocery shopping is a necessary expense, but it doesn't have to break the bank. By planning your meals, creating a grocery list, and sticking to your budget, you can save money and minimize waste. Also, shopping for groceries can be a fun and enjoyable experience if you know how to do it right!

Entertainment and Miscellaneous Expenses

Apart from groceries, another area where people often overspend is entertainment and miscellaneous expenses. These expenses can range from dining out, movie tickets, and shopping to gym memberships, hobby classes, and other types of subscriptions.

Here are some tips on how to manage your non-essential expenses and save money without compromising on your lifestyle or hobbies.

Tracking non-essential expenses

Before you can start saving money on entertainment and miscellaneous expenses, it's important to track your spending. This means keeping track of all the money you spend on non-essential items and services. You can do this by keeping a physical or digital logbook, recording your expenses through a budgeting app, or looking at your bank or credit card statements. Once you know how much you are spending, you can identify areas where you can cut back and save money.

Finding ways to save in entertainment and miscellaneous expenses

When it comes to entertainment and miscellaneous expenses, there are several ways you can save money without depriving yourself of things you enjoy. Here are some ideas to get you started:

| Expense Category | Savings Tip |

|---|---|

| Dining Out | Instead of eating out regularly, opt to cook meals at home and only dine out on special occasions. Also, look for deals and discounts at restaurants or use coupons. |

| Movie Tickets and Streaming Services | Instead of going to the movies, try renting a movie or watching it on a streaming service. Also, compare different streaming services to find one that offers the shows and movies you like at a lower cost. |

| Hobby Classes and Gym Memberships | Instead of paying for a gym membership or hobby classes, look for free or cheaper alternatives. For example, you can exercise at home or go for a walk or run outside. You can also find free tutorials or courses online for almost any hobby or skill. |

| Shopping | Instead of buying new items, try repurposing what you have or buying secondhand. You can also look for deals and discounts, but make sure you are not compromising on quality or convenience. |

In addition to finding ways to save money on individual expenses, you can also consider the following tips to reduce your overall miscellaneous expenses:

- Avoid impulse purchases: Think twice before making an unplanned purchase and ask yourself if it's something you really need or want.

- Set a spending limit: Decide how much you want to spend on non-essential items each month or week and stick to that limit.

- Comparison shop: Before making a purchase, compare prices and quality from different stores or brands to find the best value for your money.

- Re-evaluate your subscriptions: Review your subscriptions, such as magazines, streaming services, or music apps, and keep only the ones you use regularly. Cancel the ones you rarely use or can live without.

Managing your entertainment and miscellaneous expenses is essential to achieve financial stability and reach your financial goals. By tracking your spending, finding ways to save, and setting limits on your non-essential expenses, you can enjoy your hobbies and interests without breaking the bank.

Budget Check-Ins

Managing finances can be a challenge, but it is crucial to take control of your finances. One effective way to stay on top of your finances is to create a budget. A budget helps you keep track of your expenses, plan for the future, and achieve your financial goals. However, a budgeting plan is not a set-it-and-forget-it solution; it requires continuous monitoring and evaluation. This is where budget check-ins come in handy.

Reviewing your budget regularly

Set a specific date and time each month to review your budget, preferably around payday. This gives you a chance to assess your progress and make any necessary adjustments. During the review, take note of your expenses, check if you are overspending or underspending, and make sure you are sticking to your budget plan.

If you are new to budgeting, the first few months may require some extra attention. Observe how you are spending your money, and categorize your expenses into fixed bills, variable expenses, and discretionary spending. You may need to adjust your initial budget after a month or two and reallocate funds in different categories.

Making adjustments as needed

After you have completed your budget check-in, it's time to make any necessary changes to your budget. If you find that you are overspending in one category, you can adjust your budget by cutting back on that area or increasing the budget for it. Alternatively, if you have extra funds in one category, you can allocate them to another category that needs more funding.

It's also essential to update your budget when there are any life changes, such as a new job, pay raise, or addition to your family. These changes can affect your monthly expenses, and you need to adjust your budget accordingly.

