40 Ways to Save Lots Of Cash This Year

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereHey there, savvy savers! Are you ready to supercharge your savings game? Whether you're saving up for a dream vacation, a rainy day fund, or just looking to boost your bank account, we've got you covered with 40 ways to save lots of cash this year. From everyday money-saving hacks to long-term financial strategies, read on to discover how you can stash some serious cash while still living your best life!

Ready to dive into the ultimate money-saving guide? Let's get started!

Why is saving money important?

Will Cost More

Money not saved will cost you more money. You may not realize it now, but you will regret that decision when you don't save your money for the future.

It is essential to save a decent amount of money to prepare yourself or even give yourself some security if something unexpected happens. If something does happen, having saved up can help you get back on your feet a lot quicker than if you hadn't saved at all.

As stated above, if you don't have the funds to pay for an emergency, it could cost you more money.

Not having money to fix your car, you decided to charge it to your credit card. Unfortunately, credit cards will charge you an outrageous amount of interest if it is not paid in full that month.

If you don't use your credit card and use a cash advance place, you will pay fees and interests.

If you decided not to pay one of your bills and use that money to pay for your car service bill, you would pay a late fee for not spending your account one time.

There is even a service reinstated fee for having your service shut off due to no payment.

Do you see the effects of not saving money? Credit cards, cash loan services, and not paying your bills are not ways to pay for emergencies.

As you save money, your stress level will decrease because you know you have the funds to cover it.

Peace of Mind

Knowing that you have money saved will reduce your stress level. No more worrying about how you will afford that unwanted emergency. Like that noise in your car's engine that is quickly getting worse.

Not having to worry about money all the time will give you some peace of mind, which everyone needs in their lives.

As you save money, your stress level will decrease because you know you have the funds to cover it.

Control

When you save money, you have more control over your life. Having control over your money allows you to make better decisions and use the money in ways that fit your life right now.

With more control over your money, you can save for things like vacations, or even a new car or house! But, of course, you might have enough saved up by then, so it wouldn't be as much of an impact on your budget at that time.

40 Ways to Save Money

Now that you know why saving money is essential, I hope you get inspired by these 40 ways to save money that will work!

Live by the adage

This alone says it all! To live by the adage is to be thrifty and use everything you have until it is gone- no need to waste!

This could include making your meals, using up all the ingredients in a recipe, or even going out with friends and splitting the bill.

If you have something, use it up, wear it out, make it do, or do without! But, unfortunately, in today's world, we seem to forget and want more, spend more, and act like everything is a need.

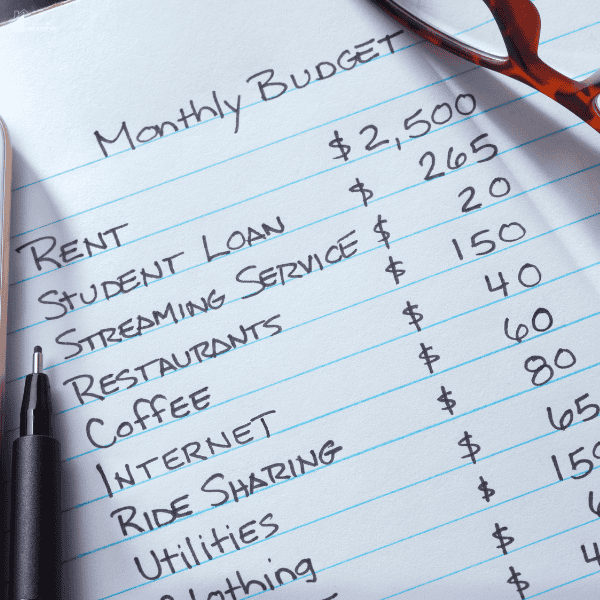

Budget – track every single dime you spend

Tracking everything you spend and your income is what needs to be done. It doesn't matter what you do. If there is no accountability for your spending, it will not be spent wisely.

It is easier to see where your money is being spent and ways to reduce the expenses when you track everything.

You can use a pen and paper, an Excel sheet, or even an app on your phone to track everything.

The key is to be honest with yourself and write down everything, no matter how small the purchase is.

Buy used

Buying used generally saves you up to 50% or even more of what the item would have cost new.

