Money Savings Challenges for Families

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereMoney-saving challenges are a great way to get your family on the same page regarding saving money. Today's blog post will cover our top five family-friendly money-saving challenges. These challenges are a fun and challenging way to start saving money. So, without further ado, let's get started!

What is the best money-saving challenge?

The best money-saving challenge is the one that fits your family's needs. If you have a large family, you may want to consider a challenge that has a larger savings goal. You may want to consider a challenge with a smaller savings goal if you have a smaller family.

Another important factor is that not all money-saving challenges are created equal. There are many different types of money-saving challenges, so it's important to find one that fits your family's lifestyle.

For example, if your family enjoys eating out, you may want to consider a challenge that saves money on groceries. Likewise, if your family enjoys travel, you may want to consider a challenge that saves money on travel expenses.

No matter what type of money-saving challenge you choose, the important thing is that you and your family are committed to saving money.

Here are our top five family-friendly money-saving challenges below:

52 Week Savings Challenge

The 52-Week Savings Challenge is a money-saving challenge that helps you save money for a year. The challenge starts with saving $52 in Week One and then increases the amount saved each week, or you can start with $1 the first week and increase it. By the end of the challenge, you will have saved $1378!

The pros of this money savings challenge are that it is very flexible and can be tailored to your family's needs.

For example, you can do the challenge reversed, starting with $52 the first week and decreasing the amount saved each week. Then, depending on your family's financial situation, you can save more or less money each week.

A con about this money-saving challenge is that it can be difficult to stick to, especially if you have a tight budget. Also, the challenge is a year-long one, and your kids may get bored of it after a few months.

You are saving a year for $1378, which is a great amount to have saved up, but if your family is struggling to make ends meet week-to-week, this challenge may not be the best one for you.

Penny-Saving Challenge

The Penny-Saving Challenge is a money-saving challenge that helps you save money for a month. The challenge starts with saving $0.01 in Week One and then increases the amount saved each week. By the end of the challenge, you will have saved $67.95!

A pro of this money-saving challenge is that it is shorter, so it may be easier to stick to than a year-long challenge.

A con of this money-saving challenge is that the amount of money saved each week is very small. This may make it difficult to save a large amount of money for a month.

If you are looking for a money-saving challenge that is shorter and easier to stick to, the Penny-Saving Challenge may be a good option for you and your family.

Interested in more money savings challenges:

No-Spend Challenge

The No-Spend Challenge is a money-saving challenge that is good for the family to do. The challenge is not to spend money on anything for a set period, usually a week or a month.

For this challenge, it is recommended to set the rules and to remember that even though it is called a No-Spend Challenge, bills and needs are still required to be paid.

An example of this money-saving challenge would be to not spend money on anything other than groceries and gas for a month.

The pros of this money-saving challenge are that it can help you save a lot of money in a short period. In addition, it can teach you discipline regarding your finances, and you can see where your money is going and what are your trigger spending items.

Another con about this money-saving challenge is that it can be difficult to stick to, especially if you have a tight budget. For example, if your family is constantly shopping every weekend, it may be hard to break that habit.

No-Spend Challenges are a great way to save money and to see where your money is going. If you are looking for a money-saving challenge that is shorter and easier to stick to, the No-Spend Challenge may be a good option for you and your family.

Learn more about no-spend activities on the links below:

- No-Spend Summer Weekend Activities For The Family: Bucket List Printable

- 27 No-Spend Fall Weekend Activities (Free Printables)

Meal Planning Challenge

The Meal Planning Challenge is a money-saving challenge that helps you save money, and your family can eat healthier. The challenge is to plan all of your family's meals for a set period, usually a week or a month.

This challenge aims to help you and your family save money on grocery bills.

One way to do this is to make a list of all the meals you will need for the week and then only buy the ingredients for those meals.

Another way to save money with this challenge is to cook larger meals and have leftovers for another meal.

The pros of this money-saving challenge are that it can help you save money on your grocery bill. It can also help you and your family eat healthier.

A con of this money-saving challenge is that it can be time-consuming to plan all of your meals for the week.

If you are looking for a money-saving challenge that is shorter and easier to stick to, the Meal Planning Challenge may be a good option for you and your family.

Learn more about meal planning when you read the posts below:

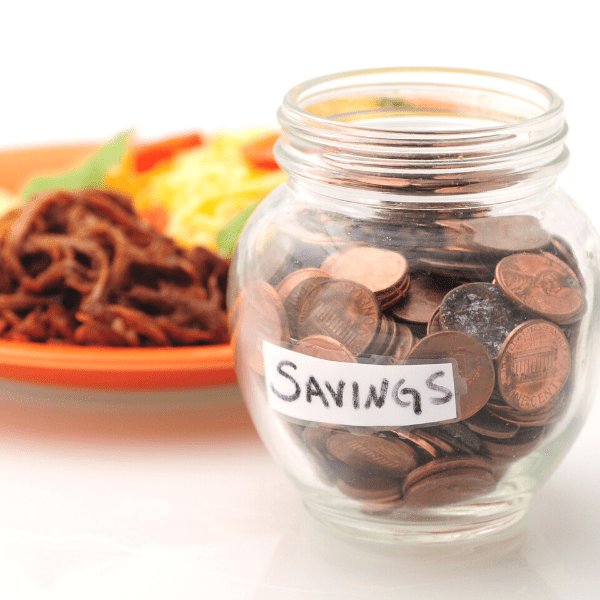

Savings Jar Challenge

The Savings Jar Challenge is a money-saving challenge for families. The challenge is to save money in a jar for a set period of time, usually a month.

So how does your family do this challenge?

Every time someone in your family has money, they put it in the savings jar. The money comes from things like allowance, birthday money, or money from a yard sale. You can even add spare change to the savings jar.

The saving jar can be anything from a mason jar to a piggy bank.

The money in the savings jar can be used for anything your family wants, like a vacation, a new toy, or a rainy day fund.

At the end of the month, you count up all the money in the savings jar, which is your family's savings for the month.

The pros of this money-saving challenge are that it is a fun way for families to save money together. It is also a great way to teach kids about money and saving.

A con of this money-saving challenge is that it may be difficult to stick to, especially if your family is used to spending money. Another con is that if your family doesn't use cash often, it may be difficult to add money to the savings jar.

If you are looking for a money-saving challenge that is shorter and easier to stick to, the Savings Jar Challenge may be a good option for you and your family.

I personally love the cash envelope system, these are great ideas!

Funny thing is I complain about it but its the best method that helps us save money!

I just want to tell you that I am really looking forward to continuing to read your blog in 2015. We’re going to be doing the change jar and cash envelopes too this year. I’m excited to hear about your progress. I love your ideas!

Thank you Lou! This means a lot to me. I look forward to what 2015 will bring with your blog as well! To 2015!

Great tips! We haven’t used any of these challenges, but have some of our own saving strategies. We have $25 automatically pulled from our checking account into a special savings each week. This account pays for birthdays and holidays. When we’re done paying for a wedding we hope to implement some more strategies!

My closest bank is 5 hours away from me, so I rarely have cash on hand, or I’d totally be all in on the cash envelope and loose change jar (I did that all throughout junior high to college)! I will go for the financial fast instead! 😛

Thanks for sharing your post on How To Get Organized At Home Monday Madness. These are great tips, I have always filled a jar with my loose change and I am always surprised how quickly it can add up. thanks again for sharing:)

What a great post. We are starting Dave Ramsey’s plan this year and he uses cash envelopes so we will be trying that this year. Thanks for linking up with Motivational Monday this week!

Dave Ramsey changed my life! Thank you for hosting this awesome link party!