How Do You Stick To a Spending Freeze?

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereWelcome to another adventure in frugality! As a stay-at-home mom and writer, I know firsthand that managing household finances can be challenging. That's why I'm thrilled to share my tried-and-true tips on a topic many of us grapple with – How Do You Stick To a Spending Freeze?

A spending freeze might sound intimidating, but the right mindset and strategies can be a transformative tool for your financial health. Whether you're saving up for a special occasion, paying down debt, or simply aiming for a more sustainable lifestyle, a spending freeze is a powerful way to reset your spending habits and take control of your budget.

.

What is a spending freeze?

A spending freeze, you ask? Picture this – it's like hitting the pause button on your shopping spree. It's a temporary period where you decide to stop all non-essential spending, kind of like a diet for your wallet.

You say no to that tempting pair of shoes, resist the allure of the latest gadget, and skip those fancy dinners out. Instead, you only spend money on the bare necessities – think bills, groceries, and essential personal items.

The goal?

To take back control of your finances, save more money, and kick those stress-inducing overspending habits to the curb. But remember, it's not a forever thing – just a temporary fix to help you get back on track. Ready to give it a shot?

Let's dive into the rules!

What are the rules of a spending freeze challenge?

Ready for a spending freeze challenge? Great! Here's the lowdown.

First, decide on a time frame – this could be a week, a month, or even a few days, whatever works for you. Next, define what's ‘essential.' Bills, groceries, medicines? Absolutely.

A new pair of shoes, eating out, that shiny gadget? Not so much. These non-essential items are off-limits. Remember, it's all about cutting back on extra spending. And finally, make a plan for the money you save.

Paying off debt? Adding to your savings? It's your call!

The key is to stick to these rules, no matter how tempting it might be to break them. Remember, it's a challenge, but think of the rewards! You've got this!

Why would you do a spending freeze?

Why would you, or anyone for that matter, voluntarily decide to hit pause on spending? Well, let's be real here. We've all had those moments when we look at our bank statement and wonder, “Where did it all go?”

That's where a spending freeze comes in. It's like a financial detox – a chance to reset your spending habits, save some serious cash, and say goodbye to the stress of living paycheck to paycheck.

Whether you're drowning in debt, struggling to build an emergency fund, or can't seem to stick to a budget, a spending freeze could be just the wake-up call you need. Think of it as a challenge, a way to prove to yourself that you CAN take control of your money.

When is the best time for a spending freeze or a no spend month?

Great question! When it comes to timing a spending freeze or a no-spend month, there's no one-size-fits-all answer. It really depends on your personal circumstances and financial goals. Some folks find it easier to start at the beginning of the year as a part of their New Year's resolutions. Others might choose a month when they don't have many social obligations or big expenses coming up.

Timing your spending freeze well can significantly improve your chances of completing it successfully. For instance, starting a spending freeze during the holiday season might not be the best idea when gifts and parties can lead to extra spending. On the flip side, a quiet month like January or February, when you're likely still recovering from holiday spending, could be an ideal time.

Remember, the goal of a spending freeze is not just to save money but also to take a good, hard look at your spending habits and identify areas where you can cut back. So, choose a time frame that works best for you – whether that's a full calendar month, 30 days, four weeks, or even just a week. Every little bit helps!

And one last tip? Go public with your goals. Sharing your plans with friends, family, or even on social media can give you that extra boost of accountability and motivation to stick with it until the end.

How do you stick to a spending freeze?

Here are some tips on how to stick to a spending freeze:

Set the rules

If you are going to take on a spending freeze challenge, the best and safest way to make sure you complete it is to set the rules for your challenge. If you are doing this with your spouse or significant other, you all must agree and be on the same page.

This is extremely important for many reasons. Are you going to use a cash system? Are credit cards allowed? Would this spending freeze challenge be for a week or a month? These are important questions to ask yourself.

I have written about overspending and ways to not spend your money. Below you will find some ideas to help you not to spend money:

- Avoid shopping for fun. I will go shopping when I need to go shopping. Shopping just because I’m bored or need to get out of the house is no excuse for spending money. I will not if I have no reason to go to the store.

- Do not go out shopping when you are hungry. Believe it or not, this seems to be one of my downfalls. I tend to go around the time when I am craving lunch. You know what happens when you are hungry and shopping; you overspend.

