How to Save Your First $500

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereSaving money can sometimes feel like an impossible feat, especially for those that don’t have a lot of spare cash. But it doesn’t have to be so hard! With careful planning and some budgeting know-how, you can easily save your first $500 even if you haven’t had any prior savings experience.

We'll show you how, from setting realistic financial goals to establishing good savings habits, with tips and tricks every beginner should know about successfully saving their first $500!

Why is saving $500 important? Well, according to a recent survey, nearly six in 10 Americans don't have enough savings to cover a $500 or $1000 unplanned expense. This means that only four out of ten Americans have at least $500 in their emergency fund.

A separate survey conducted by CBS News found that 90% of Americans said they did not have enough in savings to cover a surprise $500 expense. This indicates that most Americans are unprepared for an unexpected financial emergency.

It is important to have an emergency fund with enough cash to cover three to six months of bills. Building up your emergency fund can be done gradually and should start with at least $500.

Creating a feasible and sustainable plan will help you reach your goal of having a fully funded emergency fund.

Before we continue, there are many ways to save money, and we will answer these questions below.

How can I save $500 quickly?

One of the quickest ways to save $500 is to make a budget and track your spending. Look at your current expenses, such as rent and bills, then figure out how much money is left over.

Once you have an idea of what’s left after paying the necessary expenses, set a goal for yourself. If that means putting $50 a week or $100 a month into savings, that’s great!

Once you have set your goal, make sure to stick with it and don't be tempted to spend money on unnecessary items. Remember never to compare yourself to others, as this is your personal money-saving journey.

You might enjoy this post: How Can I Save $500 With No Money?

How can I save $500 in 3 months?

Setting a goal and timeline is important if you want to save $500 in 3 months. Start by calculating what you think is an achievable amount each week or month to help you reach your desired $500 amount within the 3-month time frame.

Once you have done this, create a budget that outlines your income and expenses. This will help you determine what is necessary to spend on and what can be saved each month.

Now it’s time to start saving!

Find ways to cut back on spending and put that money towards your goal. This could include eating out less, bringing lunch from home, or reducing your entertainment budget.

Finally, look for ways to earn more money. This might involve taking on a side job or selling items you no longer need.

How can I save $500 in 30 days?

You can save $500 in 30 days; that being said, it is a short time frame to save $500, but it can be done.

Start by listing any extra money you have or income sources you can tap into. Analyze your spending habits and look for places where you can reduce expenses.

For example, if you buy takeout lunch at work daily, try bringing lunch from home instead.

Next, put your savings on autopilot by setting up automatic transfers to your savings account. This will help ensure that you don’t forget and make it easier to reach your goal.

Finally, look for ways to increase your income over the next 30 days. Get a side job or take on freelance work for extra money.

Saving your first $500 in 30 days is a great accomplishment and can be done with careful planning.

Set a budget, track your spending, set realistic financial goals, and establish good savings habits to reach your desired amount successfully! Good luck!

Now that we have answered your top questions, it is time to find out how to save your first $500; let's continue.

What are some practical ways to save for the first $500?

Below are some tips and tricks to help you save your first $500:

Start With a Savings Goal

First, it's important to plan your savings goal. Figure out how much money you want to save, and set a timeline for when you want to achieve it. This will help keep you motivated and on track with your savings goals.

Savings goals are important because they give you a clear purpose and direction.

Start small if you have never saved money and don't have a savings goal. Set a goal of saving $50 or $100 per month and work your way up from there. Once you reach this first milestone, you can slowly increase your goal until you reach $500.

