Teaching Our Kids to Budget: Free Kids Budget Printables

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereTeaching kids to budget their money can help them be more responsible. Money is a touchy subject in many households, and it shouldn't be!

One common excuse I get from parents is how their child will get their money? I kid you not! And yes, if your comeback when we talk about teaching kids about money is this, it is pure and simple an excuse not to teach them about budgeting at an early age!

Kid's Income (Chores)

Before we discuss kids and budget, let's talk chores and paying for chores.

One of the most common debates revolves around how much allowance to give and what should be expected from children when managing their money.

You might like: 6 Ways Young Kids Can Help Around the House.

There are several schools of thought on this topic, but we’ll focus on two here: the “pay them for chores” school (kids get paid for doing household tasks) and the “give them an allowance” school.

The first approach has some obvious pros – kids are rewarded with cash for completing chores they would otherwise have to do without compensation; they learn about budgeting by having an expendable income that must be accounted for each week; there is less parental involvement in monitoring purchases.

You might enjoy these posts:

The biggest downside to this system is the difficulty in assigning a value to each chore; some chores are more labor-intensive than others, but if you pay your child for every chore they complete, they risk not completing one or “forgetting” to do something.

You can argue that this is all part of budgeting, too – each kid will have a different savings goals/play money allotment based on what they want to purchase, and it is a great lesson in the cost of things!

The second approach has several pros – children are taught from an early age to manage their money; if you pay your child according to chores, you don’t run into issues with assigning value, and you can adjust for cost of living changes over time; your child can easily determine how much is allocated for each chore.

The biggest downside to this method is the obvious one: your kid has money coming in for doing absolutely nothing except being a kid, which hardly seems fair or conducive to teaching them about working and earning an income.

Skill Building Through Chores

Chores are an important part of a child’s life, even before they have actual disposable income. Learning to do your chores is a vital skill that you'll use for the rest of your life, and it can be fun.

It's easy to make this process enjoyable and educational when you teach kids to budget their allowance.

There are infinite ways to teach kids to budget, but we’ve provided a few ideas below. Some of these ideas can be used in conjunction with one another, while others will work better on their own:

Give them an allowance based on their chores for each week. For instance, you might give your child $6/week for doing their chores and then $1/week for each additional chore they do on top of that. Then, when the week is done, hand them a small envelope with their allowance to spend however they like.

Give your child a basic spending budget. While this won’t teach your child about how money works (deposit, interest, etc.), it’s an easy way to give them some freedom while still keeping a lid on their spending. As a parent, you need to revisit the budget from time to time and make sure they aren't just blowing through their whole allowance in one week!

Give your child an allowance based on how much money they save. For instance, you might tell your child that if they can save $35 by the end of the month, they'll get an extra $3. They may decide to save more for a larger base allowance or spend less so they don’t have to save as much.

Keep your children accountable for their spending. You may find yourself with a child who spends too little or trying to stretch their money for an item that isn’t worth it to them. If they are overspending on a specific item, make sure they understand what they could have done with that extra money and encourage them to focus on saving more in the future.

Budgeting is a skill, and it's important to teach kids how to budget for the future.

Teaching our kids to budget is a skill that they're going to need for life. So it's important to teach them how to budget so they can prepare themselves for the future! We have some tips on how you can go about teaching your kids about budgeting and making it easy for both of you.

Lead by Example

It can be hard to teach your kids how to budget when you don't do it yourself. So if you want to teach your kids about budgeting, make sure you practice what you are preaching.

Budgeting as a family is important, and if you want your kids to know the value of money, it starts with you!

Talk about finances; never shy away from that conversation. Be real and honest with yourself and your family when it comes to budgeting and money.

Start with small amounts of money, like $5

Start with a small amount, like $5, and set a goal for how much they want to save by the end of the week. This will teach them that saving is possible when you start with small amounts, and they could even continue using this method as they grow older. It's never too early to start teaching your children the value of money!

Let them be in charge of their budget

Remember that when teaching your child how to budget and decide how to spend their money, let them decide and be in charge!

I know it can be hard for parents to interject in their decisions. Let them figure out if they have enough money. And when they are not sure if they can afford something, talk to them about it. Ask them how much money is left in their budget and ask what they feel like doing.