Bikes, cars, clothes, and furniture are ways that buying second-hand can save a great deal of money over time. So, consider books! You can get excellent condition ones for as little as a quarter in some places like Goodwill or Salvation Army.

Don't buy it on sale if you don't need it

The assumption that if an item is on sale, you must buy it doesn't mean you are saving money. If you don't need it, wait until you have the money to pay full price. No deal is better than a bad one, if not needed at all!

The question you need to ask yourself is if you NEED this item. Remember, spending money means you are not saving money.

Scrape containers for the last bit

Scrapping the last of the toothpaste or shampoo doesn't make you a bad person. It makes you a wise, savvy person, my friend. There is nothing wrong with getting that last of toothpaste or peanut butter from that container. You paid for it!

Pay all bills on time

Many people don't realize that paying your bills late means paying more. When you don't pay your bills on time, you pay late fees and sometimes disconnection and connection charges.

Avoid impulse buying

Impulse buying is the most significant way to blow your budget. You head out to do something and end up spending money on other things you don't need or even want because you are feeling excited about what you might buy if only you had the extra cash.

The key to avoiding impulse buying is to have a plan for your money. Know what you will spend it on, and only take that amount of cash with you when you go out. Leave the debit and credit cards at home!

Save money on groceries

One of the ways that you can save a great deal of money is by cutting down your grocery bill. This could be done by clipping coupons, buying in bulk, or only eating in season.

Cook at home

Cooking at home is a great way to save money. You can control the ingredients and the portion size, which means you aren't spending as much on food.

Make meals ahead of time for the week rather than eating out all of the time.

Coupon, shop around for the best deals

There is nothing wrong with taking the time to find the best deal on an item. However, you should be doing something if you want to save money.

This could mean clipping coupons, shopping at different stores, or even looking online for the best deal.

Maintain your things

Maintaining what you have is a great way to save money. When you maintain your things, they last longer, and you can avoid massive bills that come with maintenance.

Maintaining your things means you can also save money on repairs, which could really add up over time if left unrepaired.

Avoid buying coffee

Buying coffee every day can add up quickly. A cup of coffee from the café costs anywhere from $1.85 to $3.65.

That means if you buy one every day for $2, you spend at least $14 a week on coffee! That is over $364 a year! Yikes! Of course, this is only for an average of $2, but the average amount people spend in coffee shops is more.

Pack lunch

Another way to save money is to pack your lunch. You can have a sandwich or leftovers from last night, saving money over buying lunch daily.

You could even make your packed lunches and freeze them to eat later in the week! This is an excellent way to control what goes into your food as well.

Utilize leftovers

Leftovers are a great way to save money! Instead of throwing them away, use those leftovers for weekly meals.

You could even freeze what you have left over so that it lasts longer and can be used later on in the month! But, of course, this will also mean that your fridge is not full of things rotting every other day.

Let's be real: food waste equals money to waste.

Freeze meals

Freezing meals is a great way to save money. You can make multiple portions of meals and freeze them for later or even next month!

Freezer cooking could save your food budget this year if you are willing to take the time and do it.

Buy in bulk

Another way to save money on groceries is to buy in bulk. This could be at a warehouse club or by buying things on sale and stocking up.

This will mean that you have to do some meal planning so that everything does not go bad before eating it, but it is worth it if you want to save money.

Buy generic

Buying generic is another way to save money. You can buy the store brand or even look for ways to make your generics rather than buying name brands.

Create a shopping list

A shopping list is a great tool to help you stick to what you need to buy and not overspend.

It can also help you to stay organized while you are shopping!

Don't go grocery shopping hungry

If you are hungry, avoid going grocery shopping. This is because you are more likely to overspend on things you do not need.

Stick to your list, and only buy what you need!

Plan your meals

Planning your meals is a great way to save money. It will help you plan out what to buy and when so that nothing goes bad before you can use it.

It could also mean the difference between eating from home or going out for dinner!

Replace soda with water

The cost of soda is up, and it is also not good for you! However, you can save money by replacing soda with water or even tea.

This is a great way to keep your body hydrated and healthy as well!

DIY soap, laundry detergent, and dishwashing soap

Want to save even more money? DIY your home cleaners and soap. It seems like vinegar is the best thing around when it comes to a home cleaner.

