Debt Avalanche Method

This post may contain affiliate links which might earn us money. Please read my Disclosure and Privacy policies hereThere are many methods to pay down your debt, the debt avalanche method is one. It will help you pay less in interest compared to the snowball method.

When it comes to eliminating debt, there is no one set way to do it. The popular debt snowball method might seem to be the only way to reduce debt, but that is far from the truth.

The Debt Avalanche Method is another alternative, and it is one that I personally switched to during my debt payoff method.

Let's learn more about this debt payoff method, shall we?

What is the avalanche debt method?

The avalanche debt method is a debt payment plan that focuses the most money on the debt with the highest interest rate. The way it works is you make the minimum payment due each month on each account. Any additional money you can put toward debt will be paid on the debt with the highest interest rate.

The truth is that the snowball debt and the avalanche method of eliminating debt work. Both methods required:

- A list of all debt

- Minimum payment required

- Pay extra on one debt

The only difference you are doing is paying the additional amount to the debt with the highest interest.

How Does a Debt Avalanche Work?

The way this payment plan works is to reduce the amount of interest paid. When you're focusing all your additional money toward the debt with the highest interest rate, you'll pay less interest over time. This allows you to get out of debt faster.

Do you pay less interest in doing the Debt Avalanche Method?

Yes! Let's say you have a credit card that has a 5% interest rate from your bank, and you have another card from a big box store that has a 24% interest rate.

Both have $1000 balances, and the minimum payment is $50 per month. On the 24% card, you'll pay $252, paying the minimum payment.

On the 5% balance, you'll end up paying $45, making the same payments.

Now, if you bumped the payment up to $200 a month on the 24% balance, you would reduce the amount of interest paid to only $57. That's almost a $200 savings.

What are the advantages of the avalanche debt system?

There are many advantages to the avalanche debt system. First of all, you're paying less in interest. This can save you hundreds to thousands of dollars, depending on how much debt you have.

Another benefit is that it's so simple to do. And, if you follow the plan consistently, you'll get out of debt faster.

Disadvantages of the Debt Avalanche

The most significant disadvantage is that it can be so easy to fall off track and only pay the minimum on every debt.

When you encounter unforeseen expenses, you may not have a lot of additional money to send. You need to do everything you can to cut unneeded expenses to make sure you still get that payment made.

What is the snowball method of paying down debt?

The snowball method is different from the avalanche debt plan in that you focus on your smallest debt and work your way up. You send minimum payments to all your creditors except for the account with the lowest balance. When the smallest debt is paid off, you move on to the next smallest and so on and so on.

How can I clear my debt quickly?

The most important thing is to have a plan in place. People get into the habit of sending more money to this card and the next month it's a different card. That plan of action will not work. You need to pick a plan and stick to it.

Using either the avalanche or snowball method to pay debt will work better as it gives you a plan to eliminate your debt. The avalanche method will be the quickest way to clear your debt.

You might like:

- Financial Management

- 6 Must-Do Tips to Increase Your Personal Savings

- A Realistic Way To Using Cash Envelope System

Is the snowball or avalanche method better?

It depends on what you're looking for. If you need motivation, the snowball method will work best for you because you'll see quick results. However, the avalanche method is suitable for those that want to pay less money in the long run. Both ways do work, but you need to choose one or the other to be successful.

Can you use cash envelopes with the avalanche method?

Yes, you can cash budget with the avalanche method the same way as you can with the snowball method. If you have any questions about the cash budgeting system, read the articles below about the cash envelope system, and download the free cash envelope templates to get started.