They will quickly learn that there might have to be some decisions made on how they spend their money because of their budget limitations. Let your child see for themselves the problems that occur when they are not budgeting.

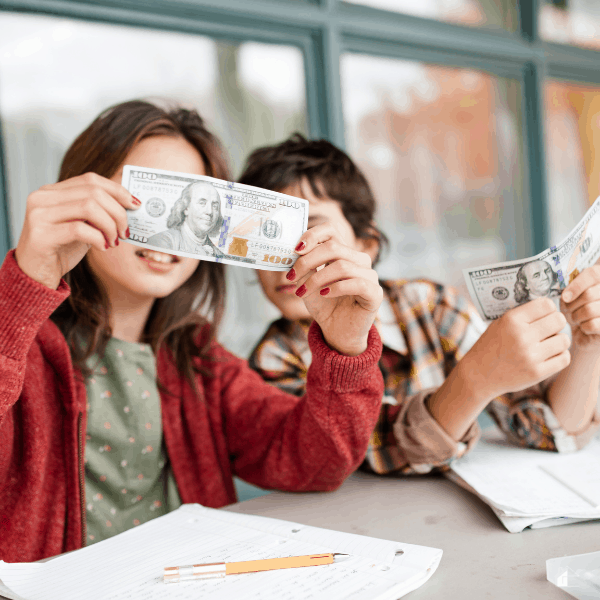

Teach kids the budgeting basics

Remember to start teaching your kids as soon as possible about money. Start with visuals about money. Talk about what different denominations of bills and coins look like. Would you please explain how to count money so that they can use cash and credit cards properly and safely when they're older?

You might laugh, but many of us, including yours truly, didn't know about budgeting until adulthood! I had no clue how to manage money. So taking the time to cover the basics is essential.

Teach them about income and expenses and budget basics. Spending too much when you don't have enough is a big problem and easily avoided by creating and sticking to a budget.

Some of what you teach kids about money may be new or different than what you learned. Just make sure your explanations are clear, simple, and practical so that they understand what you mean. This means keeping complicated financial language to a minimum.

Teach them how much something costs by breaking down the cost into smaller pieces such as 10 cents or 25 cents.

- Teach your kids about investing: Read Investing for Kids: How to Save, Invest and Grow Money

Of course, it all depends on their age. Start with jars when they are young and move on to a paper system around 6 years old. This is when you learn if your child is a save or a spender.

Around 6 is when they understand that they won't purchase if you don't have enough money.

Once they are around 11, it is time to talk about saving for cars and other things and creating a plan to save for big purchases in the future. If you have been teaching them about budgeting since they were young, they should know the value of money around this age.

Provide guidance

Allow them to make some decisions independently but still provide guidance about why certain choices are better than others; e.g., if you spend all your allowance on candy, you won't have any money left over for lunch at school tomorrow.

Encourage them!

Encourage saving by providing incentives such as a special treat when they save a little bit of money like $1.00 in an envelope.

6 Easy Ways To Teach Kid About Budgeting

Teaching our kids about budgeting at a young age can set them up for a successful financial life. Below are some ways we can teach and motivate our kids about budgeting:

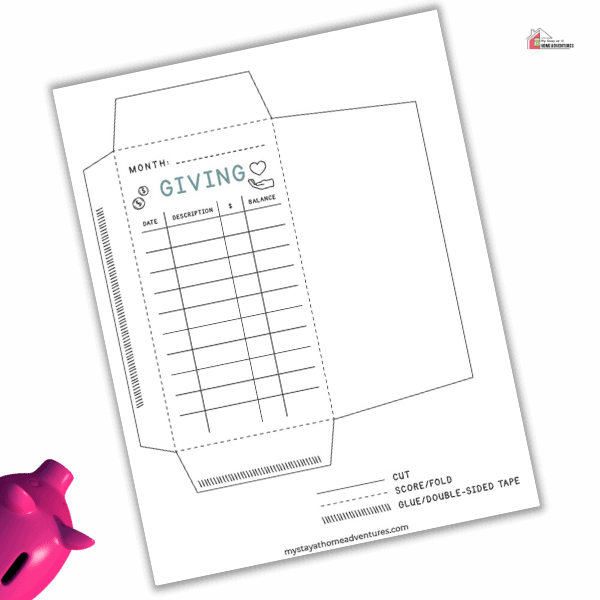

Give

Giving is essential when it comes to teaching kids about budgeting. Never skip this category! I promise you. You won't regret it! Asking questions is a great way to motivate them and keep their focus.