Check out these DIY home cleaner recipes and find the best homemade cleaner for the job.

Evaluate your cable

Yes, you can evaluate your cable and save some money each month. In addition, you could downgrade to a lower package or even get rid of cable altogether!

Cut music subscriptions

Music subscriptions can add up fast. It might seem like a good idea at first, but a few dollars here and there will add up. There are many ways to enjoy music for free.

Cancel gym memberships

If you have not visited a gym in months, chances are you need to cancel your membership.

Buy quality over cheap

Buying cheap is going to cost you more money in the long run. This is because you will be paying to replace things again and again.

This also goes for items you need, like a blender or even an outfit!

Find your inspiration

Sometimes, staying inspired to save money can be hard. Nevertheless, make sure you stay motivated to save money.

Find ways to be creative in ways that you can still enjoy the things in life but at a lower price. This could mean making your own desserts or even crafting!

Find free or money-making hobbies

Do you have a hobby that can make you money? This could be anything from selling things on Etsy to getting paid for blogging.

My money-making hobby is now my source of income! I started blogging as a hobby, never thinking it would pay me well!

Never buy toys new

Buying brand new toys is seriously a waste of money we parents and many people fall for. Toys are fantastic, but you remember as a child how we treated our toys and what happens to them after a while.

Kids love toys, and I agree with that, but kids don't care if they are new or used. So spend the money purchasing used toys. Kids are not going to care!

Plan gift-giving ahead of time

Planning will save you money, and the reason why is that you won't be rushing. Instead, you will have time to prepare and budget right.

Stop sending people faraway gifts by courier, and start sending money instead. There are more ways to send money worldwide, so finding an option that best fits you will be simple. Moreover, this makes for more practical and thoughtful presents, as they can use the funds however they see fit. Saving you on postage fees while making managing your budget simpler.

Cut expenses

Another way to save money is to write down all of your expenses and see how you can cut them.

Some expenses are necessary, but there are ways to cut back on others that you may not need.

Start with your monthly subscriptions, and then work your way down from there.

Resell unused clothing

Reselling your unused baby clothes and kids' clothes, and even gently used clothes, is the way to go. Take the money you make and either save or invest in buying used clothes.

Learn how to sew buttons

Learning how to sew buttons is just more than that; it's about learning to fix things to save a buck.

Negotiate for a better deal

If you need something, always negotiate for a better deal. This especially goes for when you are purchasing something new.

Negotiating for a better deal can save you some money, and that's what we're aiming to do!

You could negotiate your cable bill, cell phone plan, or even gas prices at the pumps. So there is no reason not to try it out and see if you get the deal!

Shop clearance racks

There is nothing wrong with buying clearance, and creating a habit of visiting clearance racks will benefit you and your wallet.

Find discount chains

Discount chains are stores that sell products below the market price. To take it a step further, you can find a liquidator store and score big on products you need around the home.

Buy Season Items

Buying fruit and vegetables when they are in season will save you money. The same can be said when you purchase summer items; you will find some deals. Of course, you can buy them on clearance, but let's be honest: you will not find everything on clearance.

Avoid fads and trends

Fads are trends that mean paying more. Don't purchase something because everyone else is doing it. You didn't miss out on anything! Seriously, skip them at all costs.

Keep your wardrobe flexible for a mix-and-match

Limit your wardrobe and make it manageable for mix-and-match. You will also save time and money on laundry.

Avoid spending temptations

I avoid deal sites, reading ads, and anything that tempts me to spend money. It's okay to treat every once in a while, but don't make it an everyday habit.

Avoid anything that triggers you to spend money.

Enjoy living in financial security!

There is nothing better than living in financial security.

It's not about the amount of money you have, knowing that your debt is low and you don't have to worry about paying credit cards or loans, and wondering where your money is going.

Being financially secure means you can enjoy life and not have to worry about money every month.

It gives you the freedom to do what you want when you want without having to think twice!

There, you have 40 ways to save money that you can start doing today! If you don't want to miss out on ways to save money and live a life of financial security, sign up for my newsletter below!

I don’t know if this is really a money-saving idea, but for what it’s worth, here you can get a prepaid visa to bed bath and beyond: http://www.bestquicktips.com/bed-bath-beyond-card