What Money Categories to Save For This Year

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereCongratulations on making money-saving this year your top priority! Now what to save for this year?

You love to save money, I do! You can sit here and tell everyone that hey, I’m a penny pincher and love to save me some money.

Now, ask yourself what you are saving for, and you will probably say just about anything except what is written here.

Can you relate?

Don’t get it wrong, many people do save, and they save their hard-earned money toward great things.

But the reality that many of us don’t.

Trying to know what to save for this year can be challenging for many of us. I mean many friends of mine are saving towards the latest iPhone.

Priorities! :/

Now, a few years ago, we weren’t able to save as much money as we wanted to. To be honest, it was a rough year personally, and it seems that one thing after another continued to happen.

Shit happens my friend. So, I can totally relate when you know you have to save money, but life gets in the way.

Still no excuse.

This year we started the year with the dishwasher breaking down, which is another expense we weren’t anticipating. Even through it all, we were able not to get ourselves into debt.

How did we manage to stay away from debt?

We used our saved money to pay for unexpected repairs, among other things. Years of learning to manage our money and savings helped us get by situations like this.

Even after, when money was the last thing on our minds, we managed to save money.

I’m assuming it just became a habit and I didn’t give in to emotions and spend money to feel better.

I didn’t manage to save as much as possible; we just didn’t have the drive or motivation that we usually have to save more money.

This year, we are looking into things differently and creating a plan to have more control over our finances and save money.

We feel that we need to go back to basics when it comes to basics like we had before and start saving money this year.

8 Forgotten Categories to Save For This Year

What do you need to save money for this year?

Good question, and depending on where you are financially, the answers may vary.

For many people who don’t have their finances in order and need to know what to save for this year, I will give you some helpful tips to help you.

And if you are just saving and don’t have any idea what you are saving for this might help you out as well.

Emergency Fund

An emergency fund is something that you hear about in the world of personal finances. What is this emergency fund people talk about and why is it so important?

An emergency fund is an account you use to set aside funds. This account is only used in case of an emergency such as medical illness, loss of a job, and other sudden, significant expenses.

An emergency fund is not for:

- bank fees

- overdraft fees

- house down-payment

- wedding

- vacation

- yearly subscription payments

- credit cards

- line of credit

Having an emergency fund gives people a sense of security because it creates a safety net of money that can be used only when unexpected things happen to reduce the chance of using credit cards and getting into debt.

This is a difference between staying afloat or sinking into more debt. Having an emergency fund will help you break the cycle of debt.

Saving for your emergency fund is extremely important and should be on top of your list for this year if you haven’t started one.

Annual Expenses

Saving money for yearly expenses is a great way to help you financially when an annual bill is due. Annual payments are things such as:

- Income taxes

- Insurances

- Insurance Deductibles

- Property taxes

- Minor repairs

They are expenses that can affect us if we don’t have a plan for them financially. This is why savings for these types of expenses is such a financial and personal relief for many of us.

To Get Out Of Debt

If you are seriously thinking of taking control of your finances, saving money to get out of debt is one of the best things to do this year.

Retirement

Saving for retirement is never too late, and you can start doing this now! This is something that many people don’t really stress over or worry as much about, but it is essential.

Sinking Fund

Saving for a sinking fund is another way to save for a small amount of money this year. What is a sinking fund?

Don’t let the name fool you; it's not going to sink your finances! A sinking fund is considered a specific account you set aside for a particular reason.

It is hard to specify what your sinking fund is for since each individual's personal finance is different.

Unlike an emergency fund, a sinking fund is not set aside for the unknown or future emergency. For your sinking fund, you decided what that money will be for; like for car maintenance, yearly inspection, and registration.

For us, we have a small amount set for yearly expenses and oil changes, and we decide that this money will be used before we use our savings account.

We see our sinking fund as a cushion before using our emergency fund, and it gives us even more peace of mind when it comes to our personal finances.

Education

You start saving up for education whether you want to go back to school in the future, or your children's education, it is never too late or too early to start saving for education.

Check out these money posts:

- 4 Financial Challenges Your Entire Family Can Do

- 6 Incredible Monthly Money Challenges

- 6 Everyday Money Wasting Habits You Need To Stop Today

Vacation

If you are looking forward to a nice vacation and your finances permit it, start saving for a vacation. I personally don’t understand why some take a loan out for a vacation just to worry about your finances for years to come.

If you are planning a vacation, there are many ways and alternatives, like a staycation, to help you save money.

Always remember to keep your vacation fund separate from your emergency fund and create a plan to prevent your vacation from affecting your finances.

Christmas

Christmas is the season when we spend more money, and I am pretty sure you know we love to spend during the holiday season.

For this reason, we have a separate account just for Christmas.

We buy things we need around this time, like food, appliances, clothes and yes, gifts using this account.

Since we know that we tend to spend more around this time of the year, we plan and save an amount to help us around this time of the year.

It is unfortunate to be stressing over finances around this time of the year, and I recommend you start saving money for Christmas.

Not just for gifts, but for other expenses that may occur around this time of the year.

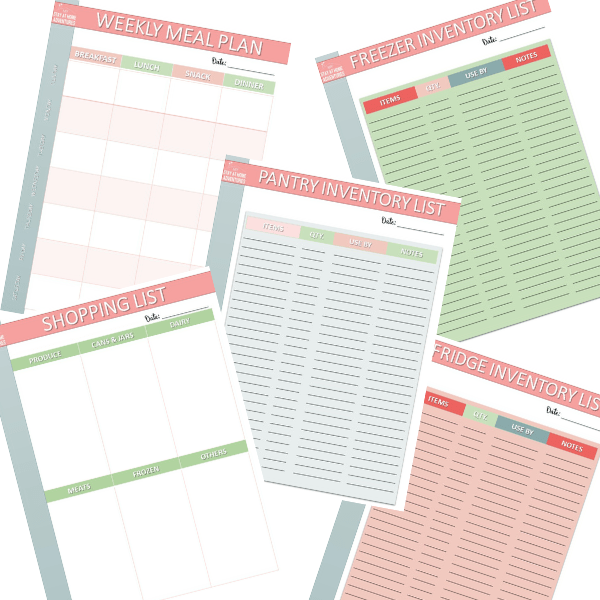

Download the free printable to help you start managing your cash!

Conclusion

There are so many reasons to save money this year, and these top choices are significant and sometimes shouldn’t be overlooked.

Everyone should have an emergency fund, and if you don’t, this is the year to start one as this is very important for you and your family.

I hope your what to save for this year questions have been answered, and this will be the year where you will learn to live knowing that you have your finances under control.

2 Comments