If you find it challenging to stick to your budget, consider using budgeting tools such as budgeting apps or personal finance software. These tools can help you keep track of your expenses and alert you when you are approaching your budget limits. Also, if you have a partner or roommate, make sure you keep them in the loop and work on your budget together.

Embracing budget check-ins is a crucial step in taking control of your finances. By reviewing your budget regularly and making necessary adjustments, you can track your financial progress and achieve your financial goals. Be flexible and willing to change your approach when necessary, and remember that budgeting is a long-term commitment to achieving financial stability.

Benefits of a Budget Binder

Reaping the Benefits of Using a Budget Binder

By using a budget binder, you can reap many financial benefits, including:

- Keeping everything organized: A budget binder can help you keep your bills, receipts, and financial documents in one convenient place.

- Staying on track: With a budget binder, you can track your progress toward your financial goals and stay motivated to achieve them.

- Saving time: A budget binder can save you time by making it easy to track your expenses and bills on a regular basis.

Additional Tips and Resources for Budgeting Success

Here are some additional tips and resources to help you succeed in budgeting:

- Plan for emergencies: It's always a good idea to set aside some money for unexpected expenses or emergencies.

- Avoid lifestyle inflation: As your income increases, it can be tempting to increase your spending as well. However, avoiding lifestyle inflation can help you save more and achieve your financial goals faster.

- Use the right tools: There are many free budgeting tools and resources available online, such as budgeting apps, personal finance blogs, and forums. Utilize these tools to help you stay on track and achieve your financial goals.

Budget check-ins are a crucial step in taking control of your finances. By reviewing your budget regularly and making necessary adjustments, you can track your financial progress and achieve your financial goals. Keep your budget binder organized and up to date, and be flexible and willing to change your approach when necessary. Remember, budgeting is a long-term commitment to achieving financial stability.

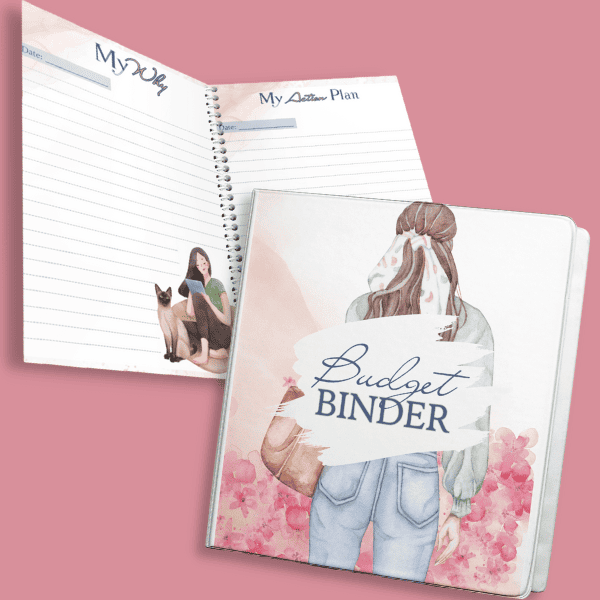

Budget Binder: Take Control of Your Finances

If you are tired of living paycheck to paycheck? Feeling overwhelmed by your bills and financial responsibilities? It's time to take control of your finances. Introducing our Budget Binders, the ultimate tool to help you manage your money effectively and achieve your financial goals.

With our Budget Binders, you'll have everything you need in one place to track your expenses, create a budget, and stay organized. From monthly budget templates to savings trackers and debt payoff worksheets, our meticulously designed printables will empower you to make informed financial decisions.

Imagine the peace of mind that comes with knowing exactly where your money is going, being able to save for those big-ticket items, or even paying off debts faster than you ever thought possible. Our Budget Binder will revolutionize the way you manage your finances, giving you the confidence and clarity you need to build a solid financial foundation.

Don't let financial stress hold you back from living the life you deserve. Invest in our Budget Binder today and embark on a journey towards financial freedom. Take control of your finances and start shaping a brighter future for yourself and your loved ones.

Order now and discover the power of effective budgeting!