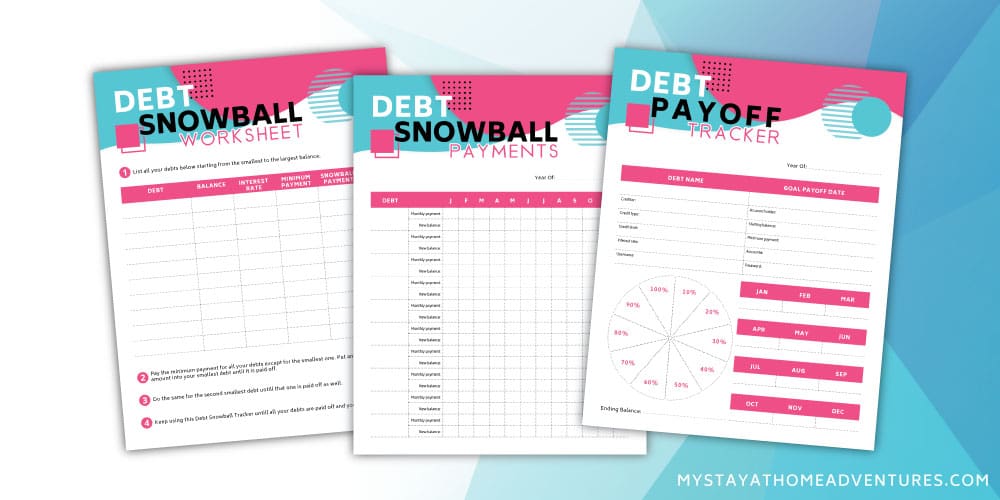

Snowball Method Printable Kit

If you want to learn more about the Snowball Method system, click this link and learn and print the free Snowball Method Printable Kit.

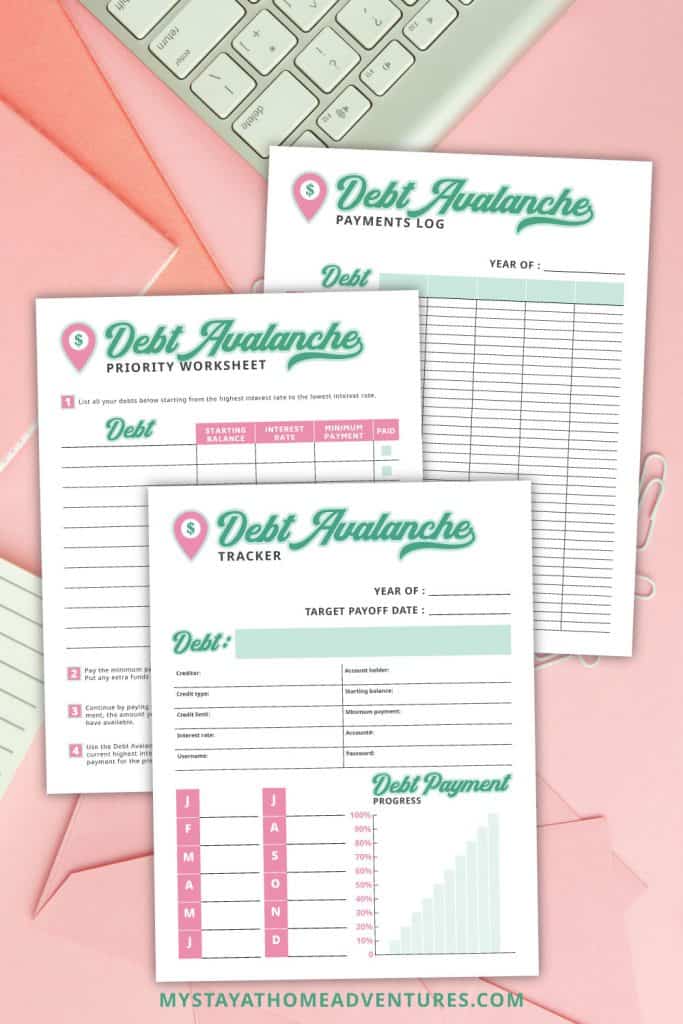

Debt Avalanche Method Printables

To help you start your financial journey, we are offering free debt avalanche method printables (3 sheets) when you subscribe to our newsletter.

