Biweekly Savings Plan for Low Income (That Actually Works)

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereIf you live on a low income, saving money can feel impossible. You get paid, you pay bills, you buy groceries, and the money is gone. And when prices keep rising, it can feel like you’re doing everything right and still falling behind.

That’s exactly why a biweekly savings plan for low income households works so well. It’s simple, it’s realistic, and it helps you build stability little by little, even if you’re starting from zero.

This isn’t about saving hundreds at a time. It’s about creating a system that makes you feel safer and less stressed over time.

My Story

I was a single mom and I didn’t make a lot of money. I was also terrible with money, not because I didn’t care, but because I didn’t have a system that worked for real life. I didn’t grow up with a roadmap for saving, so I was always trying to catch up.

One day I realized I didn’t want to keep living like that. I didn’t want to always feel behind. I wanted something steadier for myself and my kids, even if it had to start small.

So I started saving $20 every Friday into a savings account I didn’t have easy access to. Not because I had extra money, but because I needed a system that protected me from myself.

Later, I added that same small-amount system to my investing. I use Acorns, which automatically pulls $50 a month and rounds up small purchases. I don’t think about it, it just happens in the background. Over time, that account grew into the thousands.

The biggest change wasn’t just the money. It was the mindset shift. I stopped seeing myself as someone who “can’t save” and started seeing myself as someone who always sets something aside.

I’m not rich. But I’m comfortable now, and I have less stress because I built a system that, years later, truly saved me.

What Is a Biweekly Savings Plan?

A biweekly savings plan means you save money in smaller amounts on a repeating schedule, usually every two weeks or every paycheck. Financial companies like SoFi also explain how this biweekly savings method helps people build consistency and save without feeling overwhelmed.

Many people get paid weekly or biweekly. If you get paid monthly, like Social Security or a fixed income, you can still use this plan by splitting your monthly money into two parts and saving from each half.

Instead of trying to save “whatever is left” at the end of the month, you save on purpose, on a schedule.

Why Monthly Budgets Fail Low Income Families

Most budgeting advice is written for people who already have wiggle room. It assumes your bills are stable, your paycheck covers everything, and your biggest problem is spending too much on little extras.

That’s not real life for most low income families.

Real life looks like rent taking half your income, groceries changing every week, kids needing things at the worst time, a car you can’t replace but also can’t afford to fix, medical copays, school expenses, utility bills that spike, and paychecks that change.

Monthly budgets fail because they assume nothing will go wrong for 30 days. But when you’re low income, something always happens. And when the budget breaks, people think they failed. The truth is the system failed them.

A biweekly savings plan works because it fits how money actually flows. You don’t have to be perfect for an entire month. You just save a little at a time and build a cushion that protects you when life happens.

How Much Should You Save on a Low Income?

The right answer is not a percentage.

The right answer is what you can do without quitting.

If money is extremely tight, saving $5 per paycheck is enough to build the habit.

If you can breathe a little, $10 to $25 per paycheck is realistic for most low income households.

If you’re able to save more, $25 to $50 per paycheck can help you grow faster, but only if it doesn’t cause you to fall behind on essentials.

If you’re not sure where to start, pick an amount that feels almost too easy. Do it for four paychecks. Then increase it by $5. That’s how people actually stick with saving.

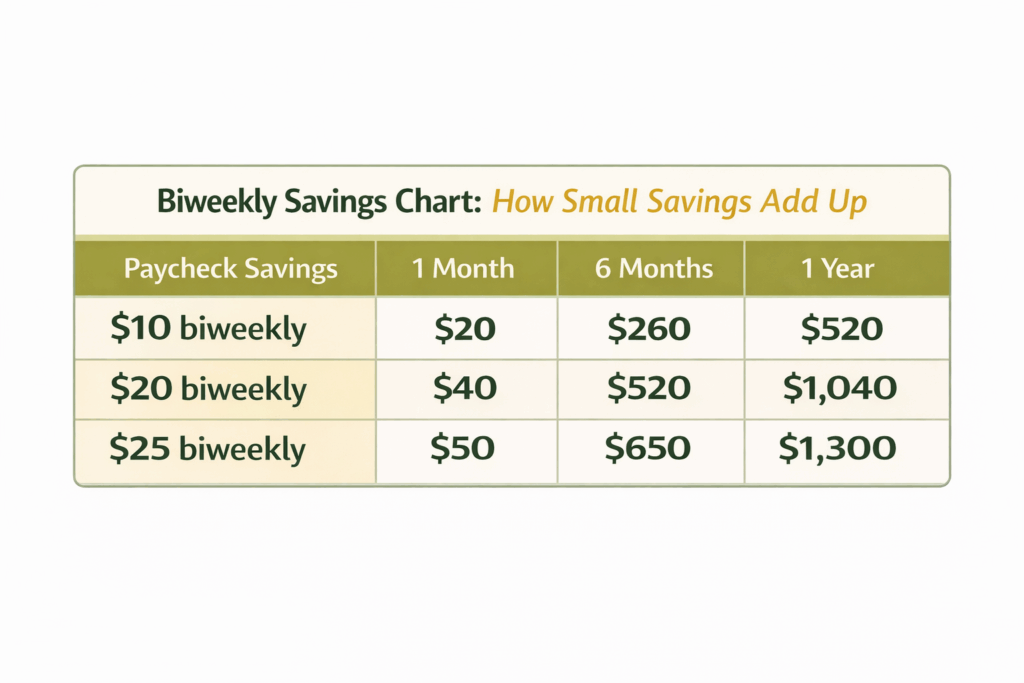

Sample Biweekly Savings Plan (Low Income)

Paycheck every two weeks: $900

Savings per paycheck: $25

Split it like this:

$15 to emergency savings

$10 to sinking funds

After one year:

Emergency savings: $390

Sinking funds: $260

Total saved: $650

Even saving $10 per paycheck adds up to $260 a year. That’s real money when you need it.

