How to Manage Your Bill Payments

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereManaging bill payments is an essential part of maintaining good financial health. It involves staying organized, budgeting effectively, and ensuring that all your monthly bills are paid on time. By effectively managing your bill payments, you can avoid late fees, maintain a good credit score, and have peace of mind knowing that your financial obligations are being met.

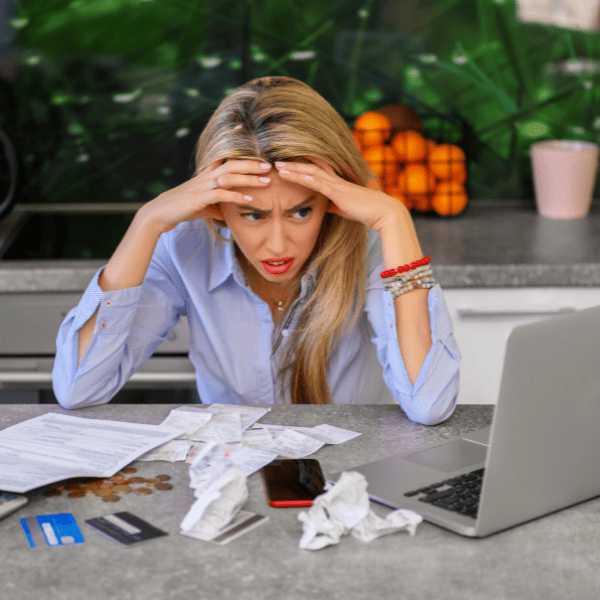

I remember a time when I really struggled to manage my bills. It seemed like the moment I paid one bill, another one would pop up, and I felt like I was constantly playing catch-up. It was a constant source of stress and anxiety, and I knew I needed to find a way to manage my finances better.

I spent hours researching different strategies, trying to find the best way to stay on top of my bills and have some peace of mind.

I want to share with you the lessons I've learned and the strategies I've developed to manage my bills successfully. I understand how overwhelming it can be, but trust me; it is possible to regain control of your finances.

I'll provide practical tips and actionable steps you can implement immediately. No matter your income level or financial situation, these methods can help you develop better bill management habits.

So, let's dive in and ensure that bills no longer keep you awake at night.

How do I organize my monthly bill payments?

Organizing your monthly payments is essential to ensure that all your bills are paid on time and avoid late fees or missed payments. Here are a few tips to help you stay organized:

- Create a monthly budget: List all your monthly expenses, including bills, rent/mortgage, groceries, and any other regular payments. This will give you an overview of your financial obligations.

- Set reminders: Use a calendar or a bill management app to set reminders for each bill is due date. This will help you stay on top of your payments and avoid late fees.

- Automate payments: Consider setting up automatic payments for your bills. This way, the payments will be deducted from your bank account on their due dates, ensuring that you never miss a payment.

- Prioritize your bills: If you are facing financial constraints, prioritize them based on their importance and urgency. Pay essential bills like rent, utilities, and loan payments first, then allocate the remaining funds to other bills.

- Track your payments: Keep a record of your payments, either through a spreadsheet or a budgeting app. This will help you track your expenses and pay all your bills.

What is the best app to organize my bills?

Several bill management apps can help you organize your monthly payments efficiently. Here are some popular options:

1. Mint: Mint is a versatile app that tracks your bills and helps you create budgets and manage your overall finances.

2. Prism: Prism allows you to track and pay all your bills in one place. It sends you reminders and notifies you of upcoming due dates.

3. Clarity Money: Clarity Money is known for its helpful budgeting tools and bill-tracking features. It can help you save money by suggesting ways to reduce your spending.

4. BillTracker: BillTracker is a simple and straightforward app that helps you stay on top of your bills. It notifies you when bills are due and tracks your payment history.

When choosing a bill management app, consider the most important features, such as bill reminders, automatic payment options, or the ability to sync with your bank accounts.

How do I manage paying all my bills when I don't have money?

If you're facing financial difficulties and struggling to pay all your bills, here are some steps you can take:

1. Prioritize essential bills: Start by paying essential bills like rent/mortgage, utilities, and basic necessities.

2. Contact your creditors: Reach out to your creditors and explain your situation. They may be able to offer temporary payment arrangements, waive late fees, or provide other solutions to help you during this time.

