How to Create a Stress-Free Financial Routine from Home

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereManaging finances from home can seem like an overwhelming task. Between keeping track of household expenses, savings, and long-term financial goals, it’s easy to feel stressed.

However, with a solid financial routine in place, you can gain control over your money and reduce the stress that often comes with it.

By following some simple steps, you can create a financial plan that works for your lifestyle and offers long-term peace of mind.

Understanding the Benefits of a Financial Routine

A financial routine is more than just a series of actions—it's a way to take charge of your money in a consistent, organized manner. The benefits of having a financial routine are undeniable. First and foremost, it helps you stay on top of your finances, ensuring that bills are paid on time and savings are steadily built.

When you have a clear plan, you don't need to worry about missing payments or going off track. This predictability leads to less anxiety, helping you focus on what matters most—family, hobbies, and personal growth.

By implementing a routine, you’re also able to recognize spending patterns and adjust as necessary. A solid financial routine allows for greater flexibility, letting you plan for future goals, whether it’s a vacation, home improvements, or an emergency fund.

A well-organized financial system will help you identify areas where you can save more, invest smarter, and ultimately feel more secure.

Setting Financial Goals That Align with Your Lifestyle

The first step in creating a stress-free financial routine is setting clear financial goals. It’s essential to ensure these goals are both realistic and aligned with your lifestyle.

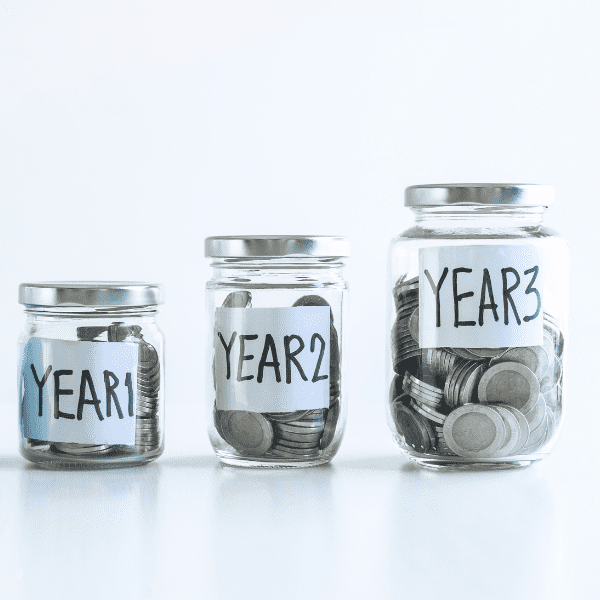

Start by breaking down larger financial aspirations, such as saving for a down payment on a house or planning for retirement, into smaller, more manageable goals. These mini-goals will help you stay motivated and track your progress over time.

For example, if you’re looking to save for a family vacation in the next year, set a target amount each month and decide how much you need to cut back on discretionary spending to reach that goal. For longer-term goals, like retirement, consider setting yearly milestones.

Adjust these goals as life evolves, but having them clearly defined will keep you on track.

Creating a Simple and Effective Budget

Budgeting doesn’t need to be complicated, especially when managing finances from home. The key is to find a system that works for your unique situation. Start by listing all sources of income, followed by your fixed expenses, like rent or mortgage, utilities, and insurance.

Next, calculate variable expenses such as groceries, entertainment, and transportation. This will give you a clear picture of where your money is going.

To simplify your financial routine, consider setting aside a percentage of your income for savings and investment goals each month. For instance, the 50/30/20 rule is a straightforward method: allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings or debt repayment.

Whether you choose a digital tool, an app, or pen and paper, keeping track of your budget regularly will prevent overspending and promote smart saving.

You may also want to consider opening a high-yield savings account online. These types of accounts offer higher interest rates than traditional savings accounts, helping your money grow passively. It’s a good option if you want to build an emergency fund or save for a short-term goal without having to think about it every day.

Automating Your Finances to Save Time and Stress

One of the easiest ways to reduce stress is by automating your finances. By setting up automatic bill payments and savings deposits, you’ll ensure that essential tasks are taken care of without needing to remember them every month.

Many financial institutions offer services where you can automatically transfer a set amount into a savings account or retirement fund.

For example, you can set up automatic transfers to your savings account the day after payday, so you don’t even have to think about it. Similarly, paying your bills through automation ensures that you never miss a payment and avoids late fees.

This step will free up mental space, making it easier to focus on other tasks. With automation, you can rest easy knowing that the financial fundamentals are handled.

Building an Emergency Fund for Financial Security

An emergency fund is one of the most important aspects of a stress-free financial routine. Life is unpredictable, and having a financial cushion to fall back on can save you from unnecessary worry.

Whether it’s for medical expenses, car repairs, or unexpected job loss, an emergency fund provides the security you need when the unexpected occurs.

To build your emergency fund, start small. Set a realistic target, such as $500, and gradually increase that amount over time. Once you have built up at least three to six months’ worth of living expenses, your financial stability will increase significantly.

Having this buffer will give you peace of mind, knowing that you are prepared for whatever comes your way.

Tracking and Adjusting Your Financial Routine Regularly

Creating a stress-free financial routine doesn’t mean you can set it and forget it. To stay on track, it’s essential to monitor your progress regularly. Reviewing your budget and goals every month allows you to identify any areas that need adjusting.

If you notice that you’re spending more on certain categories, it might be time to adjust your budget or look for areas where you can cut back.

Regularly revisiting your financial goals also ensures they remain relevant as your circumstances change. For example, if you get a raise or your expenses decrease, it may be time to increase your savings rate or reallocate funds to another goal.

By staying proactive and adjusting when necessary, you’ll avoid falling off track and maintain a routine that supports your long-term financial health.

Conclusion

Creating a stress-free financial routine from home is not about being perfect; it’s about taking control of your financial future with simple, consistent actions.

By setting clear goals, establishing a realistic budget, automating tasks, building an emergency fund, and reviewing your progress regularly, you can create a plan that works for you and your family.

Over time, your financial routine will become second nature, allowing you to focus on what truly matters while securing your financial well-being for the future.