3 Ways to Save $50 Per Week

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereSaving $50 per week might seem hard but can be done when you read this post. Learn many ways you can save an extra $50 per week starting today.

Let's break this down and see how much $50 per week can save you, shall we?

How much is $50 a week for a year?

$2600 is how much money you can save if you save $50 per week. Now, you might think it is not a lot, but it is better than nothing.

Also, the money saved could be invested with the potential to grow!

According to CBS News, about four out of 10 Americans said they had enough in savings to cover a surprise $500 expense.

Let that sink in, and with pandemics and the economy down on in 2020, many people were affected financially.

So, having $2600 saved in one year should be a goal for you. Look at how many Americans don't even have $500 saved for an emergency.

How hard can $50 a week be?

Truthfully, for many, it can be challenging. For example, if you have spending habits, have never budgeted, the first week you do this, it might seem easy, but things might seem hard after the first week.

There are reasons why this might be hard, and you will learn about them in this post. We could say:

“Save $50 per week by not spending $50,” might sound like a good idea, but let's dig into that for a minute.

- If you have not saved. Ever.

- If you have never budgeted your income

- If you have no planning and have never financially planned

I wanted to buy a $250,000 car but didn't, so I saved me $250,000. Well, first, I never had the $250,000. Second, it didn't affect my finances because it was not even real.

How do you save $50 per week?

You save your $50 per week by creating a plan, allocating that amount, and putting it aside. Yes, an actual amount.

How to Save $50 Per week

Here are three tips to save $50 per week that can change your life:

Start with a Plan

Now, you might wonder why I need to start with a plan if I just skip eating out and drinking coffee?

Everything works better with a plan. How are you going to keep track of your money? Where is this saved money going towards?

Yes, the goal is to save $50 each week, so for how longs? Are you doing this for a year?

Without a plan, you are going to get bored and not bothered to save. Create a budget, look at the budget, and create a plan on how you will save your $50 this week.

Take it one week at a time.

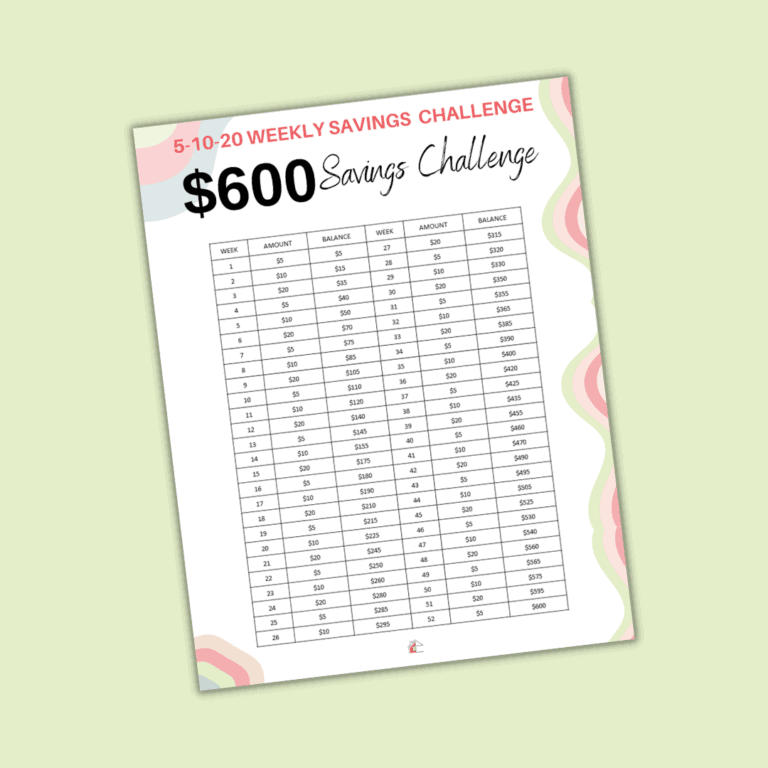

Just like creating a budget, to start our $50 per week saving challenge start by merely taking one week at a time.

Challenge yourself for one week and create a plan for that one week. If you fail, keep going. Don't give up!

Look at your previous weeks' spending and create a plan from there.

Look at the overall picture.

If you want to start saving an extra $50 per week, you already know what your plan is for the week and how you will get this done.

But what about if you take a closer look at the overall picture. Are you doing this for how many weeks?

Can we focus on canceling subscriptions, reducing the electric bill, and switching cell phone providers to Tello or Republic Wireless?

By doing this, you could be saving your $2600 a year by looking at just more than a quick way to making $50.

Yes, not eating out or buying coffee is a great way to save an extra $50 this week. Are you willing to not enjoy your coffee or eat out anymore?

Below are ideas to help you save $50 a week. Again, by focusing on planning, making it a week at a time, and looking at the overall picture will benefit you and create money-saving habits.

Make your coffee at home.

Those $6+ coffees every morning (or at lunch and on the way home) can add up. Plus, they have way more sugar and calories in them than if you make your own coffee and bring it with you. You'll save a ton of money, and you have total control over the taste of your own.

Cook at home instead of eating out.

Cook at home instead of eating out also applies to bringing your own lunch to work. It sounds simple, but when you realize you can spend $10 or more per meal per person, eating out all week really adds up.

Always use cash for purchases.

When you get small items from the store or buy groceries or other needs for the home, always use cash, and only take the amount you need.

You will be tempted to spend more when using plastic, and with the cash plan, you can also save all of the change. This adds up, too. Win-win!

Go on a spending freeze.

Reducing your spending for one week can be beneficial if you tracked your spending and compared them to the previous week.

The challenge with this is how to take this freeze and continue it for the following weeks. The cons are that if you run out of food, would you spend an extra $50 the next weeks because you didn't pay $50 the previous week?

Conclusion

Saving $50 per week is doable but in different ways. Could you save an extra week this week? Absolutely, but the challenge will be saving that extra week beyond this week.

Removing eating out, buying coffee, and using cash might work for one week, but would it work for the weeks ahead?

It comes down to planning, taking one week at a time, and looking at the overall picture.

Good tips. Thank you!

Savings=Earnings. Nice blog, I would love to read more