3. Explore assistance programs: Look for local or national assistance programs that can help with bill payments, such as government assistance programs or charitable organizations.

4. Create a budget and cut expenses: Review your budget and find areas where you can cut expenses to allocate more money towards your bills. This could include reducing discretionary spending, canceling subscriptions, or finding ways to save on groceries.

5. Consider debt consolidation or negotiation: If you have multiple debts, consider consolidating them into a single payment or negotiating with your creditors for better repayment terms.

Remember, it's crucial to communicate with your creditors and seek assistance when needed. They may have options available to help you manage your bills during financial hardship.

Is it better to pay all bills at once?

Paying all your bills at once can have its advantages, but it may not always be feasible, especially if you're living paycheck to paycheck. Here are a few things to consider:

1. Convenience: Paying all your bills at once can be more convenient as you only need to allocate time and effort for bill payment once a month.

2. Better financial visibility: Clearing all your bills simultaneously gives you a better overview of your financial situation and available funds.

3. Budgeting challenges: Paying all bills simultaneously can be challenging if you have limited funds. It may require careful budgeting and prioritizing bills based on due dates and importance.

4. Cash flow management: Paying bills throughout the month can help you better manage your cash flow, ensuring that you have sufficient funds to cover each payment.

Ultimately, the best approach depends on your financial situation and personal preferences. Some people prefer paying bills as they come to avoid any potential financial strain, while others find it more manageable to pay all bills at once. Choose a payment strategy that works best for you and helps you stay on top of your financial obligations.

What is the smartest way to pay bills?

When it comes to managing bill payments, it's important to have a strategy in place to ensure that bills are paid on time and efficiently. Here are some tips on the smartest way to pay bills:

1. Create a budget: Create a monthly budget outlining your income and expenses. This will give you a clear understanding of how much money you can allocate toward bill payments.

2. Set up automatic payments: Whenever possible, set up automatic bill payments through online banking or directly with the service provider. This will help ensure that bills are paid on time and avoid late fees.

3. Prioritize essential bills: Identify which ones must be paid first. These typically include rent or mortgage payments, utilities (electricity, water), and insurance premiums.

4. Use bill payment reminders: Set up reminders or alerts on your phone or calendar to notify you when bills are due. This will help you stay organized and avoid late payments.

5. Consider bill consolidation: If you have multiple bills with different due dates, consider consolidating them into one monthly payment. This can make bill management more streamlined and easier to keep track of.

6. Check for discounts or payment options: Some service providers offer discounts for setting up auto-pay or paying bills in advance. Take advantage of these options to save money on your bill payments.

Remember, managing bill payments is all about staying organized, budgeting effectively, and prioritizing essential bills. By doing so, you can avoid late fees, maintain a good credit score, and know that your financial obligations are taken care of.

What bills should always be paid first?

When it comes to prioritizing bill payments, it's important to focus on essential expenses to ensure that your basic needs are met. Here are some bills that should always be paid first:

1. Rent or mortgage payment: Keeping a roof over your head should be a top priority. Failure to pay rent or mortgage can lead to eviction or foreclosure.

2. Utilities: To maintain a comfortable living environment, essential utilities such as electricity, water, and heating should be paid.

3. Insurance premiums: Maintaining insurance coverage for your health, home, and vehicles is crucial. Failure to pay insurance premiums may result in coverage lapses.

4. Transportation expenses: If you rely on a vehicle for commuting, it's important to prioritize car payments, fuel costs, and insurance payments to ensure reliable transportation.

5. Debts: If you have outstanding debts, such as credit card bills or student loans, it's important to make at least the minimum required payments to avoid penalties and maintain a good credit score.

By prioritizing these essential bills, you are ensuring that your basic needs and financial stability are met. It's important to allocate your available funds accordingly to avoid consequences such as service disconnections, eviction, or negative impacts on your credit score.

Now that we have answered important questions and how I manage my bill payments, let's get into the importance of managing bill payments, shall we?

The Importance of Managing Bill Payments

Managing your bills properly is important to maintaining financial stability and good credit health. Not only does it help you stay on top of payments, but it also helps avoid late fees and penalties. It is important to create a budget that includes all your bills and expenses so you can accurately allocate funds for bill payments. Also, setting up reminders or automatic payments can help ensure that bills are paid on time and avoid any financial strain.