Ask your kids these questions:

- How much money do you want to give or donate on this day?

- How much money do you want to give each year?

Spend

There is more to budgeting than spending. Help your child understand their spending by asking these types of questions:

- What are you going to spend your money on today?

- What are you going to spend your money on this week?

Save

Teaching kids to save money at a young age will help them as adults! Always talk about the importance of saving money. Because budgeting is personal, remember that and always ask these questions to help them understand their journey.

- What percentage of your money will you save each day and as an annual goal?

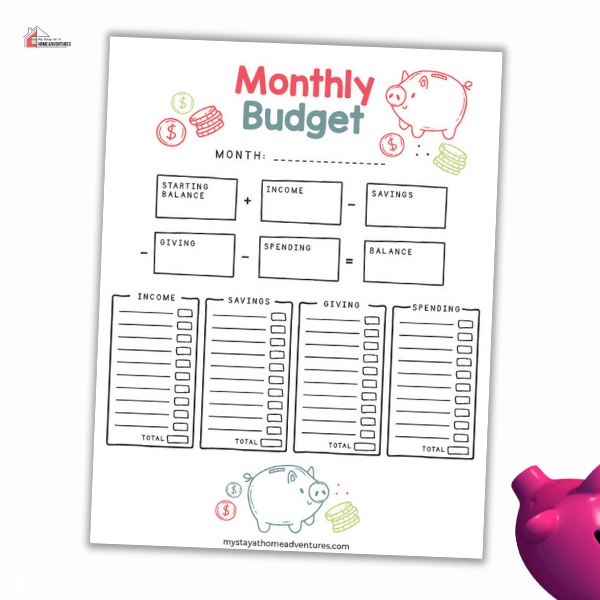

Budget

Once they are old enough to write, talk about budgeting and create a budget with them. Make them understand the importance of having a budget.

- What will help you to budget your money?

- How do you record your purchases and spending for a month or year?

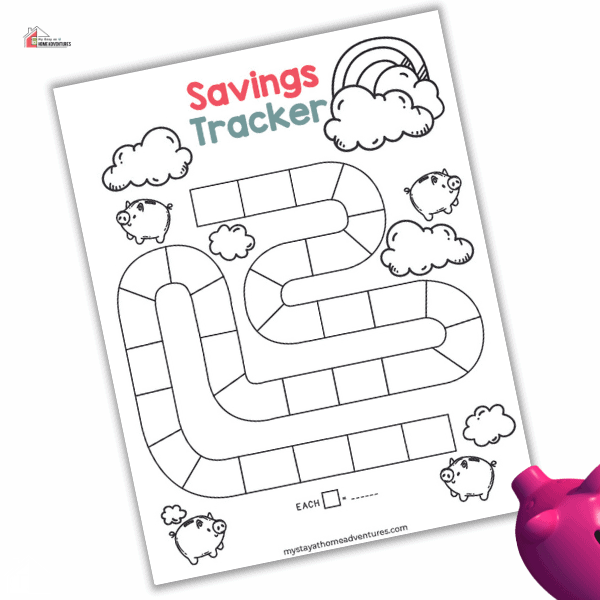

Track

Tracking is essential when it comes to budgeting and understanding your money. Even as adults, we tend to forget about tracking our money and, yes, end up in a financial mess. Encourage your kid to track their spending!

- How can you track your spending throughout the day, week and year?

Record

As adults, we tend to start a budget and forget about it. Instead, teach them to get in the habit of recording their income and spending. Budgeting comes in many ways, writing, apps, spreadsheet.

You will understand that your child might enjoy spreadsheets or a certain way of budgeting at some age. , But, remember we are budget differently. Allow them to try and find a budgeting style that works for them.

- How do I record my income and spending throughout the day, week or year?

Give, Spend, Save, Budget, Track, and Record are ways to teach our kids about budgeting at young ages.