Step-by-Step Biweekly Savings Plan

First, choose where your savings will go. Pick a separate savings account, a bank you don’t use for bills, a savings app, or a place that makes it harder to spend the money.

Next, choose your schedule. If you’re paid biweekly, save every paycheck. If you’re paid weekly, save every week or every other week. If you’re paid monthly, split your money into two parts and save twice a month.

Then choose your starting amount. Pick something small on purpose. $5, $10, $20, or $25 is perfect.

Set it up automatically if you can. Have the transfer happen the day your money comes in, or the next morning. If you can’t automate it, set a reminder on your phone.

Split your savings into two buckets: emergency money for things you didn’t plan and sinking funds for things you know are coming like Christmas, birthdays, or school expenses.

If you get paid biweekly, use your two “extra” paychecks each year to catch up on bills, boost savings, or pay ahead on something important. Those paychecks are one of the biggest ways low income families get ahead.

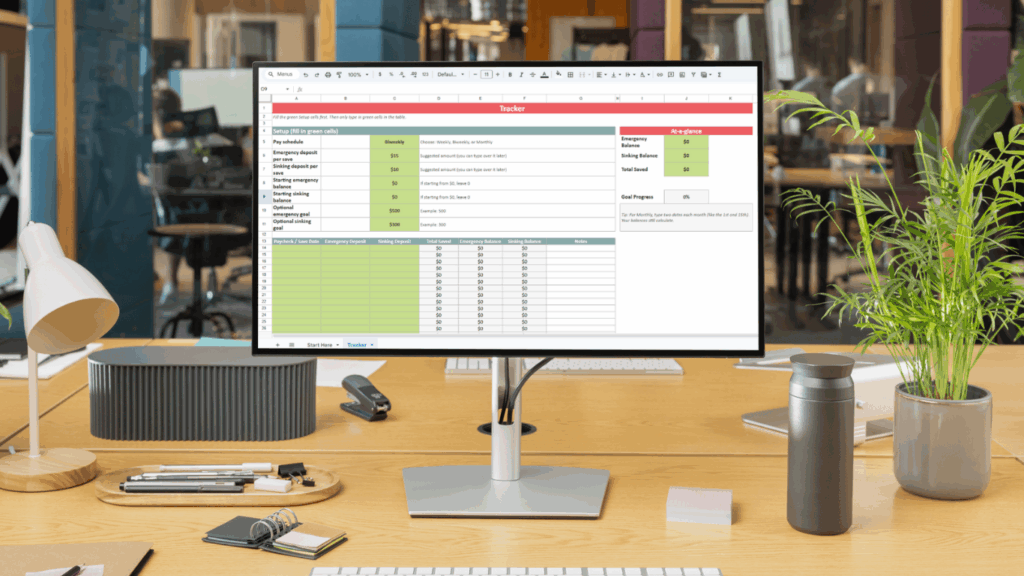

If you want to actually start this without overthinking it, I created a free Biweekly Savings Tracker that matches everything you just read. It’s the same system I use, just laid out in a simple Google Sheet so you can track every paycheck and watch your savings grow.

Why This Works When Prices Keep Rising

Having even a small amount saved keeps you from putting emergencies on a credit card, using payday loans, or falling into panic mode. Savings gives you breathing room. Even a little changes everything.

You Don’t Need To Be Rich To Save

You don’t need a big income to build stability. You need a system that works for your real life.

A biweekly savings plan for low income households is one of the simplest ways to stop living in constant catch-up mode and start feeling secure, one paycheck at a time.

A couple of things to add to this list:

1. Choose alternative/generic brands over name brands. The higher cost for name brand items usually goes to help boost their marketing budget anyways. The quality of the product is typically the same with the generic brand, so if you are trying to save be wise and go for the generic brand when possible.

2. Focus on your grocery bill since buying food is often one of your highest monthly expenses. Avoid the temptation of that candy bar at the checkout stand. Freeze perishable foods and meats so you don’t waste what you buy and end up re-buying a week later. Simple things like this will help lower your grocery bill.

3. Cut back on the things you never use. Maybe you don’t have the time to watch television anymore…get rid of cable! Going along with your point about selling unwanted items, have a garage sale or sell items on eBay that you don’t use anymore. Haven’t touched that bread maker in two years? Sell it!

Once you find ways to save, make sure those savings are tucked away in an interest account.

Thank you Robert for these amazing tips! You are correct on store brands. If consumers will turn the bottles and look at the company that makes them they will see that its a well known company. Thank you for stopping by.

In these Blog Very Nicely written about how we save our low Income, 10 different ways given such a nice Blog. Should Have to be writing that kind of blogs always. I can say that blog should more easy access to peoples for getting information & implement in lifes. I Appreciated.