Effectively managing bill payments is crucial for several reasons:

1. Avoiding Late Fees: Paying bills on time helps you avoid costly late fees that can add up over time and strain your budget.

2. Maintaining Good Credit: Paying your bills on time is important in building and maintaining a good credit score. Late payments can negatively impact your credit history and make it harder to obtain credit in the future.

3. Financial Stability: By staying organized and keeping track of your bills, you can ensure that you have enough funds available to cover your expenses and maintain financial stability.

Benefits of Paying Bills on Time

Paying bills on time can help you enjoy numerous benefits that come with financial stability and good credit. Here are some of the benefits:

1. Avoiding Credit Issues: Timely bill payments help you avoid negative marks on your credit report, such as late payments or collections, which can impact your ability to get approved for loans or credit cards in the future.

2. Saving Money: You can avoid late fees and penalties by paying your bills on time, saving you money in the long run.

3. Peace of Mind: Knowing that your bills are paid on time reduces stress and provides peace of mind, allowing you to focus on other important areas of your life.

Managing bill payments doesn't have to be complicated. By setting up a budget, utilizing automatic payments, and setting reminders, you can stay organized and ensure that your bills are paid.

Creating a Bill Payment System

Creating a bill payment system is a great way to ensure that your bills are paid on time. Here's how to set up an effective system:

Making a List of Bills and Due Dates

One of the first steps in managing bill payments is to create a list of all the bills you need to pay and their respective due dates. This will help you stay organized and ensure that you don't miss any payments. Here are some tips for making a comprehensive list:

- List all your bills, including utilities, credit cards, rent or mortgage payments, and any other loan payments.

- Include the amount owed and the due date for each bill.

- Use an app, spreadsheet, or notebook to track your bills and update it regularly.

- Set up reminders on your phone or calendar to alert you of upcoming due dates.

Organizing Paper Bills and Digital Documents

Keeping your bills organized is essential for easy access and reference when it's time to pay them. Here are some strategies for organizing both paper bills and digital documents:

- Designate specific locations to store physical bills, such as folders or drawers.

- Label each folder or envelope with the respective bill's name and due date.

- Consider scanning your paper bills and organizing them in your computer or cloud storage folders for easy digital access.

Setting Up Automated Payments

Automating bill payments can save you time and ensure that your bills are paid on time. Here's how to set up automated payments:

- Contact your bank or biller to inquire about automatic payment options.

- Provide the necessary account information and authorize recurring payments.

- Check your bank account regularly to ensure that funds are available for automatic payments.

- Keep track of your automated payments to ensure accuracy and avoid any unexpected issues.

By following these steps and implementing a bill payment system, you can manage your bills efficiently and avoid late fees or missed payments. Remember to regularly review your bill list and make any necessary adjustments to stay on top.

Paying Bills on Time

We have discussed the importance of paying bills on time in this post, but below we have a summary:

Choosing the Right Payment Method

When it comes to paying bills on time, choosing the right payment method is essential. Here are some options to consider:

1. Online Bill Pay: Many banks offer online bill pay services, allowing you to schedule and pay your bills electronically easily. This can save time and ensure your payments are made on time.

2. Automatic Bill Payments: Setting up automatic bill payments can be convenient and help you avoid late fees. You can authorize your bank to automatically deduct the amount of your bill from your account on the due date.

3. Mobile Payment Apps: Various mobile payment apps are available that allow you to pay bills directly from your smartphone. These apps often provide reminders and notifications to help you stay on top of your payments.

Scheduling Bill Payments

Scheduling bill payments is another key aspect of managing your bills effectively. Here are some tips:

1. Create a Payment Calendar: Keep track of your bill due dates by creating a payment calendar. This can be a physical calendar or a digital reminder on your phone or computer.

2. Set Reminders: Take advantage of reminders provided by your bank or payment apps. This will ensure you don't forget to make your payments on time.

3. Consider Cash Flow: Consider your cash flow when scheduling bill payments. Make sure you have sufficient funds in your account to cover the payments on their due dates.

Monitoring Transactions and Account Balances

Monitoring your transactions and account balances is vital to ensure that your payments are processed correctly. Here are some steps to follow:

1. Regularly Check Your Accounts: Take the time to review your bank statements and transaction history to ensure that all payments have been made and credited to your account.

2. Set Up Alerts: Many banks offer the option to set up alerts for low balances, large transactions, or suspicious activity. These alerts can help you stay on top of your finances.