- Shop with a shopping list. This always helps me out and keeps me on track. My problem is that I tend to forget the list when I go shopping. I finally got this app for my mobile phone that is helping me in this department.

- Create a menu plan. I’m a big fan of menu planning. I love creating and using them. If you don’t have a menu plan, you miss out on how much time and money you can save by creating them. Below are two important reasons why I love creating and using a menu plan:

Convenience:

Creating a meal plan will reduce the amount you spend going to the grocery store to look for what you need. You have all the ingredients available for your meals. This will avoid stress and the “what’s for dinner” from the rest of the family.

Less waste:

When you plan what your family is going to eat for the week, you will plan meals that you know everyone will enjoy. This avoids having food wasted because you didn’t overbuy products you didn’t need. You avoided creating meals that were not popular with your family.

Create a plan for your spending freeze

Without a plan, chances are you are going to fail again. This challenge is difficult, and you need to make sure you can look at your plan and stay focused.

Look at your rules and plan out your challenge. Are you an emotional spender? What causes you to spend? What can you do that will help you not to spend?

Write down what your weaknesses are and the reasons you spend. I will tell you that writing and finding a solution to avoid these issues will help you in the future.

When I am tempted to buy something that I really don't need and costs money, I wait until the next day to decide. The reason is that many things look different when I sleep and wake up.

Find your motivation

When you plan and create goals, write them down. Then, create a motivational notebook, wall, or anything that will remind you why you are doing this spending freeze.

I am visual, and I love having things or pictures to remind me why I am doing this.

I read books and join challenges to help me keep motivated during my no-spending free challenge. And you know they work! You can also find groups that are dedicated to this challenge as well.

A spending freeze has so many benefits, even though it's a hard challenge. It will change how you view your finances and will change you personally. The result of completing a spending freeze and seeing the results of it is an amazing feeling.

How can I be successful in a no-spend month?

There are a few key things to remember if you want to be successful in a no-spend month.

- First, make sure you have a clear goal in mind. What are you hoping to accomplish by not spending money? Are you trying to save up for a specific purchase or simply want to get out of debt?

- Once you have your goal in mind, sticking to your spending freeze will be easier.

- Next, make a budget and stick to it. This is probably the most important step in successfully completing a no-spend month.

- Decide how much you can realistically afford to spend in a month, and then make sure you don't exceed that amount. If you find yourself getting close to your budget, cut back on your spending even further.

- Finally, be prepared for temptation. There will undoubtedly be times when you're tempted to spend money, even if you're in the middle of a spending freeze.

- When this happens, remind yourself of your goals and why you're doing a spending freeze in the first place. This will help you stay on track and resist the temptation to spend. With these tips in mind, you'll be well on your way to successfully completing a no-spend month.

Just remember to stay focused on your goals, make a budget stick to it, and be prepared for temptation, and you'll be successful!

How do I resist spending temptations?

To resist temptation, have a plan in place for what you'll do when it strikes. For example, you might tell yourself that you'll take a walk, call a friend, or do something else to occupy your time instead of spending money. This will help you stay on track and avoid spending money unnecessarily.

Keep your credit and debit cards out of sight and reach. This will help you avoid the temptation to spend money impulsively.

Finally, remind yourself of your goals. Why are you doing a spending freeze? What are you hoping to accomplish? This will help you resist the temptation to spend and stay on track.

How can I put my money away and not spend it?

You can put your money away by doing a few things.

The first thing you need to do is figure out what your spending priorities are. This means knowing what you need to spend money on and what you can live without. Once you have your priorities straight, it will be easier to start saving.

Next, you need to make a budget. Determine how much money you have coming in and your regular expenses. Once you have an idea of your monthly cash flow, you can start setting money aside for savings.

Last, you need to be disciplined with your spending. When you want to splurge, ask yourself if the purchase is necessary. If it isn't, resist the temptation and continue saving money.

How do I prepare for a no-spending year?

To get prepare for a non-spending year, it is important to have a plan and be organized. Keep in mind that this is not a monthly challenge but an entire year of not spending money on nonessential. This means you’ll have to get creative with your budget and make some adjustments to your lifestyle. Here are some tips:

- Start by evaluating your current spending habits. Track where you are spending your money for at least a month. This will give you a starting point to see where you can cut back.

- Make a list of your essential expenses. This will be different for everyone but should include things like housing, food, transportation, and healthcare.