What's inside the Debt Avalanche Method Kit:

- Debt Avalanche Priority Worksheet

- Debt Avalanche Payment Log

- Debt Avalanche Tracker

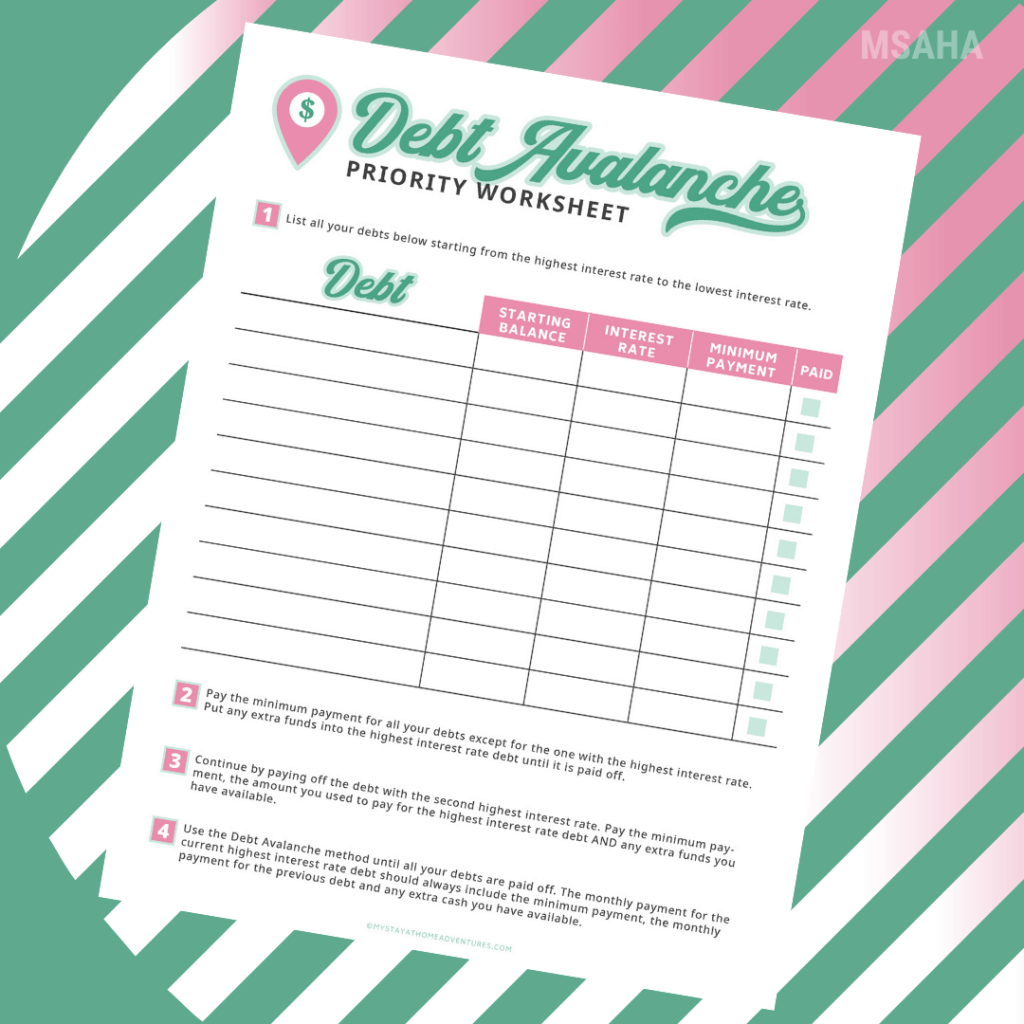

Debt Avalanche Priority Worksheet

On the first printable, its where it all begins. Follow the steps below to fill the form out.

- List all your debts below, starting from the highest interest rate to the lowest interest rate.

- Pay the minimum payment for all your debts except for the one with the highest interest rate. Put any extra funds into the highest interest rate debt until it is paid off.

- Continue by paying off the debt with the second-highest interest rate. Pay the minimum payment, the amount you used to pay for the highest interest rate debt, AND any extra funds you have available.