3. Contact Your Bank: If you notice any discrepancies or issues with your bills or payments, contact your bank immediately for assistance.

By choosing the right payment method, scheduling bill payments, and actively monitoring your transactions and account balances, you can effectively manage your bill payments and avoid late fees and penalties.

Tools and Resources for Managing Bills

Managing bill payments can be made easier with the help of various tools and resources available. Here are some useful options:

Using Online Calendars and Reminders

Online calendars and reminders can be valuable tools for tracking bill due dates and ensuring timely payments. Some benefits of using online calendars include:

- Easy Scheduling: You can easily schedule bill due dates and set reminders on your preferred calendar platform, be it Google Calendar, Apple Calendar, or any other popular online calendar.

- Alerts and Notifications: Online calendars can send you alerts and notifications before your bill due dates, helping you stay organized and avoid late payments.

- Sync Across Devices: Online calendars can be accessed from multiple devices, such as your smartphone, tablet, or computer, ensuring you have access to your bill payment schedule wherever you are.

Specialized Apps for Bill Organization

Various specialized apps are available specifically designed to help manage and organize bill payments. Some key features of these apps include:

- Budget Tracking: Many bill organization apps can track and manage your expenses, allowing you to see how your bill payments fit within your overall budget.

- Due Date Notifications: These apps can send you notifications when bills are due, reminding you to make payments on time.

- Bill Payment Management: Some apps allow you to link your bank accounts and credit cards, making it easier to track bill payments and manage multiple accounts in one place.

Utilizing Alerts and Notifications

In addition to online calendars and specialized bill organization apps, you can also leverage alerts and notifications offered by your bank or service providers. Some common types of alerts to consider:

- Low Balance Alert: Get notified when your account balance is low to avoid overdraft fees and ensure you have enough funds to cover your bill payments.

- Due Date Reminder: Receive reminders well before your bill due dates, helping you stay on top of your payments.

- Payment Confirmation: Some banks and service providers offer alerts to confirm that your bill payment has been received and processed successfully.

By using these tools and resources, you can effectively manage your bill payments, stay organized, and avoid any potential late payment fees or penalties.

Tips for Struggling to Pay Bills on Time

Prioritizing Bill Payments

When you're struggling to pay your bills on time, it's important to prioritize which ones to pay first. By focusing on the most critical bills, you can avoid more severe consequences like late fees and potential utility shut-offs. Here are some tips for prioritizing bill payments:

- Start by paying essential bills like rent/mortgage, utilities, and insurance premiums.

- Next, prioritize bills with high-interest rates, such as credit card payments, to avoid accumulating more debt.

- Consider negotiating with creditors (more on this in the next section) to potentially lower monthly payments or interest rates.

- Set up payment plans for outstanding debts, ensuring that you pay at least the minimum required amount each month.

- Monitor your credit score regularly to stay aware of any negative impacts from missed or late payments.

Negotiating with Creditors and Service Providers

Negotiating with creditors and service providers to alleviate some of your financial burdens may be possible. Here are some strategies to consider:

- Contact your creditors and explain your financial situation. They may be willing to work with you to create a more manageable payment plan.

- Ask about hardship programs or assistance options that may be available, such as deferring payments or reducing interest rates temporarily.

- Consider debt consolidation or debt settlement programs if you have multiple debts and are struggling to keep up with payments. These programs can help you negotiate with creditors to reduce the amount you owe or consolidate your debts into one more affordable payment.

Seeking Financial Assistance and Guidance

If you're still struggling to manage your bill payments, seeking financial assistance and guidance can provide much-needed support. Here are a few resources to consider:

- Non-profit credit counseling agencies can help you develop a budget, negotiate with creditors, and provide financial education.

- Your local utility companies may offer assistance programs for low-income individuals or those facing financial hardship.

- Community organizations and charities often provide emergency financial assistance to needy individuals and families.

Remember that it's crucial to reach out for help as early as possible. Ignoring your financial difficulties will only make them worse. By taking proactive steps and seeking assistance when needed, you can find solutions to manage your bill payments and regain financial stability.

Remember, staying on top of your bill payments helps you avoid late fees and penalties and builds a positive credit history. By implementing these strategies and finding a system that works for you, you can effectively manage your monthly bill payments and gain peace of mind in your financial journey.

2 Comments