- Create a realistic budget. Once you know where your money is going, you can start to create a budget that allows for your essential expenses while cutting back on nonessentials.

- Find free or low-cost activities. When you’re not spending money, you’ll need to find other ways to occupy your time. This is a great opportunity to explore your local community and find free or low-cost activities that you enjoy.

- Get support from friends and family. Undertaking a no-spending year can be challenging, so it’s important to have a support system in place. Talk to your friends and family about your goals and ask for their help and understanding.

With a little planning and preparation, a no-spending year can be a great way to save money and simplify your life. Just remember to take it one day at a time and be flexible with your goals. If you slip up, don’t give up – just get back on track and keep going.

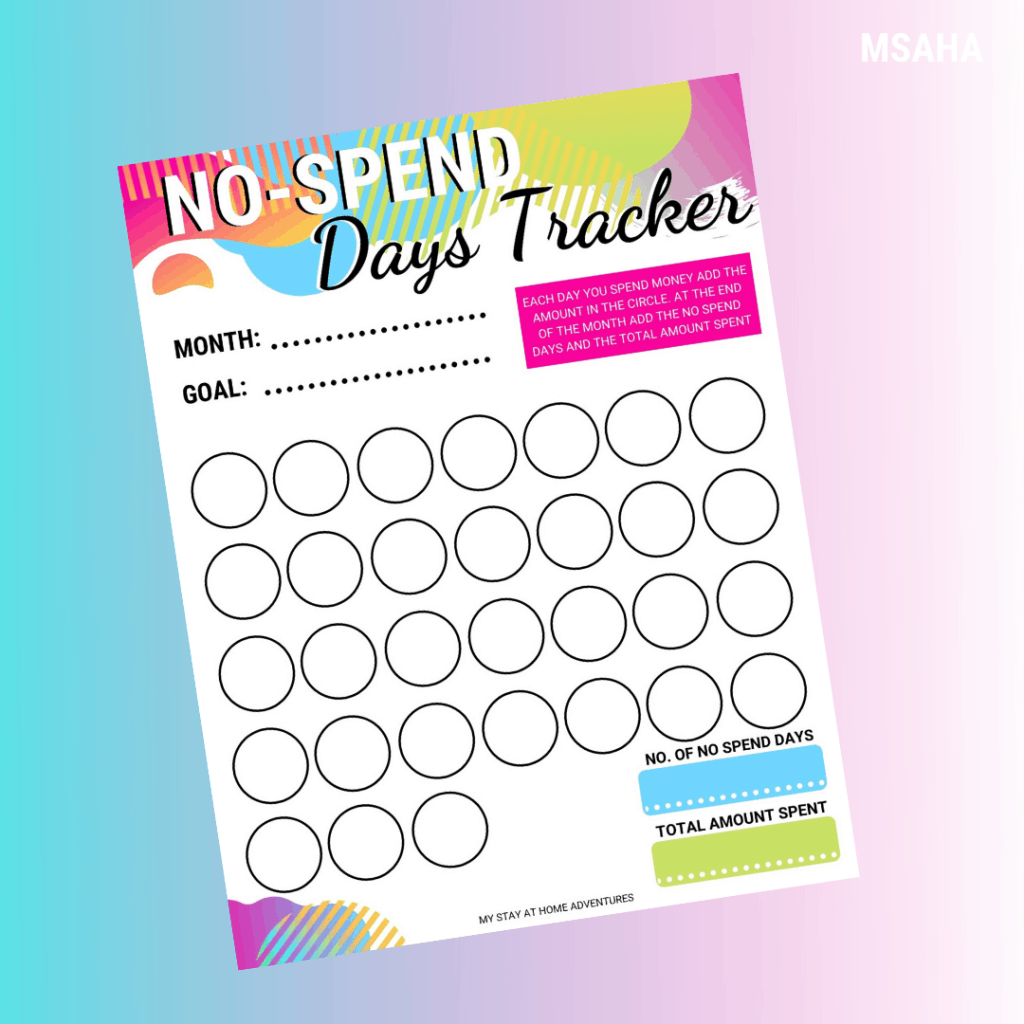

Download the No Spend Days Tracker

Subscribe to receive our newsletter and access our subscriber-only library, where you can find the No Spend Days Tracker printable absolutely free.

Fill out the form below, and you will receive access to our library.

This is a great article! I need to do this. It is something I have been wanting to do for a while. Thank you!