These are great ways to help a child learn about budgeting that won't be complicated. If they are toddlers, start with jars and label them:

- Give

- Spend

- Save

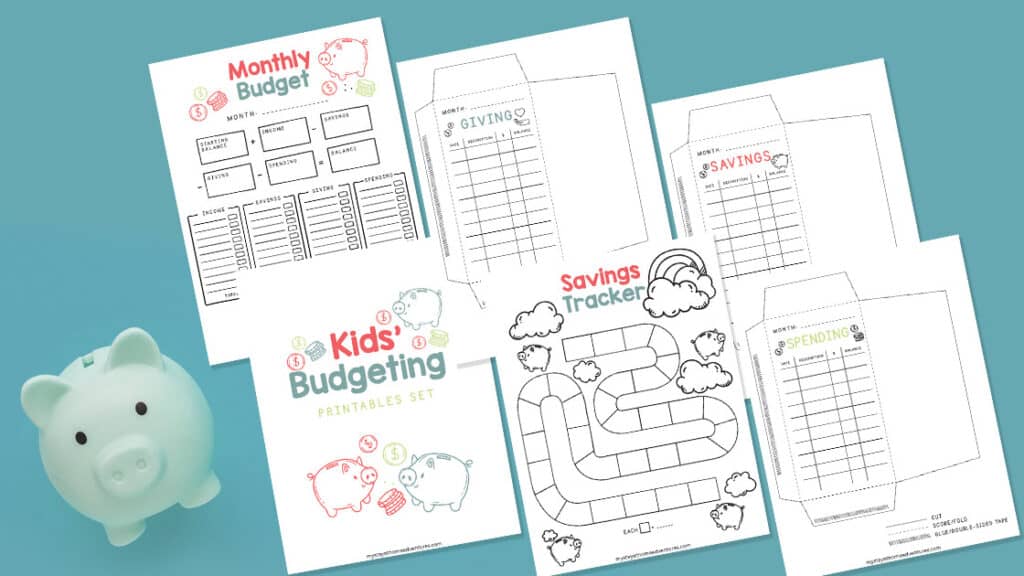

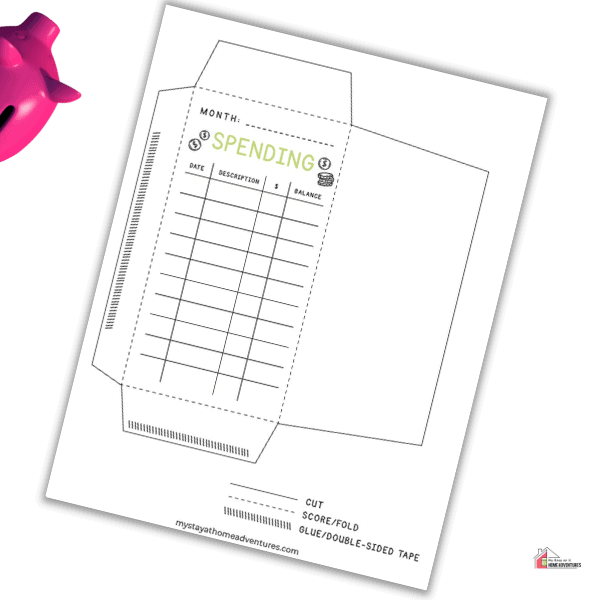

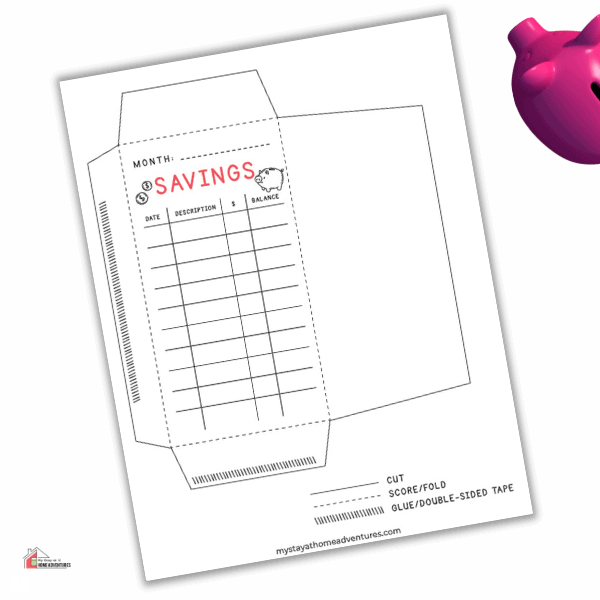

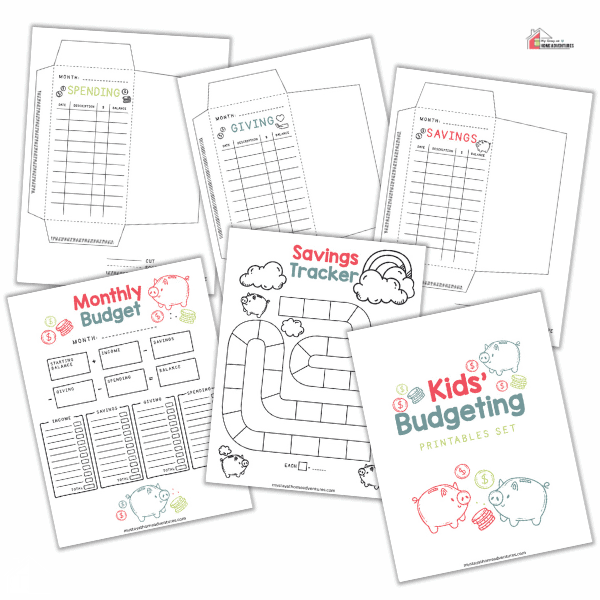

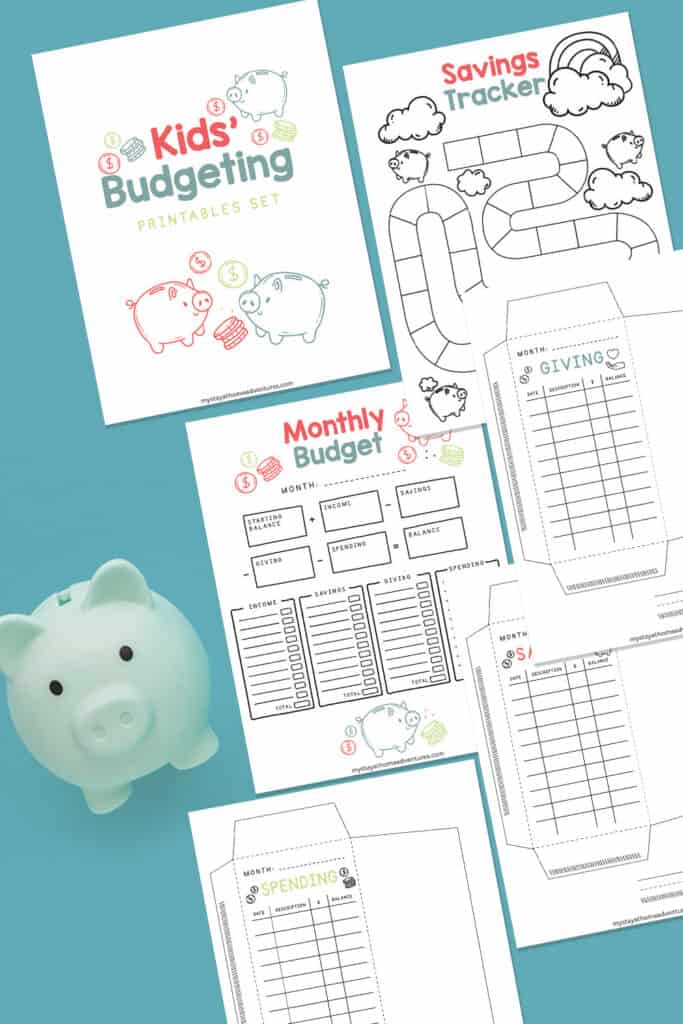

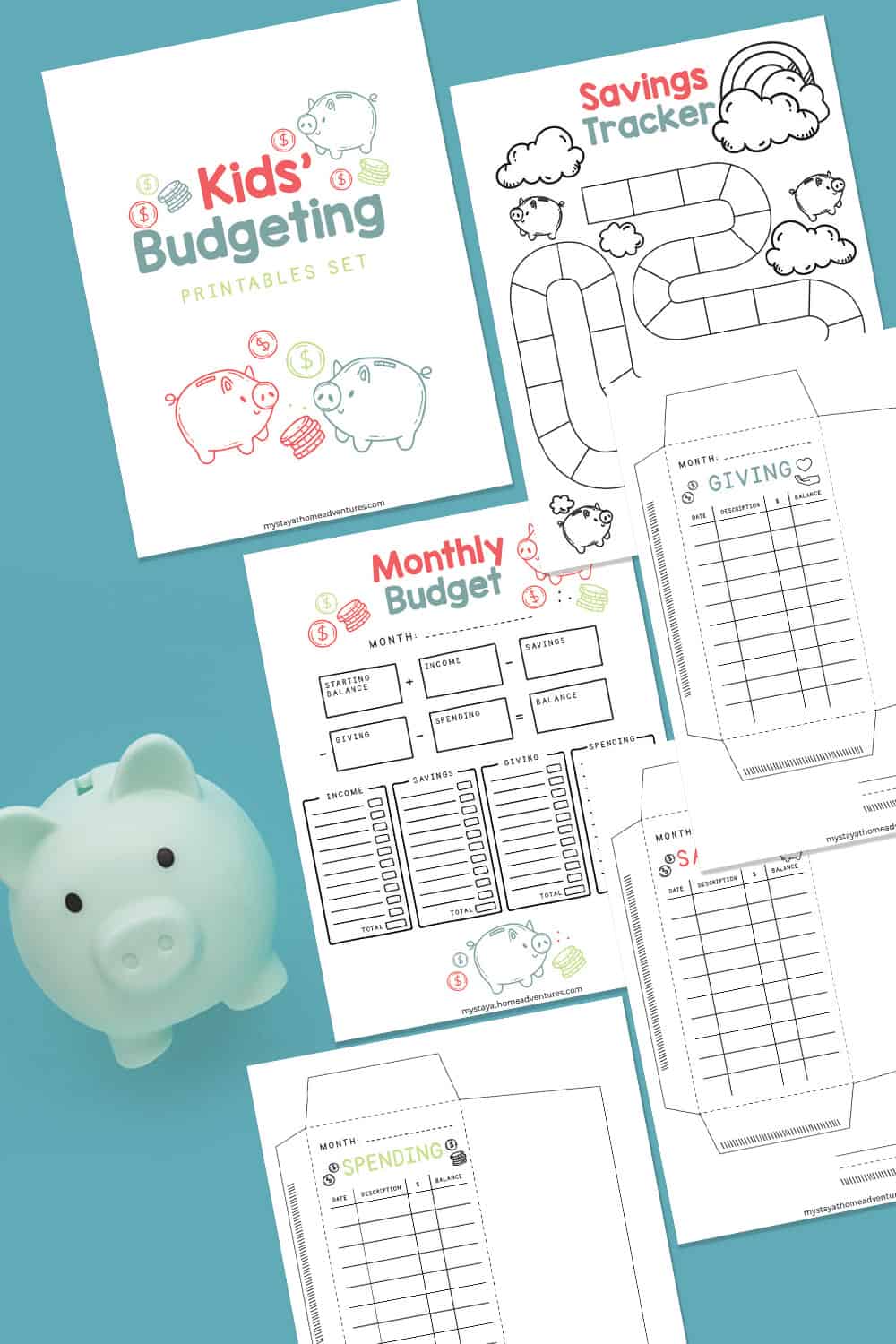

Or maybe when they are 6 and older, use envelopes (provided in the printables) and insert cash. This is a great way for visuals to start a cash budgeting system and see those envelopes empty as they spend.

Tracking their income and expenses is a great way to help your child understand money! But, again, you know your child best and when you feel that they can write and get this part of the budget done, let them do it!

Just like adulthood, tracking and recording your income and expenses is important and something you should teach your child early in life so, um, they don't end up like me!

To teach our kids about budgeting, we need first to understand what they’re capable of comprehending.

Therefore, the younger the child is, the more hands-on and visual learning activities you should use in your teaching efforts. For example, for a 4-year old who's just starting on their own personal finance journey, pictures are going to be much easier than words or numbers.

Budgeting should be taught as soon as possible because it will benefit them in adulthood.

Free Kids Budgeting Sheets

Below is a great tool to help parents start teaching their kids about budgeting.

One Comment