- Use the Debt Avalanche method until all your debts are paid off. The monthly payment for the current highest interest rate debt should always include the minimum payment, the monthly payment for the previous debt, and any extra cash you have available.

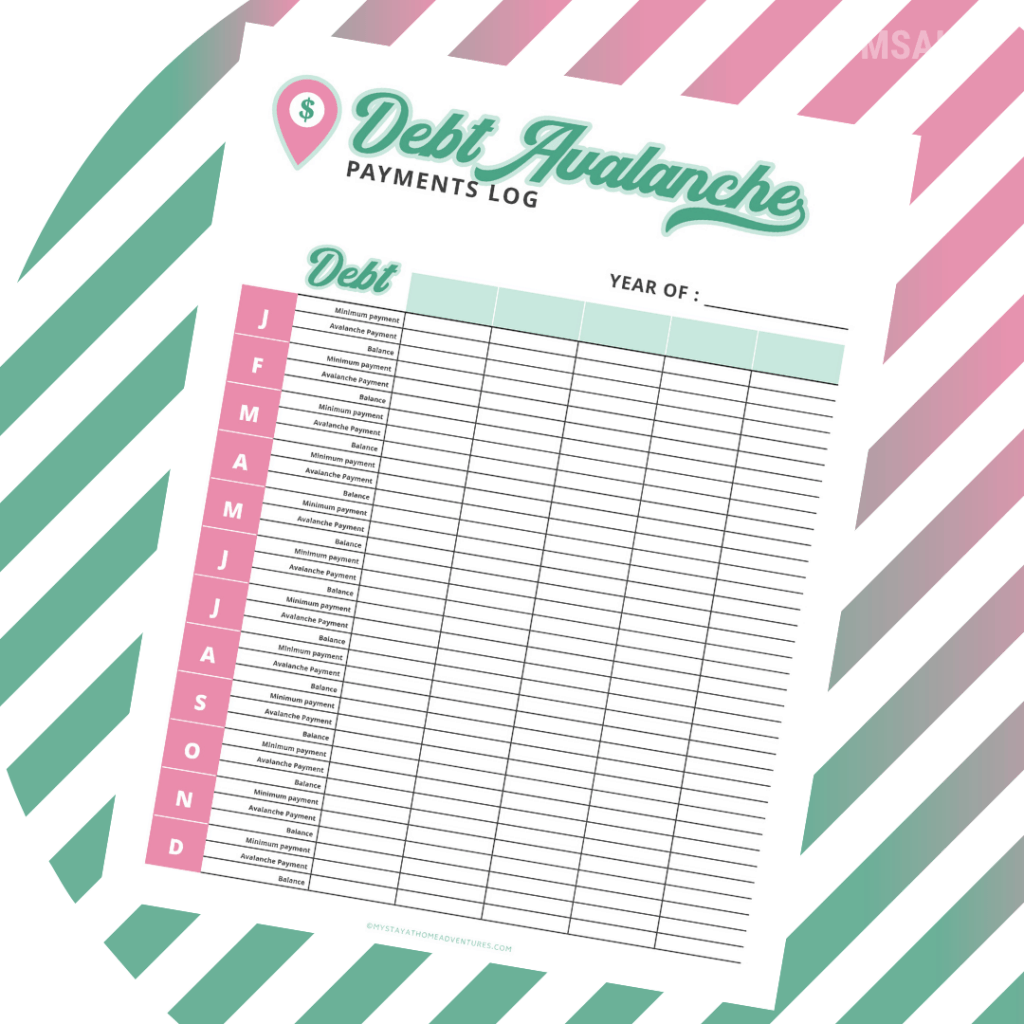

Debt Avalanche Payment Log

On this sheet, you will track your monthly minimum payments, avalanche payments, and your balance.

Debt Avalanche Tracker

Use this sheet for all your accounts and track each account's progress.

How to download the Debt Avalanche Printables

To download the avalanche method printables for free when you subscribe to our newsletter.

Subscribe to our newsletter and receive it for free when you fill out the form below.

One Comment