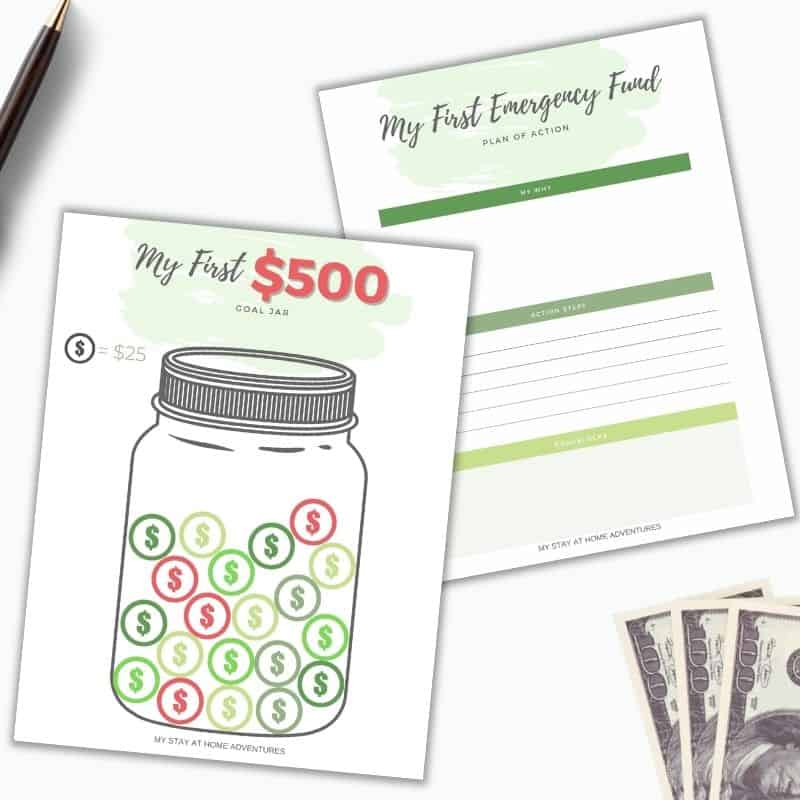

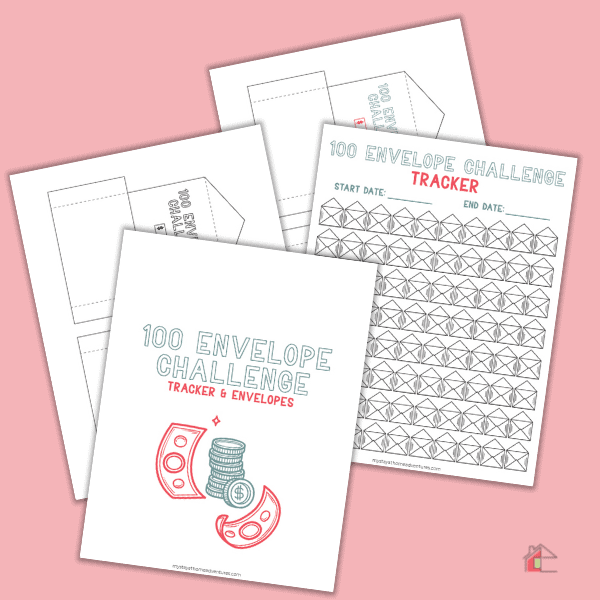

Some great tools are used when creating savings goals and staying motivated and on track, such as savings tracker printables, budgeting apps, and automatic transfers.

Create a Budget

Creating a budget is essential to saving money. Start by tracking your income and expenses. This will help you identify areas where you are spending too much money and areas where you can cut back on spending.

If you plan to skip creating a budget, you are in trouble. You see, a budget is the foundation of any savings plan. It helps keep you on track and accountable for your spending, which is crucial when trying to save money.

Budgeting can seem intimidating for a beginner, but there are plenty of resources to help you get started. Budgeting apps, budgeting sheets we offer to our email subscribers, and online programs are great ways to keep track of your budget.

Once you have identified your spending patterns, create a budget that outlines your income and expenses. Make sure to include all your expenses, such as rent or mortgage payments, utilities, transportation costs, and food.

Once you have created a budget and identify areas where you can cut back on spending, make sure to stick to it. This will help you reach your first $500 savings goal in no time.

For example, if takeout is eating away at your budget, plan to cook more meals at home.

Now for the next tip below.

Set Up Automatic Transfers

Now that you have created a savings goal and a budget, it is time to implement your plan. One of the best ways to save money is to set up automatic transfers from your checking account to your savings account.

This helps you stay on track and take the guesswork out of saving money. Plus, adjusting or canceling your transfers is easy if you need to make any changes down the line.

Look For Extra Income

To save money, sometimes, you have to find ways to make more money. Look for opportunities to make extra income, such as picking up a side job or taking on freelance work. This can help you reach your first $500 in 30 days much faster.

Saving your first $500 can be intimidating, but it is achievable with careful planning and dedication. Start by creating a savings goal, setting up a budget, and setting up automatic transfers to make sure you’re on track to reach your first $500.

If you need extra income, look for opportunities to make money on the side and use this extra money to save your first $500. With these tips, you can establish good savings habits, reach your first $500 goal, and start your journey toward financial freedom.

Free My First $500 Savings Tracker

Sign up to receive our newsletter and get a copy of this $500 Saving Thermometer, cash envelope, and tracker to motivate you to start saving right now.

6 Comments